Decentraland [MANA] sits at overbought highs- A recipe for disaster?

![Decentraland [MANA] sits at overbought highs- A recipe for disaster?](https://ambcrypto.com/wp-content/uploads/2023/01/1668164660433-60bded8a-3f9f-46b8-974e-c9d8d02e71a8.jpg)

- Decentraland saw growth in its ecosystem metrics in the last week.

- MANA’s price jumped by over 70% in the last seven days.

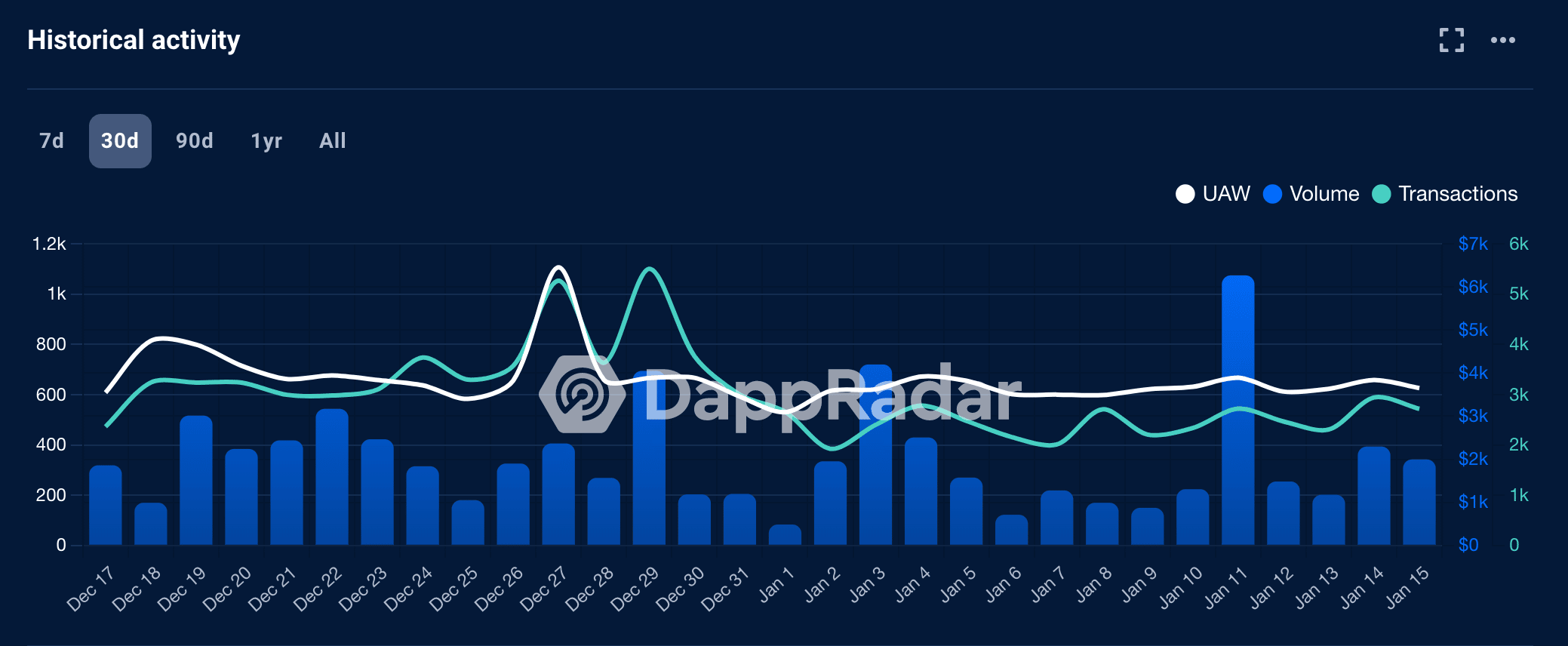

Decentraland [MANA], the Ethereum-based decentralized virtual world, saw a jump in growth metrics in the last week, per data from DappRadar.

According to the decentralized applications (dApps) data tracking platform, the virtual world logged an increment in its weekly users, transactions count, and sales volume in the last seven days.

With 1,770 unique active wallets (UAW) on Decentraland in the last week, the total count of UAW went up by 4%. Within the period under review, the number of transactions made between UAWs on Decenraland totaled 17,900. This represented an 8.44% jump in transaction count on the metaverse-based platform.

Realistic or not, here’s MANA’s market cap in BTC’s terms

Further, increased interaction between active wallets culminated in a rally in sales volume on Decentraland, data from DappRadar showed. With sales worth $15,990 completed on Decentraland in the last seven days, sales volume spiked by 19.47%.

