CVX crypto soars 20% in 24 hours – Is $5 the next target?

- CVX crypto pumped 83% on the 19th of November; will the uptrend continue?

- A notable whale could have triggered the wild upswing, per an analytics firm.

Convex Finance’s native token, CVX crypto, soared 20% in 24 hours, a surprise pump reportedly triggered by a massive whale bid.

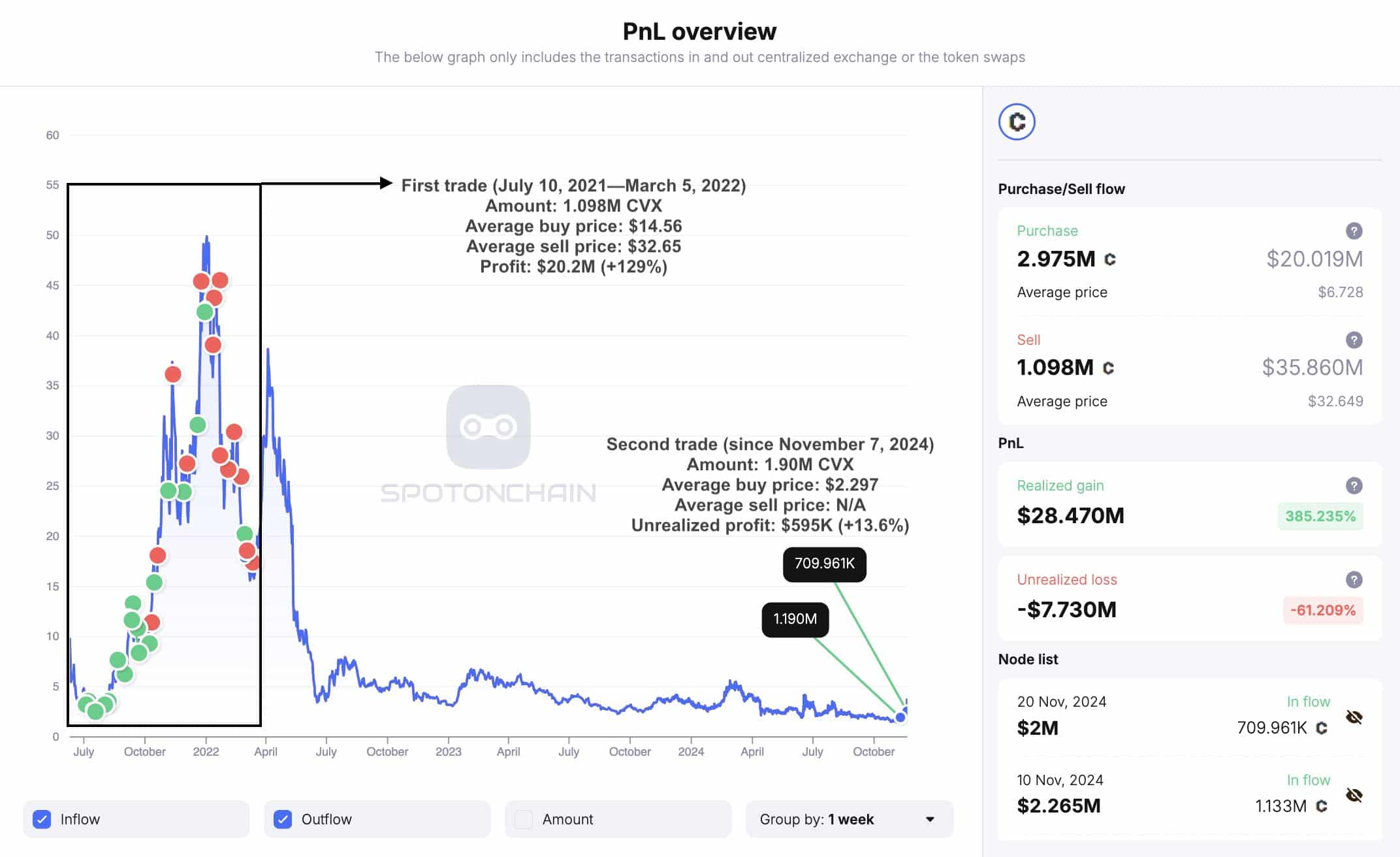

According to SpotOnChain, a profitable CVX whale opened a $2M bid (709961 CVX), and the token mooned 61% a few hours later.

Part of the analytics firm update read,

“Between July 2021 and March 2022, this whale traded 1.098M $CVX, earning a $20.2M profit (+129%) from that first trade.”

