Decentraland: Traders could see some profits if MANA stays put at these levels

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- MANA formed an ascending triangle chart pattern

- A possible upside breakout target could be $0.4740 and the 38.2% Fib level ($0.5054)

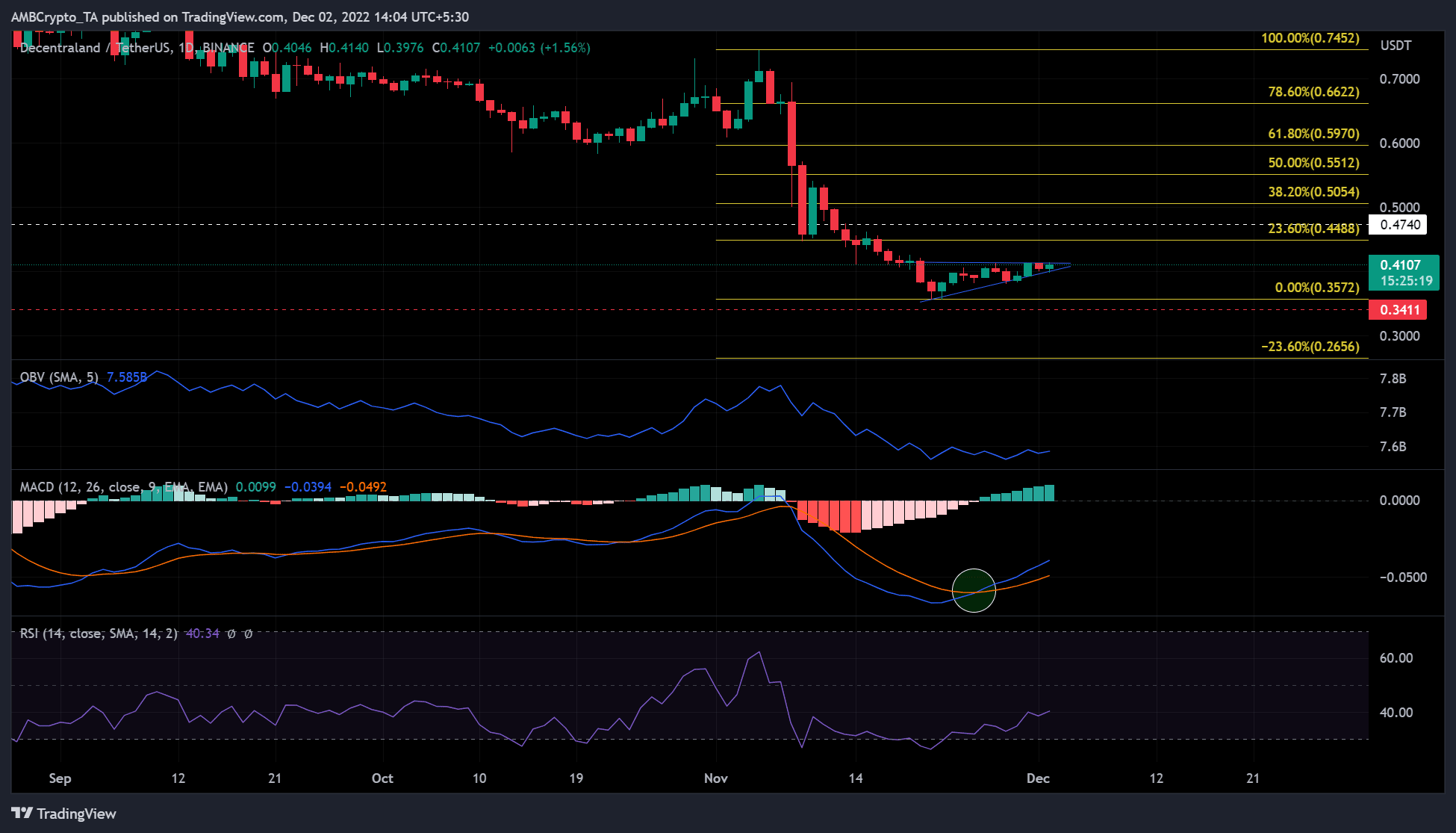

Decentraland [MANA], the Metaverse-based project, recorded a bullish Moving Average Convergence Divergence (MACD) crossover on 25 November. The crossover opened buying opportunities for interested MANA investors.

Further gains could occur if MANA could manage to record a bullish breakout from its recent ascending triangle pattern. As of 2 December, MANA was trading at $0.4107. If Bitcoin [BTC] recaptures and holds the $17K level, a bullish breakout from the ascending triangle could be possible. This could put MANA on an uptrend towards $0.4740 and $0.5054.

