Data shows Bitcoin dominance in US is on the rise – Here’s what it means

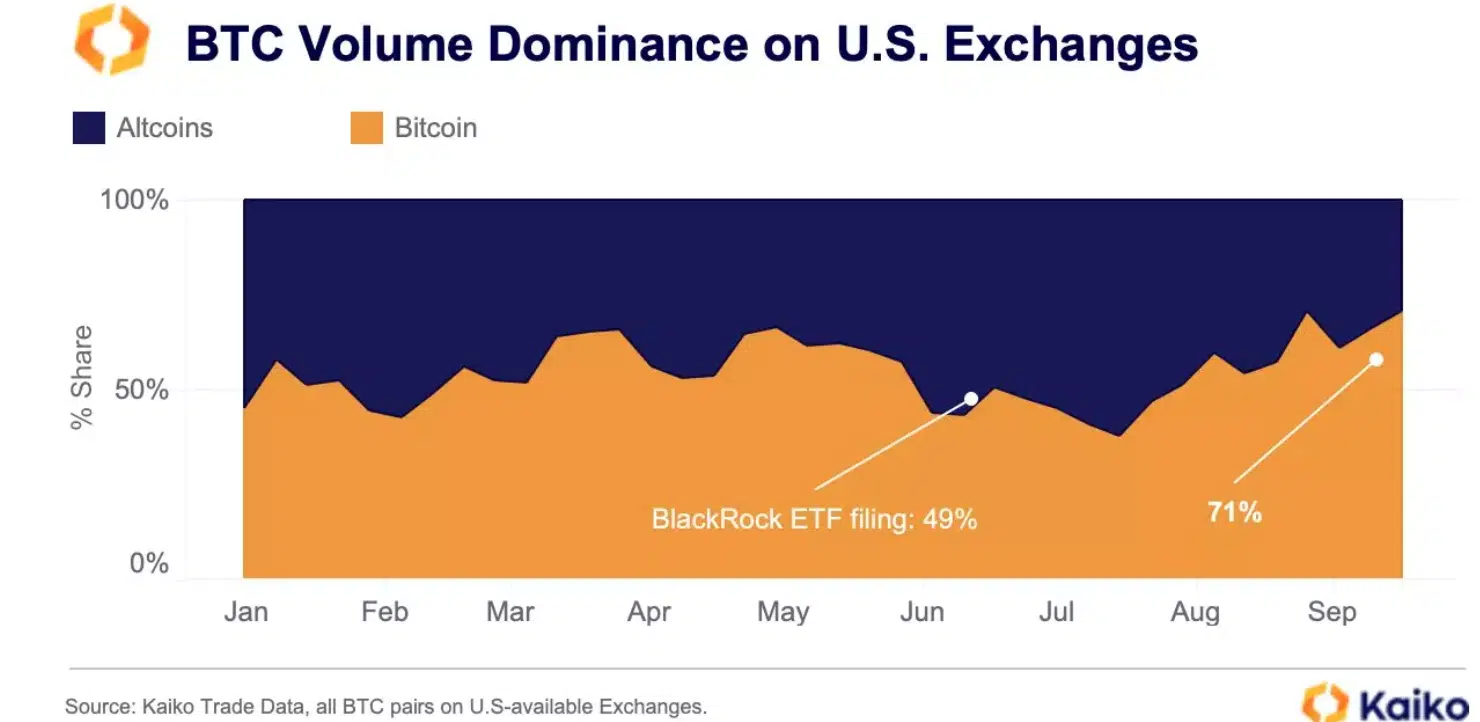

- Bitcoin’s dominance on US exchanges soared to 71%.