This was the whale’s second trade (accumulation) after about a 2-year hiatus, signaling a potential extra upside for CVX.

What’s next for CVX crypto?

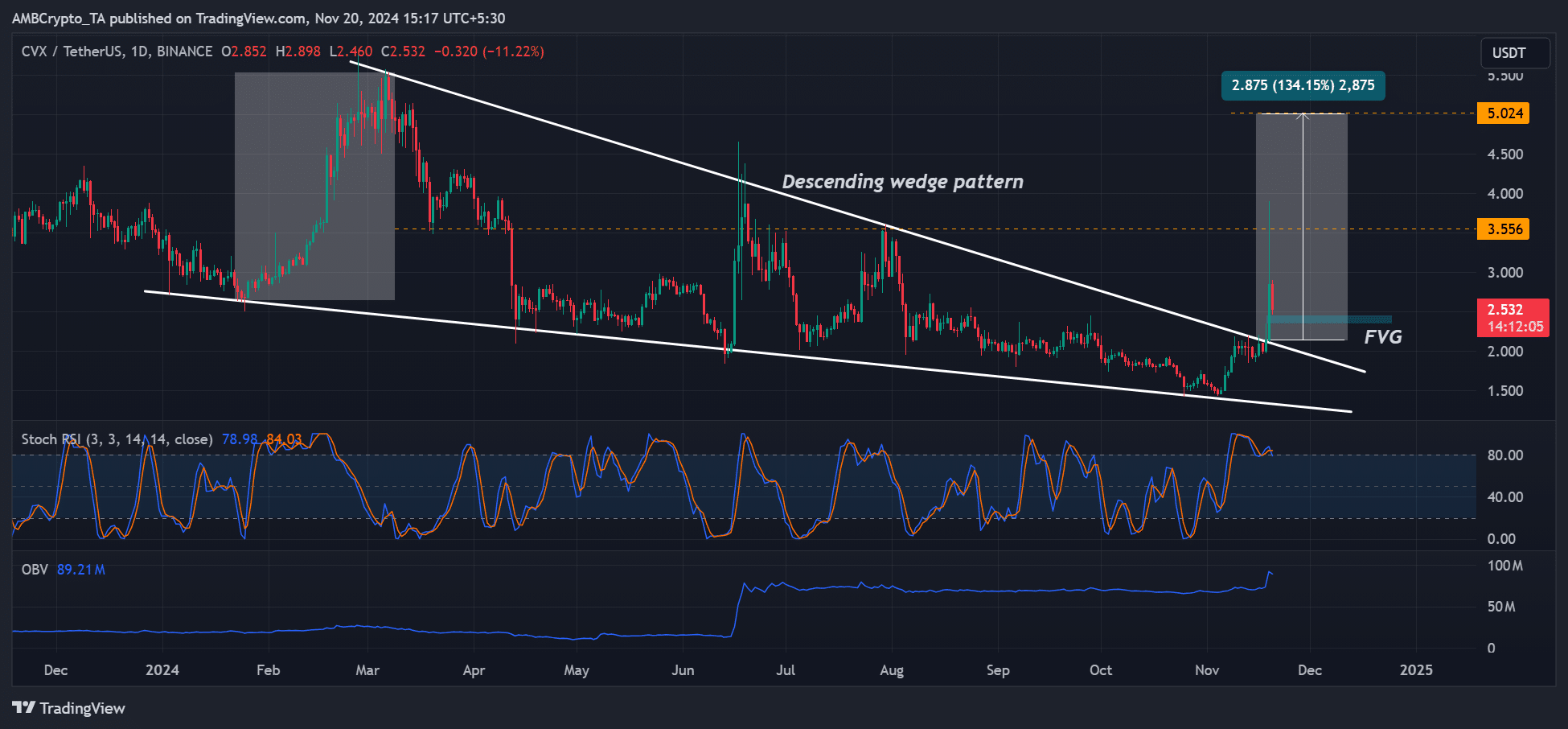

From a classical charting perspective, CVX chalked a descending wedge pattern from its 2024 price action. The wild +80% breakout rally could be just a teaser for CVX.

In most cases, a breakout from the pattern tends to soar to a level similar to the height of the wedge.

If the classical scenario plays out, that would translate to the $5 price target. That’s an implied 134% price rally.

Put differently, the pullback to the price imbalance and FVG (fair value gap) could be a massive buy opportunity if CVX eyes $5.

However, the price momentum was still overheated, as indicated by the Stochastic RSI. So, any further pullbacks could act as a great bid opportunity for another potential run.

