DAI struggles to reclaim $1 peg: Will the stablecoin succeed?

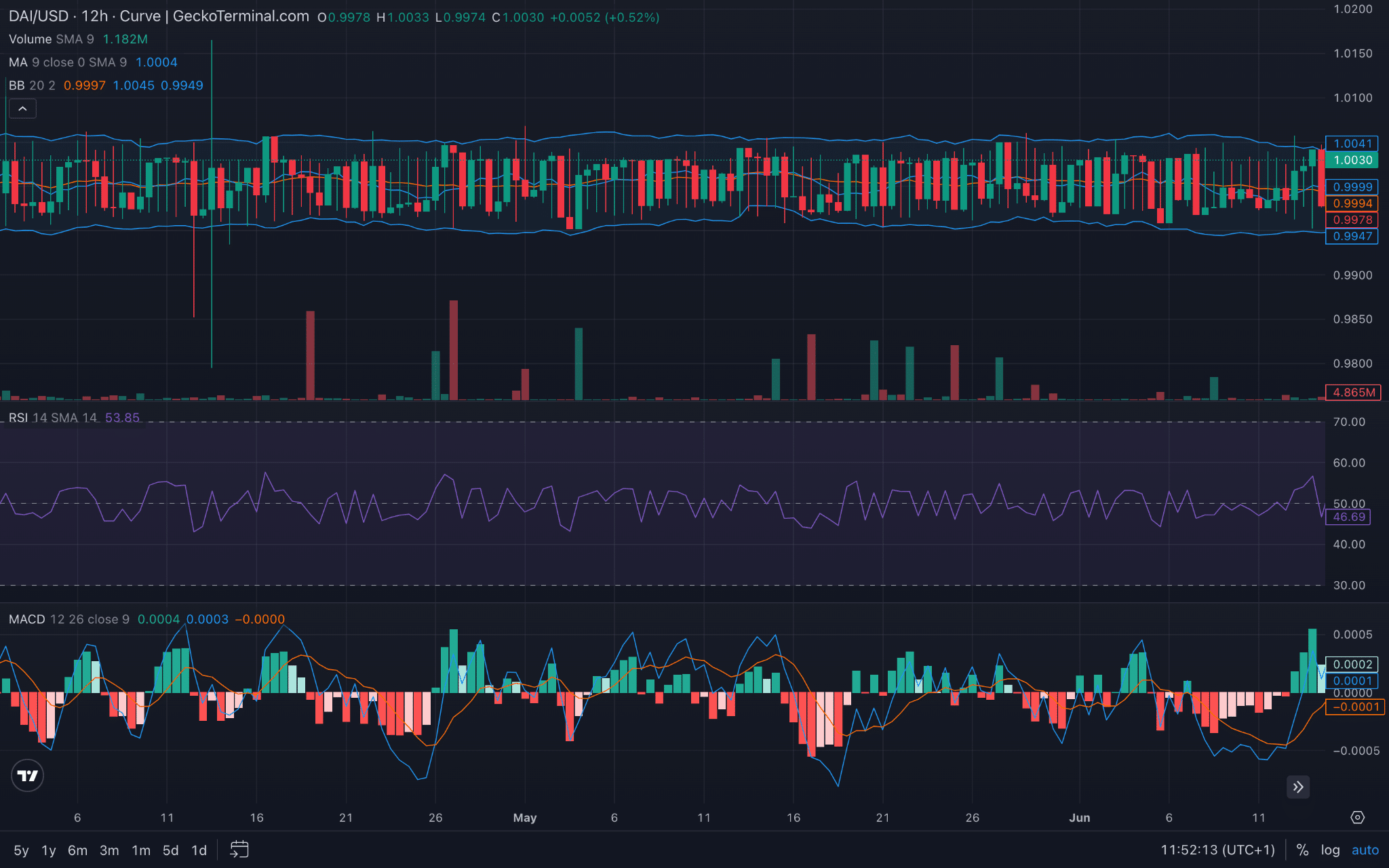

- DAI struggled to maintain its dollar peg, with trading confined within a narrow range of the Bollinger Bands.

- Mixed indicators signaled ongoing stability struggles, without strong trends pushing away from the peg.

For the past month, DAI has been struggling to maintain its dollar peg, facing significant challenges in holding steady at $1.00.

Recent fluctuations have seen DAI’s price deviate between highs of $1.001 and lows of $0.98.

Despite the fluctuations, DAI’s price action has been largely contained within the Bollinger Bands, indicating relatively stable volatility levels.

The candles staying near the upper and middle band suggested an attempt to maintain the peg at $1.00.

Assessing DAI’s future

The volume has been variable but not excessively high, suggesting that there haven’t been massive sell-offs or buys, which could otherwise destabilize the peg even more.

The RSI was around 53.85 at press time, indicating a balance between buying and selling pressures.