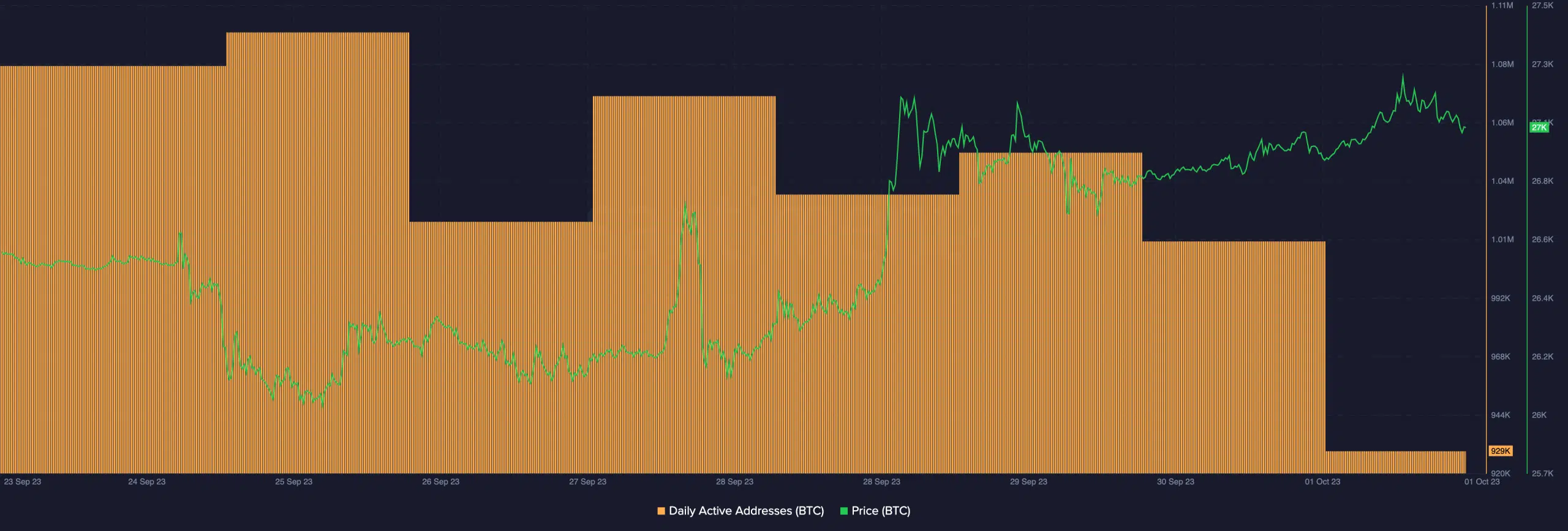

- Overall activity on Bitcoin declined despite the surge in price.

In the wake of Bitcoin’s surge beyond the $26,000 threshold, the crypto market was infused with renewed bullish sentiment.

Read Bitcoin’s Price Prediction 2023-2024

High on dominance

Additionally, Bitcoin’s [BTC] dominance on US exchanges witnessed a substantial upswing. According to Kaiko’s data, the dominance reached 71% last month, marking its highest level since October 2022.

The surge far exceeded the previous peak of 66%, observed during the US banking turmoil in March. This resurgence in dominance suggests a potential influx of institutional traders into Bitcoin, possibly influenced by rising real yields and a deteriorating global risk sentiment.

Towards the end of September, Bitcoin’s cumulative volume delta (CVD) transitioned into positive territory, indicating a net buying trend.

This increased buying pressure can help explain why Bitcoin largely maintained its price range, even after a brief dip below $25,000 in early September following FTX’s announcement of offloading its $3.4 billion crypto holdings as part of bankruptcy proceedings.

However, the recent capital injection into altcoin markets ahead of the anticipated launch of nine Ethereum ETFs in the US could temporarily disrupt this trend.

Looking at the past

Historical data from Kaiko also revealed that September traditionally tends to be a challenging month for both conventional equities and cryptocurrencies, with Bitcoin registering negative returns in 8 out of the past 12 years.

Despite modest trading volumes and surging risk-free rates, BTC recorded one of its strongest September monthly performances, closing last month with a 4.7% gain.

On the contrary, QCP Capital, a crypto asset trading firm, expressed skepticism regarding the sustainability of the recent price surge. They stated that Bitcoin might test the critical support level of $25,000 in the final quarter of 2023.

Is your portfolio green? Check out the BTC Profit Calculator

Factors contributing to this outlook include the potential diversion of demand from the spot market due to approved Ethereum futures ETFs and lower-than-expected core PCE inflation.

As of the most recent data available, Bitcoin was trading at $27,000. Despite the rising price, the number of daily active addresses on the Bitcoin network experienced a significant decline, raising questions about the underlying dynamics of the market.