Decentraland: Gauging the potential of MANA sustaining above $1

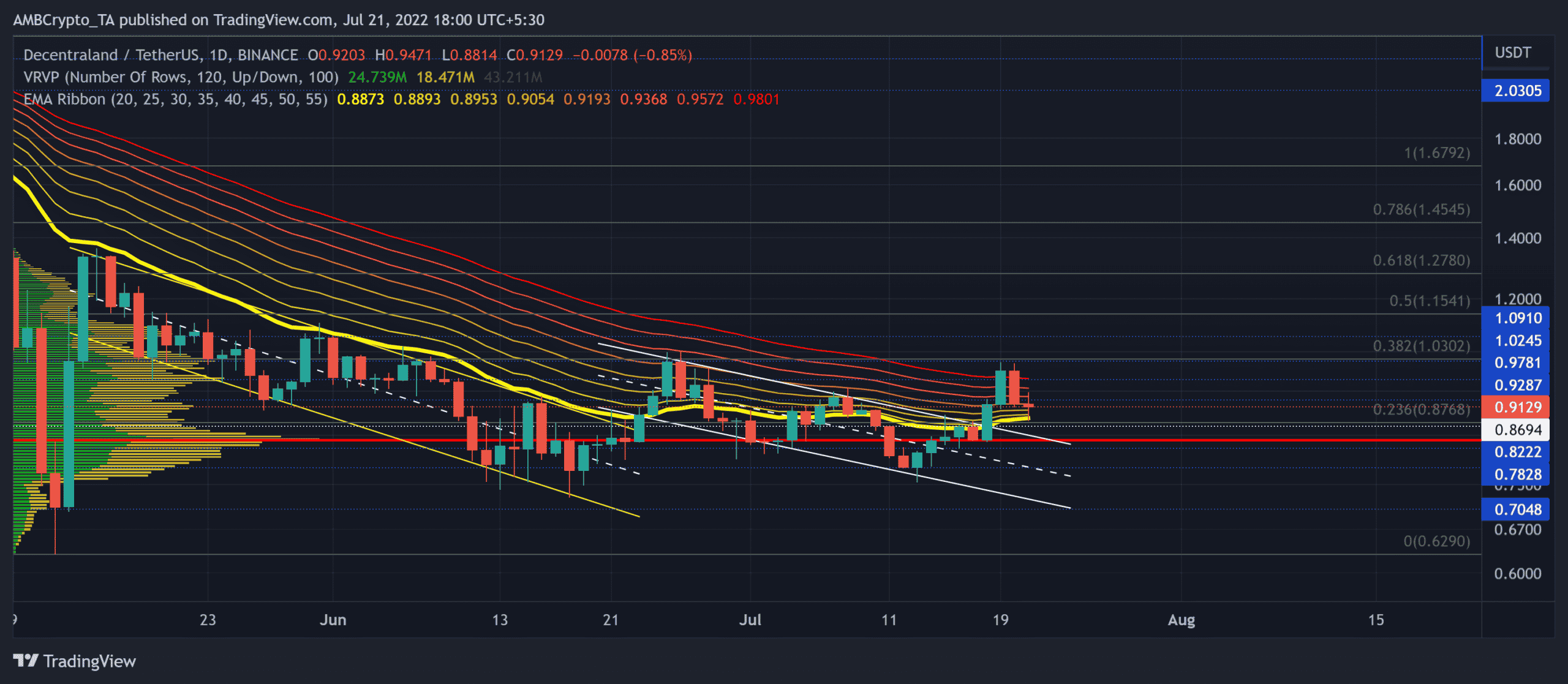

Decentraland’s [MANA] descent below the $2-mark has constricted the alt within the bearish shackles. The alt has been struggling to find a position above the EMA ribbons for over three months now.

During this phase, MANA witnessed two down-channels whilst facing hurdles near the 23.6% and the 38.2% Fibonacci resistances. The bulls needed to find a close above the ribbons to reinforce the chances of snapping the 38.2% level.

At press time, MANA traded at $0.9129, down by 6.95% in the last 24 hours.

MANA Daily Chart

The 38.2% Fibonacci resistance subdued the previous down-channel (yellow) breakout in the $1.03-region. As the selling pressure started to mount, MANA again fell into a down channel (white) to retest the $0.78-support.

With the Point of Control (POC, red) being in the $0.82-zone, the alt could not escape its low volatility over the last month. Also, the 20 EMA finally refused to look south. Any bullish crossover on the EMA ribbons would reaffirm the near-term recovery chances.

The price action could see a reversal from the $0.87-level in the coming sessions. A revival above the 20 EMA can help the buyers retest the 38.2% level in the $1.03-zone. Any bullish invalidations could provoke further losses until the POC region.

Rationale

The Relative Strength Index (RSI) finally sustained itself above the mid-line after nearly three weeks. While displaying a somewhat neutral picture, the index needed to show some improvements to confirm a strong buying edge.

The CMF’s north-looking tendencies have reflected the recent rise in money volumes. This reading amplified the chances of the bulls ensuring immediate support. Also, the DMI lines resonated with these indicators to exhibit a slight bullish edge. But the ADX continued to display a weak directional trend.

Conclusion

While the indicators took a slightly bullish bias, the MANA could see near-term gains. In this case, the potential targets would remain the same as discussed.

Finally, the alt shares a 69% 30-day correlation with Bitcoin. So, keeping a watch on the king coin’s movement could be useful to make a profitable bet.