But a drop back to the wedge pattern could invalidate the bullish outlook.

Spot market demand dominates

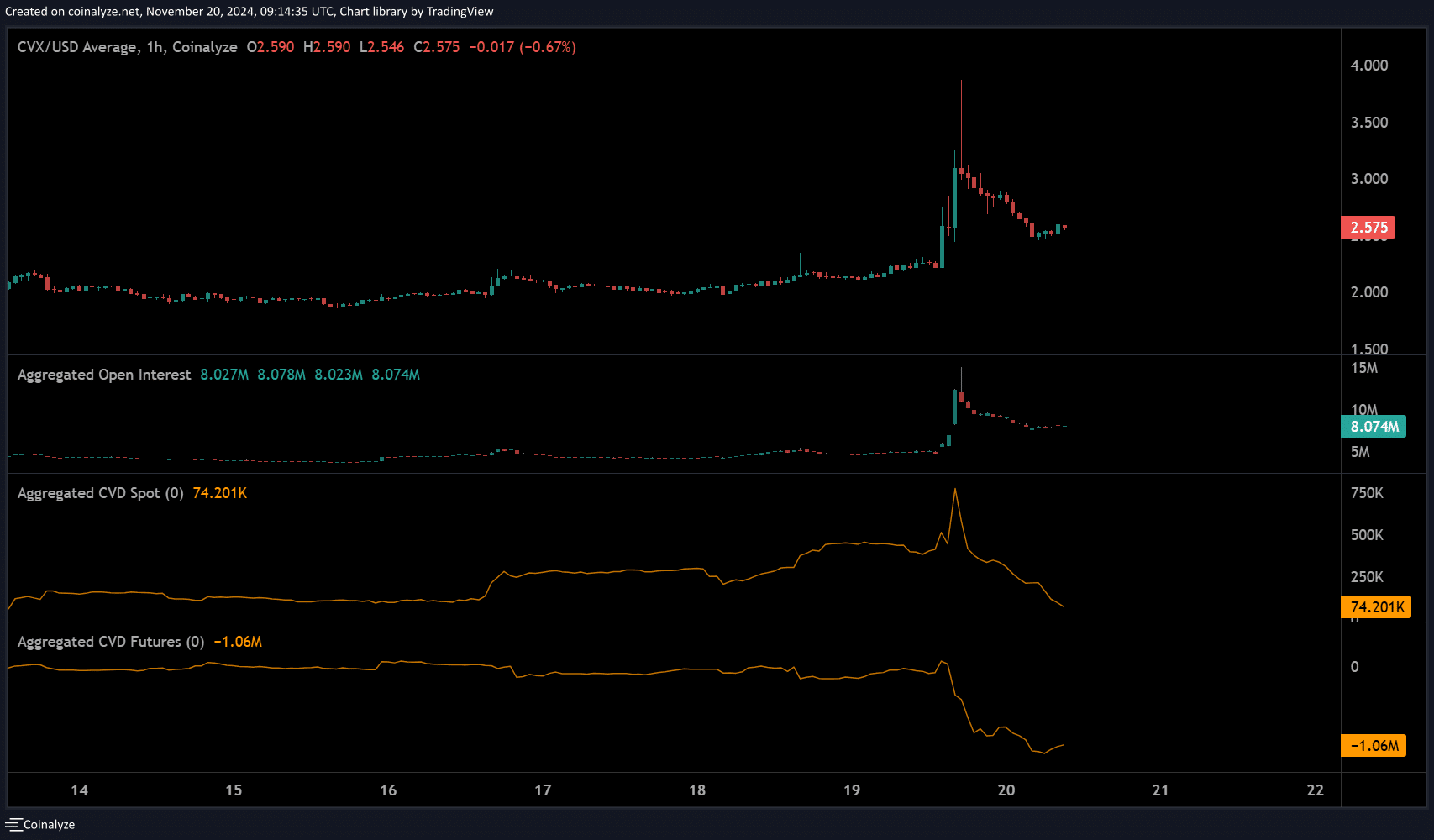

The latest price pump was massively driven by spot market demand, as illustrated by the CVD (Cumulative Volume Delta) Spot. The CVD gauges the difference between bid and ask volumes across exchanges.

The spike in CVD in spot, compared to Futures, during the price pump meant that spot market buying volume outpaced sell pressure.

Read Convex Finance [CVX] Price Prediction 2024-2025

However, as of press time, short sellers dominated the market, as demonstrated by the southbound movement on CVDs.

However, the bulls’ defense of the breakout level on the wedge pattern could be a bullish reversal sign worth tracking.