Decoding how Arbitrum [ARB] constantly outshines its peers in the L2 space

![Decoding how Arbitrum [ARB] constantly outshines its peers in the L2 space](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_group_of_figures_dressed_in_medieval_garb_gathered__1dcb9711-29f0-4247-bb47-2ee04bde3e2d-e1683464586199.png)

- Arbitrum’s dApp activity surged as the protocol continued to generate interest.

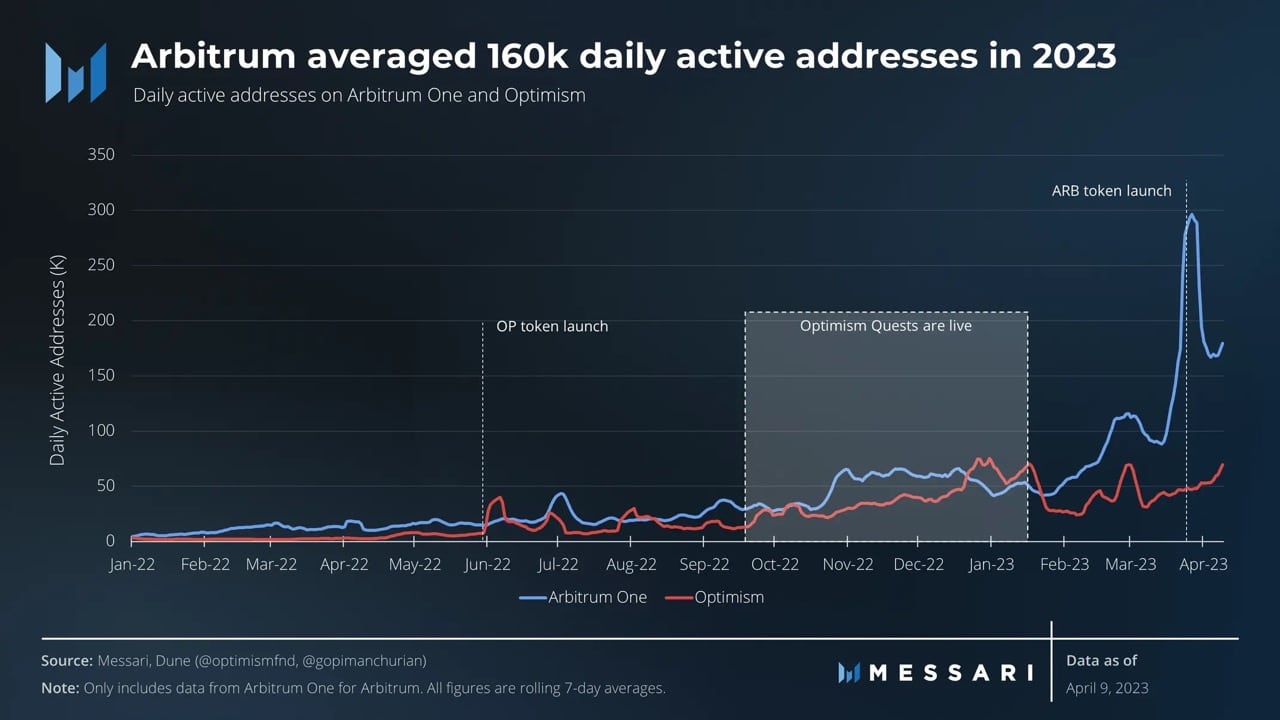

- Arbitrum averaged 160,000 daily active addresses in 2023.

Arbitrum [ARB] has managed to consistently outperform many other layer 2 solutions in terms of growth over the last few months. The dApps on the network have played a huge role in keeping the improvements consistent.

Realistic or not, here’s ARB’s market cap in BTC terms

Return of the dApps

Axelar, a popular dApp on Arbitrum witnessed a 249.5% spike in gas usage on its network. Other dApps on Arbitrum, such as Gnosis and Perennial also witnessed a surge in activity.

Axelar launches GMP this week while reaches the highest increase in gas consumption on @arbitrum pic.twitter.com/8NPCoTL3tK

— Emperor Osmo? (@Flowslikeosmo) May 7, 2023

The high interest in Arbitrum dApps contributed immensely to the surge in transactions on the network.

According to Messari’s data, Arbitrum averaged 160,000 daily active addresses in 2023 alone. The protocol managed to have almost double the number of transactions when compared to the Optimism network.

