Decoding Bitcoin’s recent price surge: This group leads the way

- Short-term holders began to accumulate large amounts of BTC.

- Whale accumulation of BTC slowed down.

Bitcoin [BTC] witnessed a massive bump in price over the last few days, causing a surge in optimism amongst traders. But it wasn’t just traders that were showing optimism around BTC.

Short term holders move in

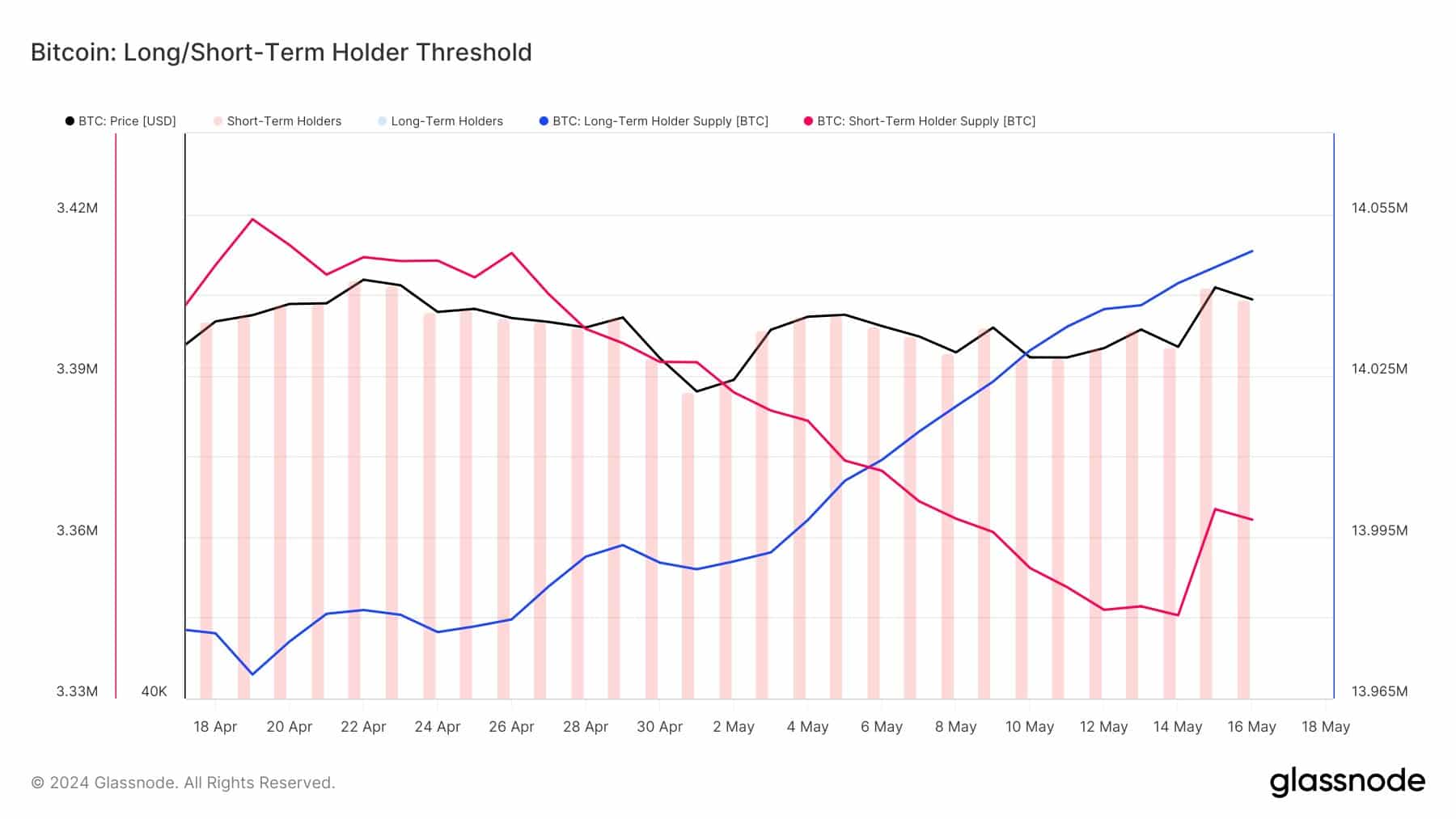

In the last few days, the Short Term Holders (STH) supply saw a net increase of over 20,000 Bitcoin.

U.S. ETFs accumulated 11,000 Bitcoin during the same period, even when considering outflows from the Hong Kong ETFs. This suggested significant demand from other sources, as reflected in the price movement.

This increased demand from STHs creates a positive feedback loop. As more people buy in, the price goes up, attracting even more buyers. This can accelerate price increases.

However, it’s important to remember that STHs are typically more likely to sell quickly on price dips, potentially leading to higher volatility.

So, while STH accumulation is a positive sign for Bitcoin’s short-term momentum, it could affect BTC’s long term growth.

What are holders up to?

Another indicator of the rising number of Short Term Holders would be the declining Long/Short ratio. A falling long/short ratio suggested that the number of long-term holders accumulating BTC were declining.

These long-term holders are more likely to keep their holdings during violent price fluctuations, which could also impact BTC negatively in the long run.