Read Decentraland’s [MANA] price prediction 2023-2024

At press time, MANA was trading at $0.418602 and was trading 3.5% higher in the last 24 hours.

MANA forms an ascending triangle: can bulls influence an upside breakout?

MANA was already posting lower lows before the FTX implosion. However, two weeks before the FTX saga, MANA rallied, reaching a high of $0.7452. The post-market plunge caused it to break through several support levels.

The bulls found a resting zone at $0.2572, from which a successful rally was initiated on 22 November. Since the beginning of the recent rally, MANA’s price movement formed an ascending triangle – a typical bullish chart pattern.

In addition, the price formed a bullish MACD crossover, which was a buy signal for an early uptrend. Therefore, MANA will likely target $0.4740 and $0.5054 on an upside breakout.

In particular, the Relative Strength Index (RSI) also moved out of the oversold territory and was seen on a steady rise. It showed that sellers had less and less influence, and buying opportunities were increasing.

The On-Balance Volume (OBV) also increased slightly after being relatively flat for about two weeks. This indicated that buying momentum was growing as trading volume witnessed a rise. This could increase buying pressure and help the bulls make an upside breakout from the ascending triangle in a few days or weeks.

However, an intraday close below the current support at $0.3572 would negate the bullish bias described above.

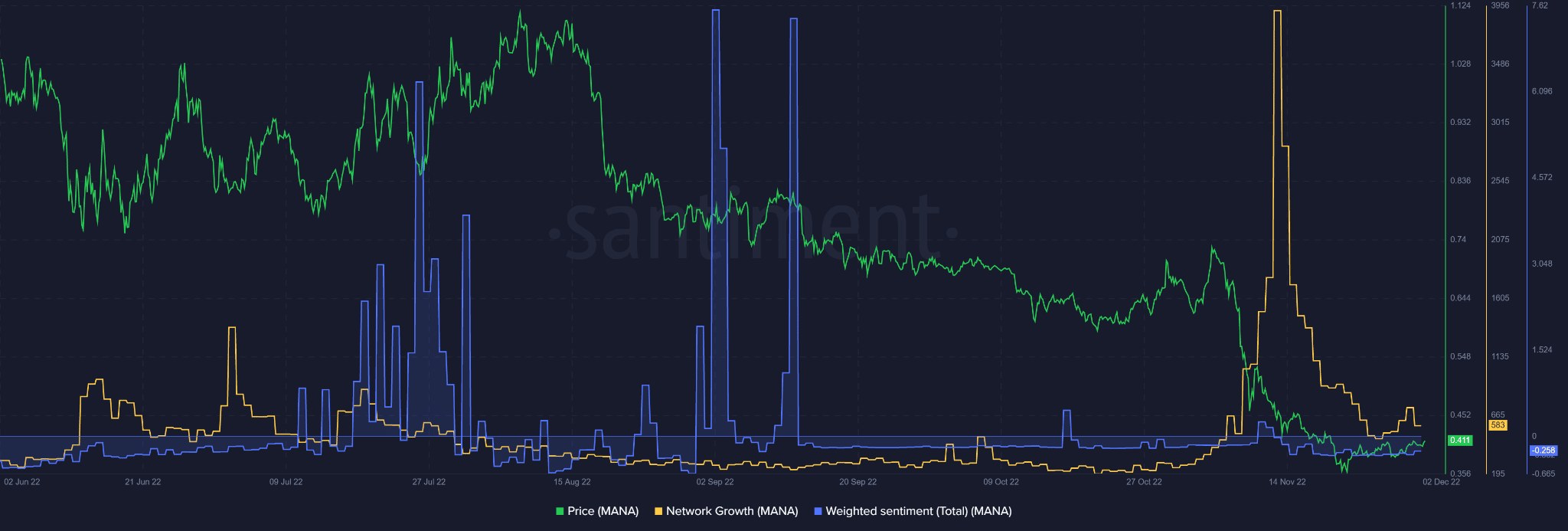

MANA saw steady network growth, but …

Decentraland saw a slight increase in network growth in the last days of November. This occurred after a significant peak in network growth in mid-November.

Interestingly, network growth from MANA bottomed out in Q3, which coincided with falling prices. So the recent uptick in growth could contribute to a price recovery.

Unfortunately, another obstacle decided to impact MANA’s growth. The overall weighted sentiment was negative at the time of publication. However, it was important to note that sentiment recovered slightly from the negative territory at the time of publication.

This could indicate that sentiment was improving, although there was still a long way to go. Thus, investors should keep an eye on BTC and MANA sentiment.