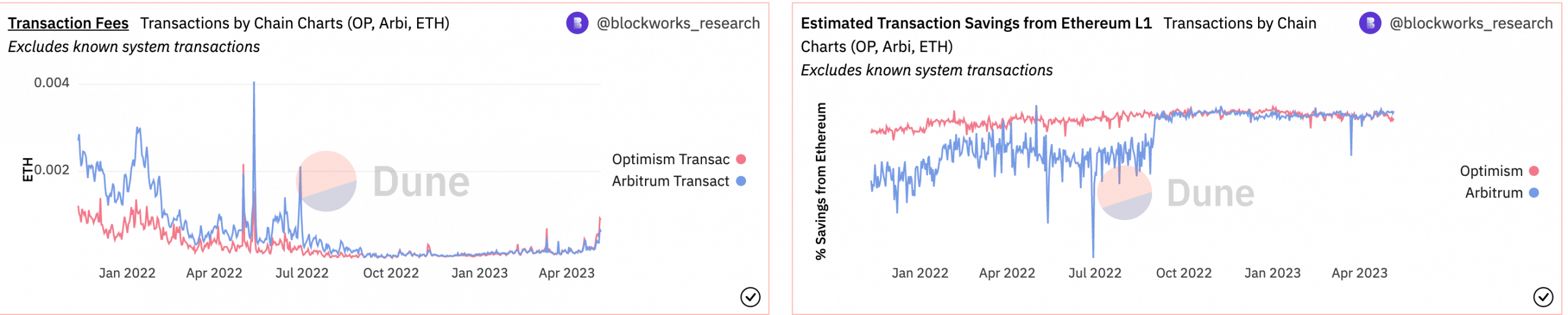

The discrepancy in activity was high despite both protocols providing the same utility to users. In terms of transaction fees both Optimism and Arbitrum charged similar fees. The difference in savings made on each protocol by users was also not too large in comparison.

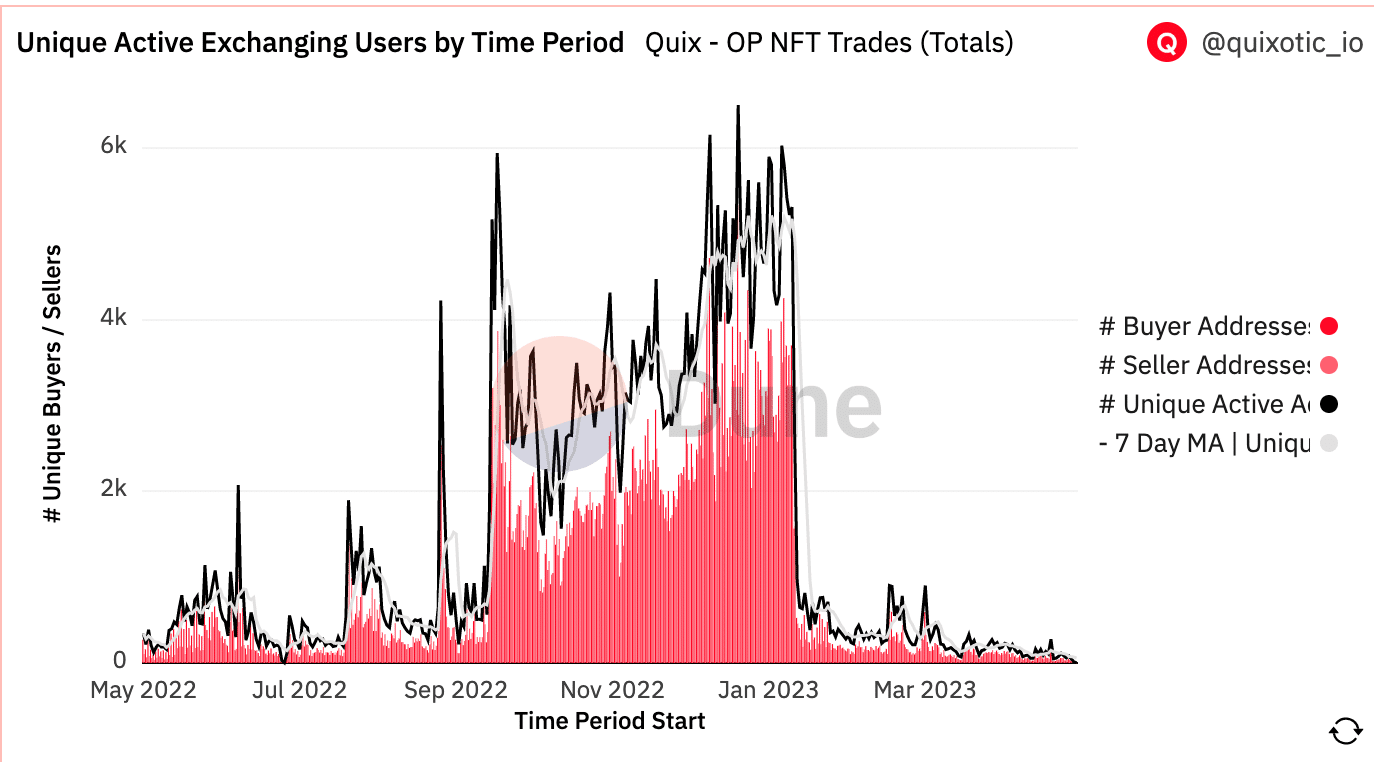

One of the reasons for the decline in interest in Optimism could be the falling enthusiasm for its NFTs.

