Decoding the latest USDC update- Are USDT and DAI safer bets

- Circle’s new statement revealed that USDC was 100% collateralized with the majority of its holdings collateralized through U.S. treasury bills.

- Many investors sold their USDC, some, however, bought the bottom.

Over the last few days, there has been a lot of FUD surrounding Circle after the firm was impacted by the bank run on Silicon Valley Bank (SVB).

On 12 March, Jeremy Allaire, CEO and co-founder of Circle, tweeted Circle’s statement on this matter.

Circle du Soleil

According to Circle’s statement, its stablecoin USDC was 100% collateralized. Based on the data provided by Circle, 77% of USDC was collateralized through U.S. Treasury Bills, which amounted to $32.4B. The rest of its funds, which totaled $9.7 billion, were held at various institutions, one of which was SVB.

It was found that out of the remaining $9.7 billion, $5.4 billion of the funds were moved to BNY Mellon, in an effort to reduce bank risk.

At press time, SVB held a total of $3.3 billion of Circle’s funds.

The market reacts

Despite all the efforts made by the Circle team to give clarity on the matter, the FUD continued to haunt the stablecoin.

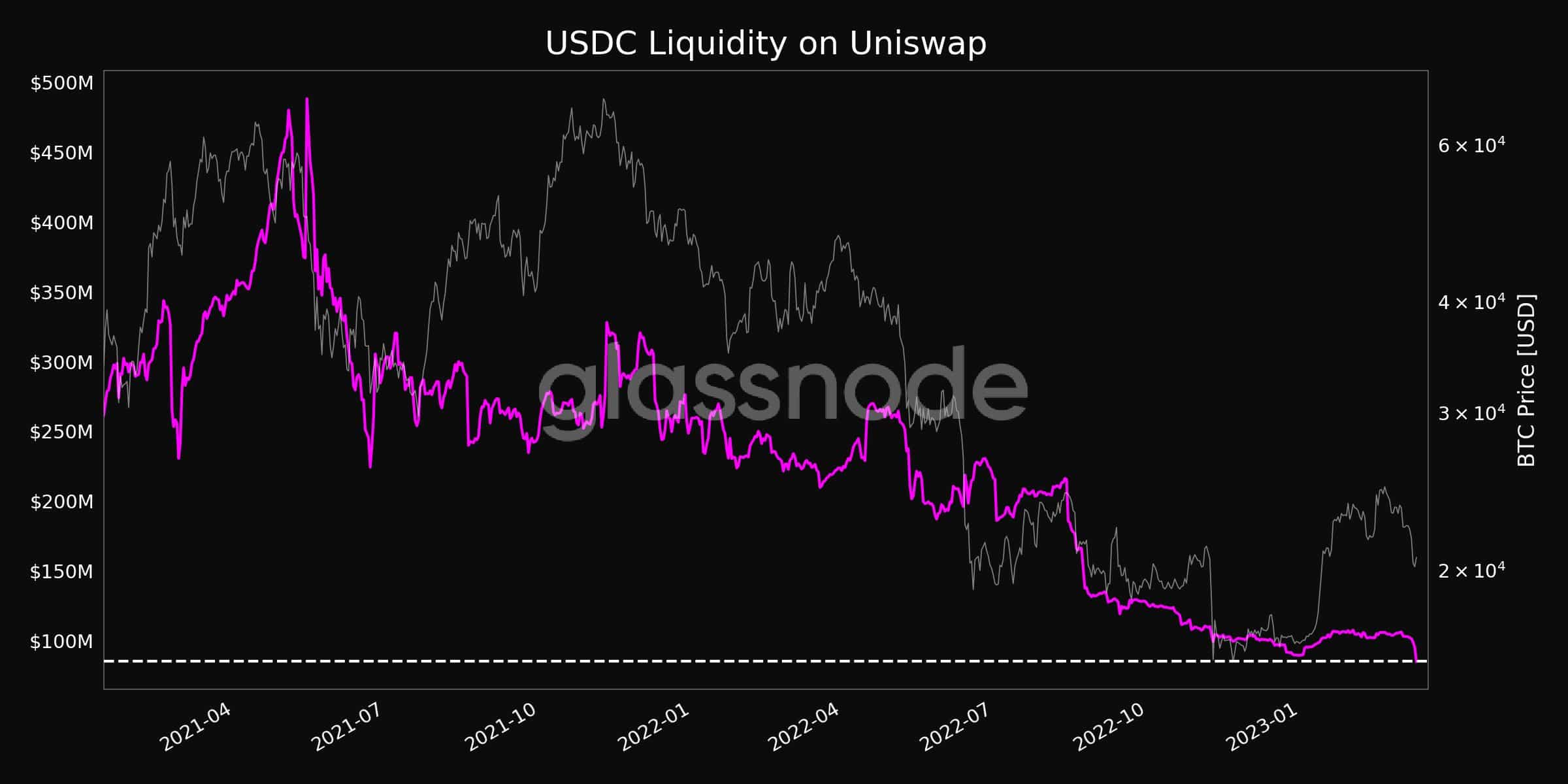

One indicator of the declining interest and rise in FUD was the decreasing liquidity of USDC on Uniswap. At press time, the liquidity of USDC on the DEX reached a 2-year low of $85,190,702.41.

