Altcoin

Curve Finance faces uncertain future as hack spreads FUD

Curve Finance faces challenges after a recent hack, with a bid-side liquidity surge providing hope, while CEO’s $168M debt poses risks. Uncertain times ahead.

- CRV saw increased liquidity on centralized exchanges as the hack sparked FUD.

- The debt position of Curve’s CEO, worth over $168 million, has sparked worries across DeFi.

Curve Finance [CRV] has endured a turbulent beginning and end of the month due to a recent hack, which has led to fear, uncertainty, and doubt (FUD) in the community. Despite facing significant selling pressure on its CRV token, there was a silver lining as its bid-side liquidity surged. Was this increase in buying activity enough to stem the downtrend of the asset?

How much are 1,10,100 CRVs worth today

Curve sees increased liquidity

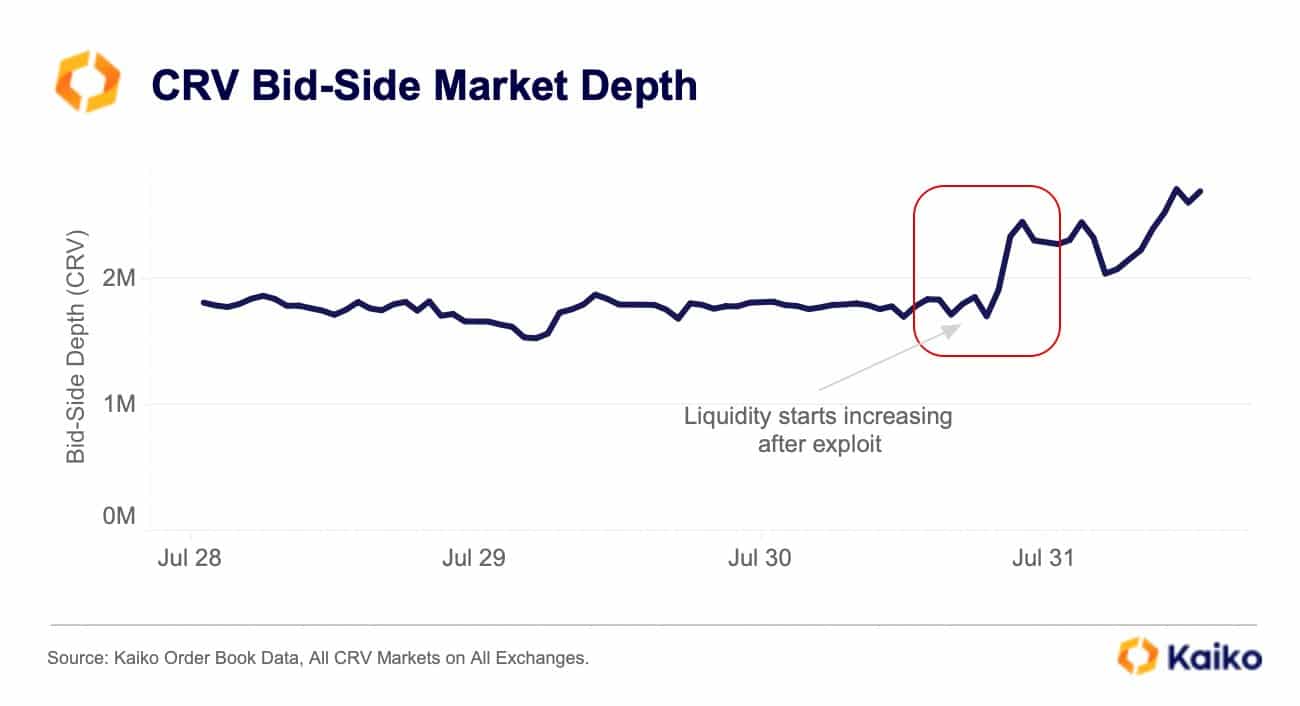

In a recent data report by Kaiko, it was revealed that as news of the Curve Finance hack spread, there was a noticeable rise in bid-side liquidity on centralized exchanges. Bid-side liquidity refers to the total volume and depth of buy orders available at different price levels for CRV, indicating the eagerness of buyers to acquire the cryptocurrency at various market prices.

This surge in bid-side liquidity is generally viewed positively by the market because it signifies strong demand from buyers, potentially supporting or even driving up the price of CRV. Conversely, lower bid-side liquidity might imply weaker demand, leading to price drops or increased market volatility.

Despite the encouraging increase in liquidity on these exchanges, Curve Finance still faced imminent danger.

Liquidation risks sparks more FUD

Debanks‘ data revealed a concerning situation involving Curve Finance’s CEO, Michael Egorov. Egorov holds a substantial debt position that could exacerbate turmoil within Curve Finance and the broader DeFi space. His debt amounted to $168 million, secured by CRV tokens, which represented nearly 34% of the token’s total market capitalization.

Egorov’s strategy involved locking up approximately $168 million in CRV tokens on Aave Protocol V2, allowing him to take out a $63 million loan denominated in Tether’s USDT stablecoin. Additionally, he borrowed an extra $17 million of the FRAX stablecoin, using $32 million of CRV as collateral on Fraxlend.

The interconnected nature of the DeFi ecosystem means that any adverse impact on Egorov’s position could ripple through other decentralized lending protocols and influence CRV’s price. If his position faces liquidation, it may exert significant pressure on various lending platforms, affecting their stability and potentially causing repercussions for the overall DeFi sector.

CRV still bending the curve

Looking at CRV on the daily timeframe chart, it experienced around 25% decline between July 30 and July 31. This sharp drop drove the price below 30 on the Relative Strength Index (RSI), signaling an oversold condition during that period.

Is your portfolio green? Check out the Curve DAO Profit Calculator

As of this writing, there has been a slight recovery, with CRV trading around $0.59, showing a positive price increase of over 4%. The RSI line was still in the oversold region but indicated signs of an upward trend. The recent increase in bid-side liquidity likely gave traders some confidence, contributing to the price rebound.

Despite the recent uptick, data from Coinglass indicated that Curve was still heavily shorted. The negative funding rate suggests that traders expect the price to decline further.