Decentraland [MANA] falls to half-dollar value- Can bulls prevail?

![Decentraland [MANA] falls to half-dollar value- Can bulls prevail?](https://ambcrypto.com/wp-content/uploads/2023/03/julien-tromeur-EOSHmMbjT8g-unsplash-scaled-e1678534344224.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The daily chart was strongly bearish.

- The lower timeframe charts were bearish too.

Decentraland [MANA] broke below its consolidation range of $0.8254 – $0.6314 in early March, attracting aggressive selling afterward. At press time, the virtual reality blockchain platform’s token struggled to maintain its half-dollar value.

Read Decentraland [MANA] Price Prediction 2023-24

Similarly, Bitcoin [BTC] struggled to maintain the $20K value as overall market uncertainty persisted and could expose MANA to price fluctuations too.

A consolidation, sustained dump, or recovery for MANA

MANA curved a bullish flag pattern, but a potential bullish rally was undermined by increasing market uncertainty. Bulls lost crucial leverage after bears breached the $0.6314 support on March 3.

The aggressive selling afterward has further sunk MANA below another key support at $0.5326. At the time of writing, MANA oscillated between the 100-day MA (Moving Average) of $0.5422 and $0.4986.

If BTC fluctuations persist, MANA could enter a sideways market structure. As such, investors could target the upper and lower boundaries of the $0.5422 – $0.4986 range for gains.

However, a breach of the range will invalidate the above sideway structure. Notably, a bearish breakout could settle at $0.4600 or $0.4200.

On the other hand, a bullish breakout and a daily candlestick close above $0.5326 could inflict recovery with an immediate target at $0.6314.

Is your portfolio green? Check the MANA Profit Calculator

The RSI has declined significantly, while the OBV (On Balance Volume) also dipped, showing limited buying pressure and trading volumes.

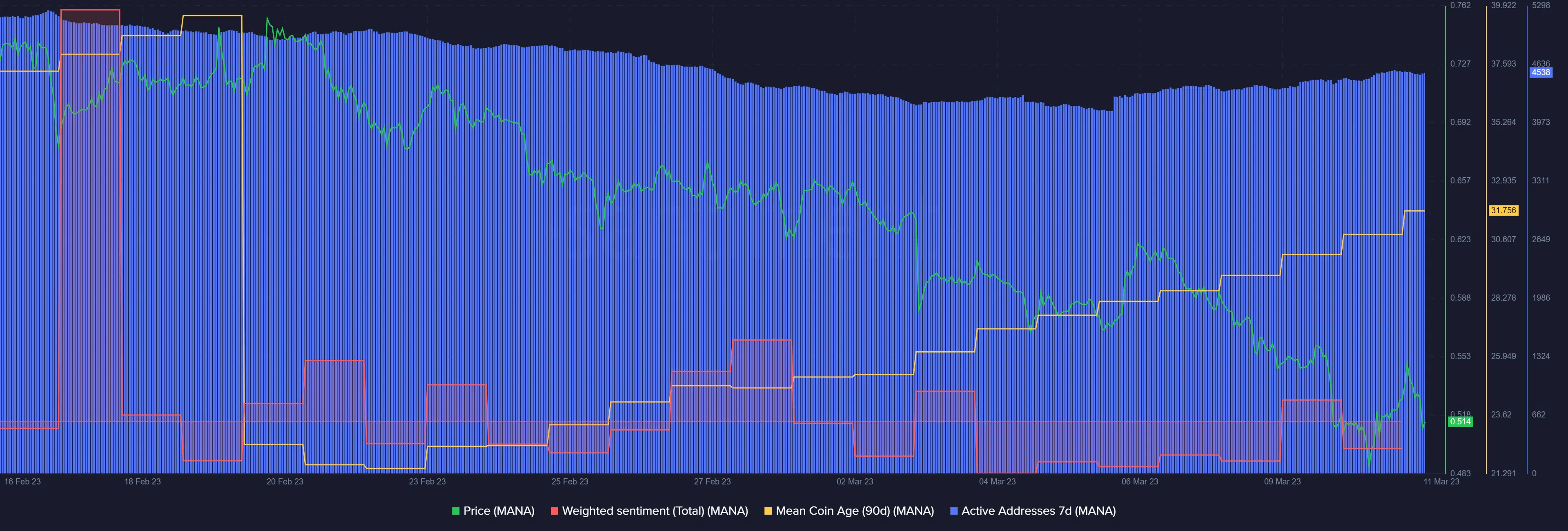

Mean Coin Age and weekly active addresses increased

According to Santiment, the 90-day Mean Coin Age rose steadily, suggesting a possible bullish rally. Similarly, an uptick in weekly active addresses in the past few days could boost the trading volumes needed to inflict a recovery.

However, the weighted sentiment remained in the negative territory, showing that investors’ confidence in the asset declined. In addition, the uncertainty around BTC could delay a strong recovery. Therefore, BTC and investors should track the king coin’s price action before making moves.