This level of RSI suggested that while the asset is neither overbought nor oversold, it is somewhat stable around its intended peg.

The MACD line was near zero, and the signal line shows small fluctuations around the zero mark.

This aligned with the struggle to settle definitively at $1.00, showing minor fluctuations but no strong trend away from the peg.

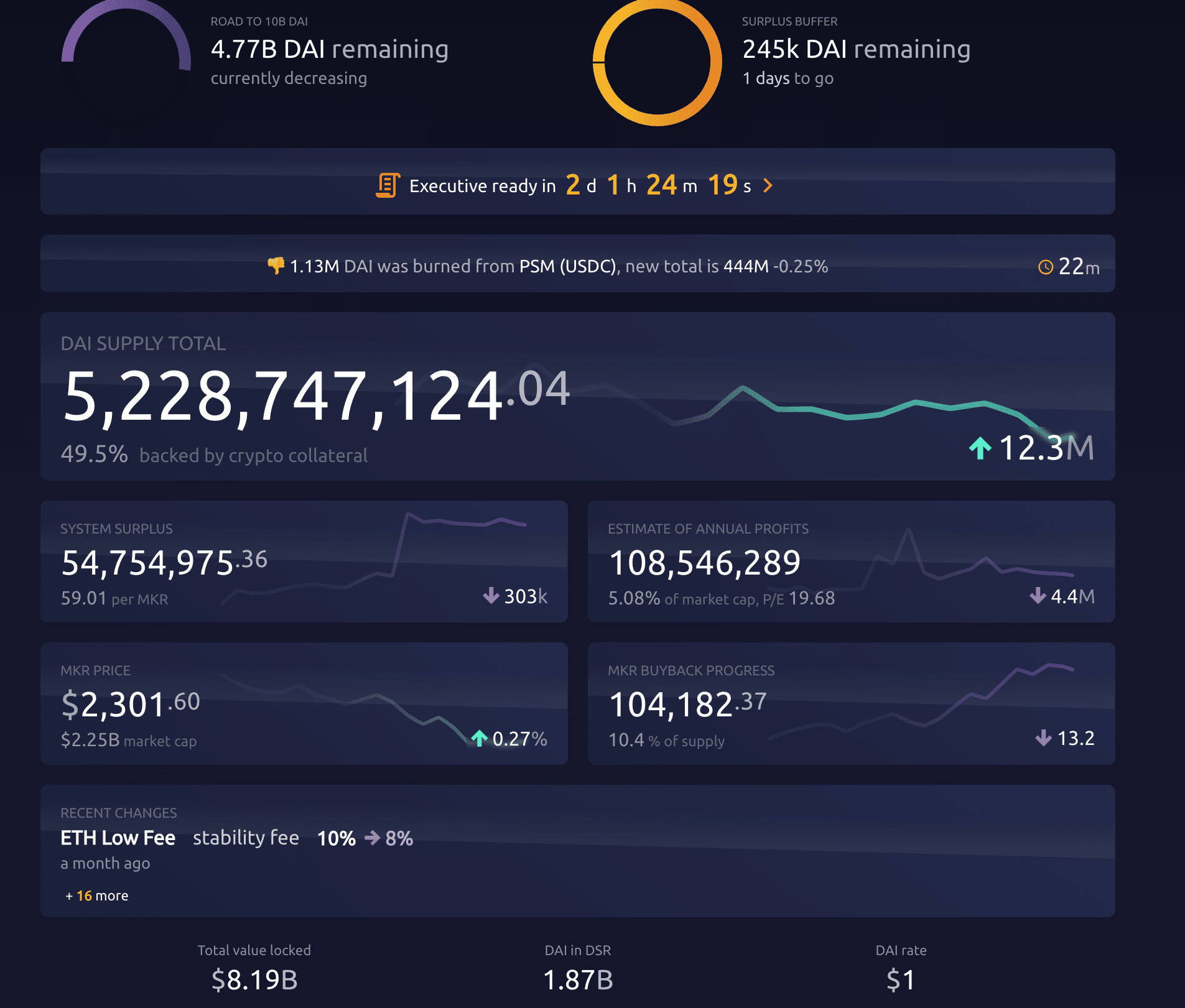

49.5% of the total DAI supply is backed by cryptocurrency collateral.

This indicated that nearly half of the DAI issued is secured by other cryptos. They can affect its stability and trustworthiness as a stablecoin if their prices are plunging, which, at the moment, they are.

A significant 67% of DAI holders were out of the money at press time, indicating that most holders acquired DAI at rates diverging from its current level.

Realistic or not, here’s MKR’s market cap in BTC terms

With 56% of DAI held by large holders, there’s a considerable concentration of control. So, liquidity and price stability are heavily swayed by the actions of a few holders.

Exchange inflows and outflows show $18.97 million coming into exchanges and $21.03 million moving out. This net outflow could slightly relieve selling pressure on DAI, helping it edge closer to its peg.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)