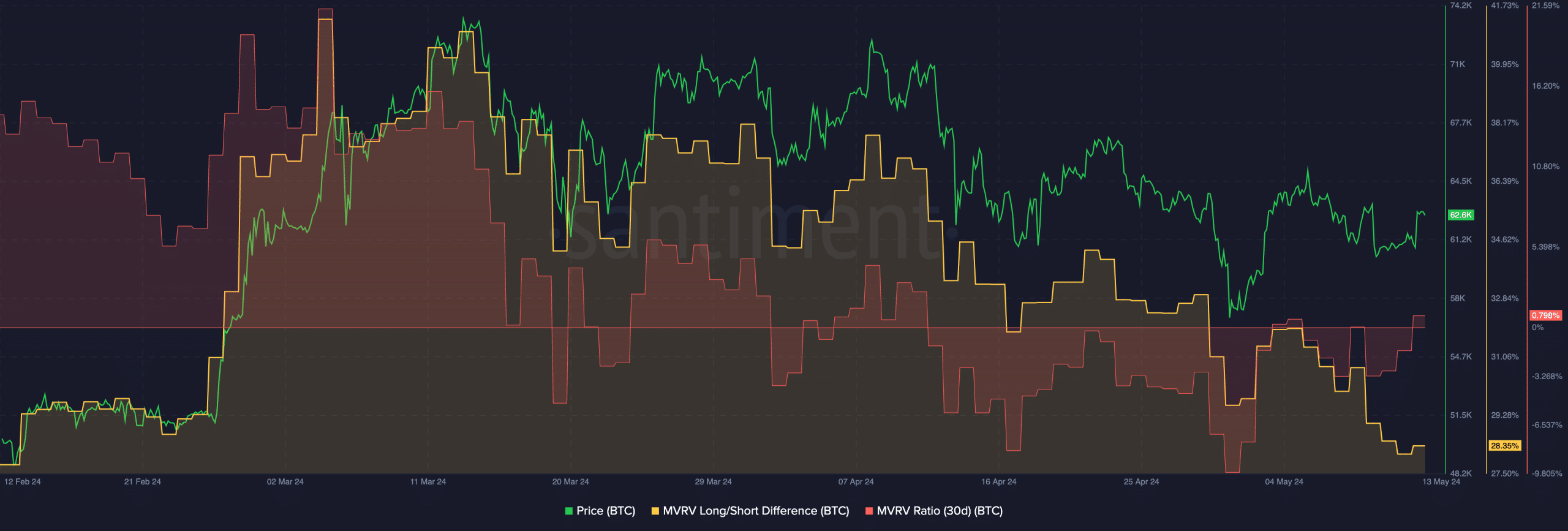

The MVRV ratio for BTC had surged in the last few days, indicating that a large number of addresses holding BTC had turned profitable.

This could add selling pressure on BTC, as STHs may be incentivized to sell their holdings for profit.

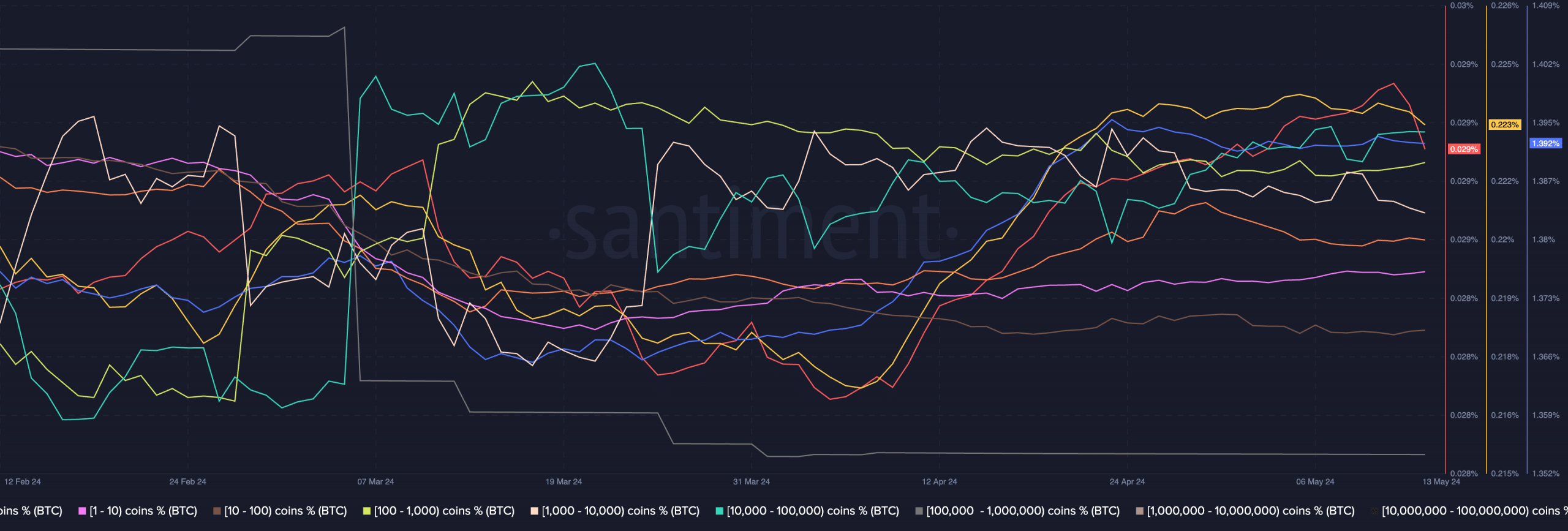

Whale behavior would also play a great role in determining the price of BTC in the future. In the last few days, whales have been stagnant in terms of accumulation of BTC.

They have not sold any of their holdings, but have shown no interest in accumulating BTC at this price level.

Is your portfolio green? Check out the BTC Profit Calculator

Retail traders, on the other hand, have been observed to buying Bitcoin en masse, which may have also contributed to the recent surge in BTC’s price.

At the time of writing, BTC was trading at $67,110.39 and its price had grown by 1.17% in the last 24 hours.