MANA is not left out

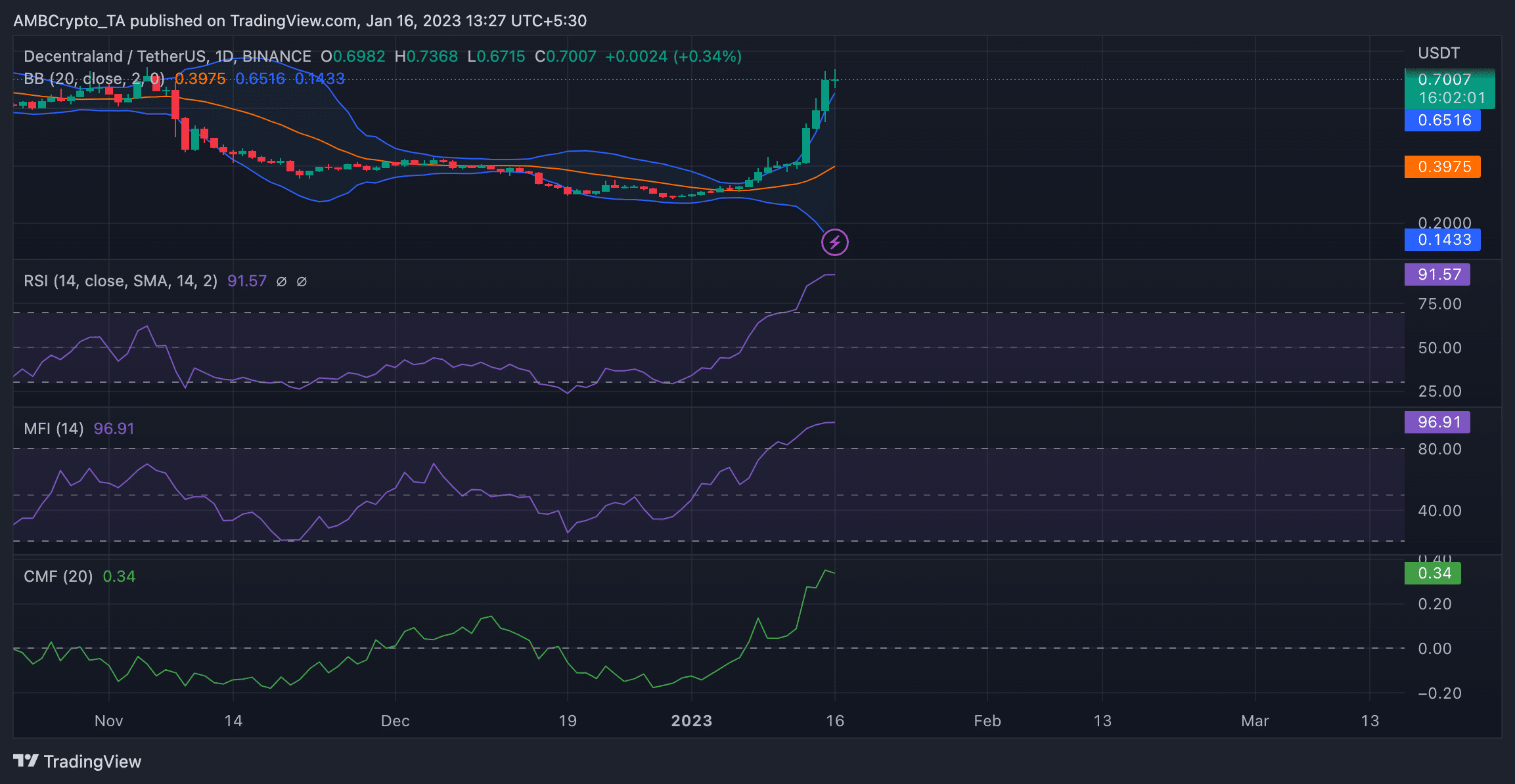

MANA, the native token that powers Decentraland saw a growth in its price in the last week, data from CoinMarketCap showed. Exchanging hands at $0.7007 at press time, the metaverse token ranked as the cryptocurrency asset with the second-highest gains in the last week. Its price ballooned by 76% within that period.

A price chart assessment revealed that the altcoin was severely overbought at press time. For example, the Relative Strength Index (RSI) was 91.57. Likewise, MANA’s Money Flow Index (MFI) rested at 96.91.

Also indicating significant buying pressure in the market, the dynamic line of MANA’s Chaikin Money Flow (CMF) laid in the positive zone far from the central line at 0.34.

It is imperative to note that when a crypto asset is overbought, it means that demand for it is greater than the current market conditions would justify, and its price has risen to a level that is considered too high.

At such a level, profit-taking is common, and buyers typically find it difficult to sustain further price rallies. Hence, a drawdown in MANA’s price might occur in the coming days.

How many are 1,10,100 MANAs worth today?

Further, an assessment of the alt’s Bollinger Bands (BB) hinted at severe price volatility in the current MANA market as a wide band existed between the upper and lower bands of the BB.

High volatility in the price of an asset can lead to significant fluctuations in a short period of time, with prices moving both upward and downward. This could be both beneficial and detrimental for investors, as it presents opportunities for rapid gains, but also increases the risk of significant losses if the price moves against their position.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)