Curve Protocol beckons investors following Frax Finance’s high APR

- Frax Finance offered a high APR, attracting potential CRV users.

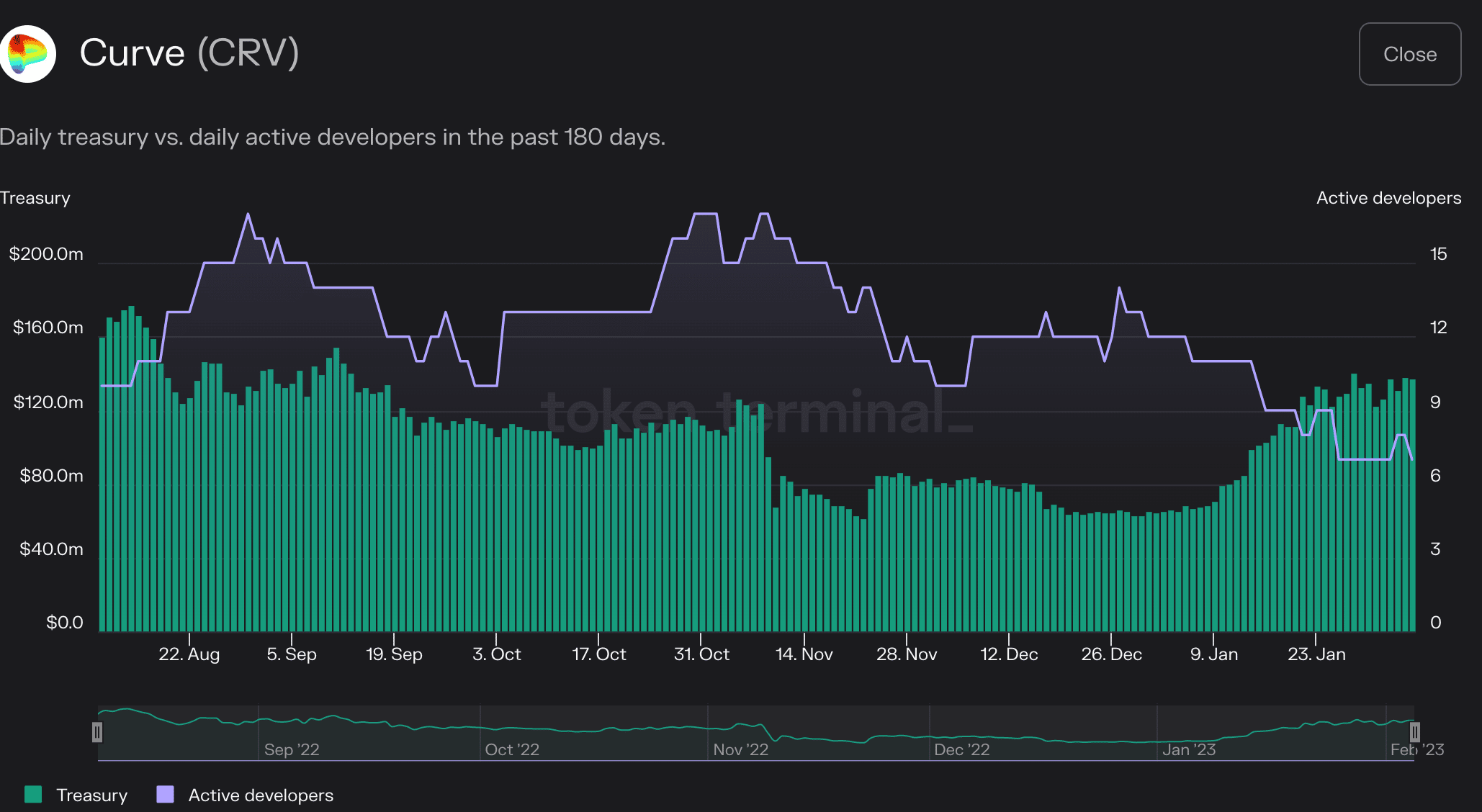

- Despite treasury growth, Curve struggled with declining user and developer engagement.

Frax Finance’s sfrxETH has been offering high annual percentage rates (APR) to its users, as reported by Messari on 6 February. This attractive return on investment has the potential to bring new users to the Curve Finance [CRV] network.

.@fraxfinance is one of the largest holders of Convex Finance’s $CVX token, providing it with an outsized influence over @CurveFinance's gauge system.