When Optimism Quests NFT was announced, to incentivize new users to the protocol, the activity on the network surged. However, as the Quest initiative came to an end, the activity on the network took a hit as well.

The overall interest across Optimism NFTs fell significantly in the past few months as evidenced by Dune Analytics’ data.

Looking at the DeFi angle

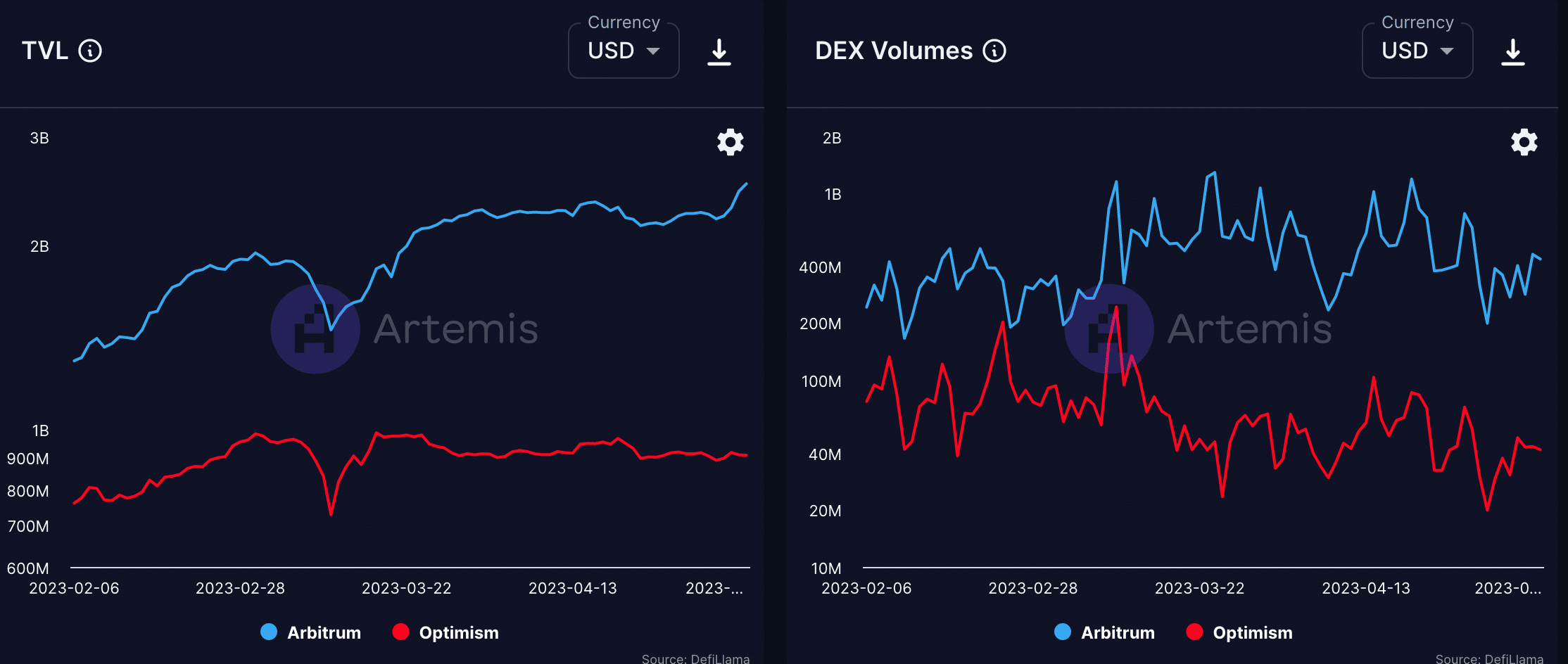

Coming to the DeFi sector, both protocols showcased positive developments in terms of DEX volumes in the last few weeks. However, the TVL on both networks did not have the same level of congruency.

Arbitrum’s TVL continued to soar in the last few weeks, while Optimism’s TVL remained stagnant.

Is your portfolio green? Check out the Arbitrum Profit Calculator

Even though Arbitrum has been dominating the L2 sector, it is important to note that a lot of the activity on the network was due to the launch of the ARB token.

Over time, as the interest in the token fades away and new competitors such as zkSync Era and StarkNet start to gain traction, Arbitrum’s dominance could be threatened.