This influence has afforded users that choose to stake in the sfrxETH vault market-leading APR. pic.twitter.com/yu0lYV0gmQ

— Messari (@MessariCrypto) February 6, 2023

Is your portfolio green? Check out the Curve Profit Calculator

In recent times, the DeFi space has seen a lot of growth and innovation, and Curve Finance has been at the forefront of this trend. However, despite its many advantages, the protocol has been facing some challenges lately.

Messari’s data showed that the number of unique users on the Curve network has declined by 0.26% over the last 30 days. This has resulted in a declining dominance of the Curve protocol in the DeFi space. The dominance of Curve, as per data from Dune Analytics, has fallen from 39.9% to 7.1% over the last few months.

Frax Finance’s sfrxETH could help Curve improve its dominance in the DeFI space. However, there were multiple issues that plagued the protocol at press time.

Multiple barriers for Curve

The Curve protocol was facing a declining number of active developers on the platform, which could impact the protocol’s overall development and future prospects. However, despite these challenges, the treasury of the protocol continued to grow.

This growth could be beneficial to the protocol in the long run, as it could provide more resources and stability.

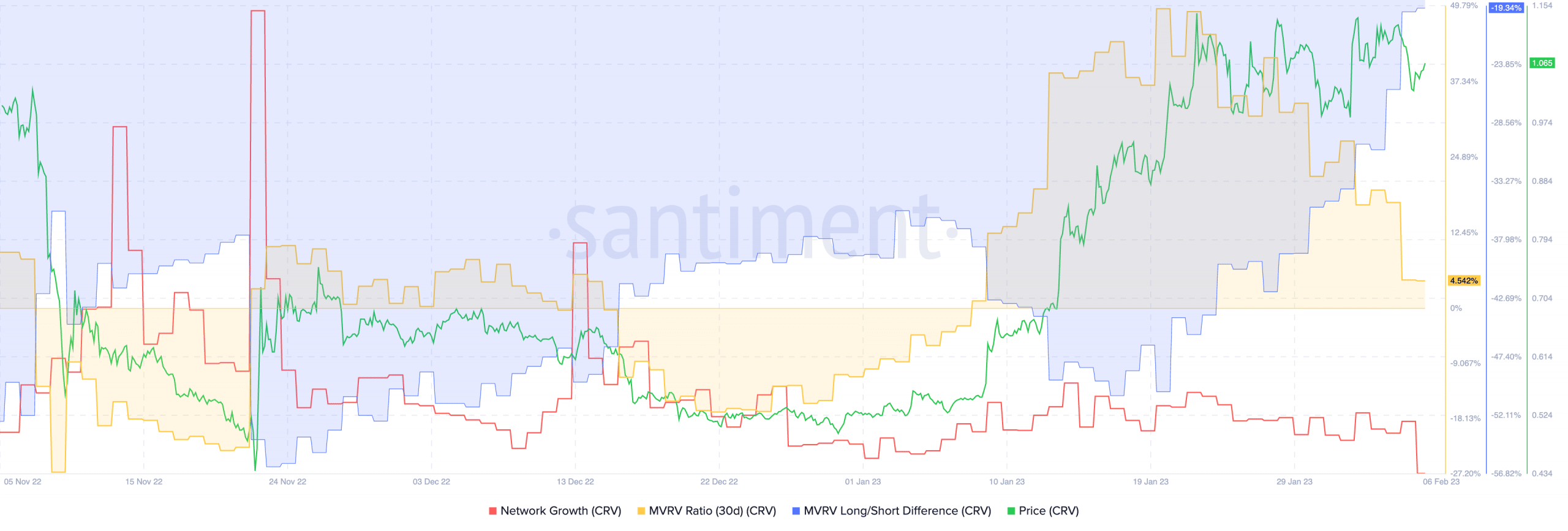

The CRV token has also not seen any positive growth as well, as network growth declined at press time. This implied that new addresses were losing interest in the CRV token.

However, the MVRV ratio of the CRV token plummeted, indicating lower selling pressure. This could be a sign that CRV holders were becoming more confident in the long-term prospects of the token.

How much are 1,10,100 CRV worth today?

Furthermore, the long/short difference of the CRV token suggested that a lot of short-term holders were still holding on to the token. These short-term holders could sell their tokens in the near future, which could impact the token’s price and overall market sentiment.

In conclusion, despite the Curve protocol’s press time challenges, its treasury growth and lower selling pressure on the CRV token could be positive indicators for the future. Additionally, Frax Finance’s high APR could bring new users to the Curve network and help rekindle interest in CRV.