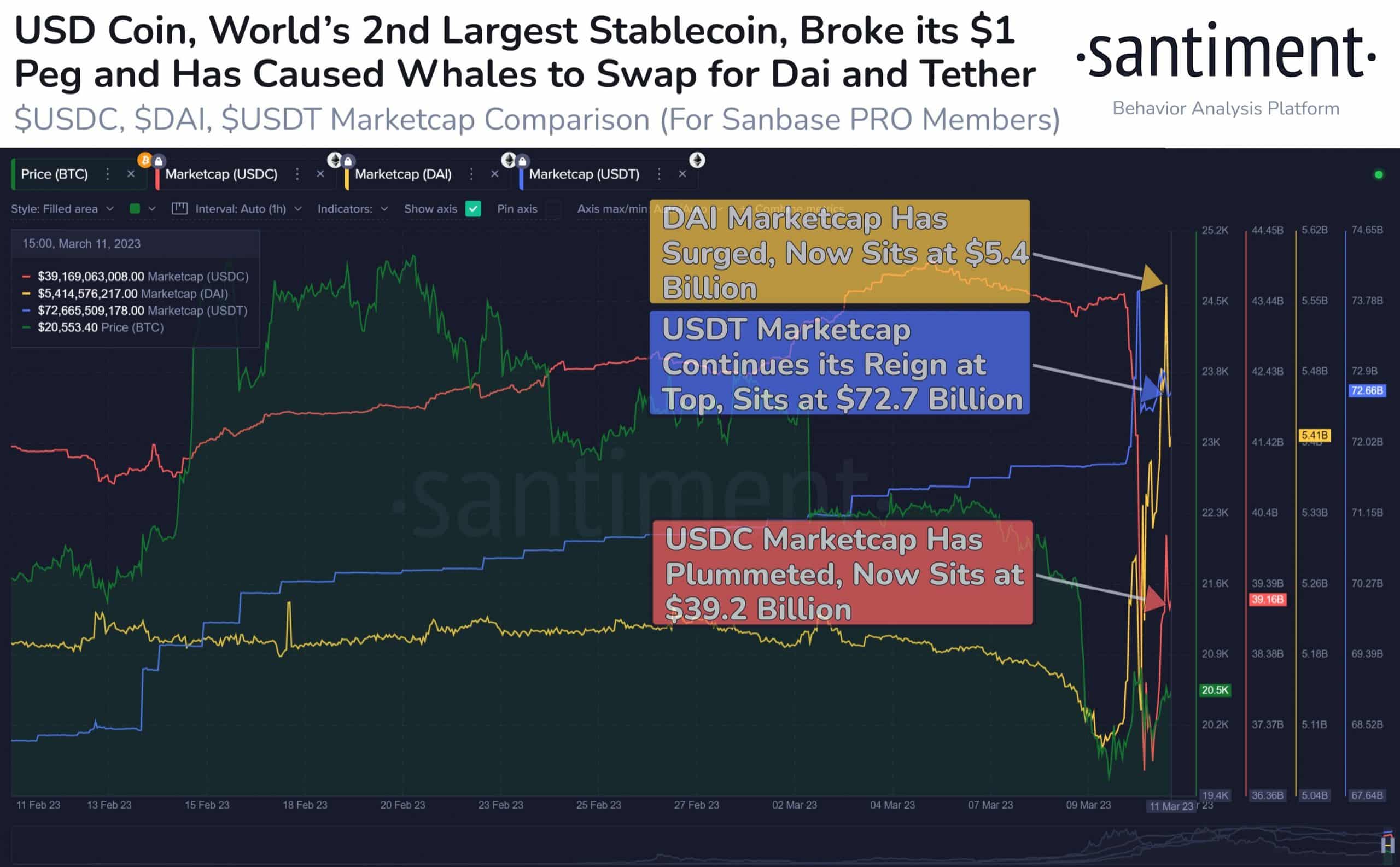

As the skepticism against USDC began to rise, the interest in other alternative stablecoins such as USDT and DAI, went uphill.

According to Santiment’s data, the overall market cap for DAI and USDT surged by 6.8% and 1.2%, respectively. However, USDC continued to lose its footing as its market cap fell by 8.1% during the same period.

One of the reasons for the sharp decline in USDC’s market cap was the behavior of various large-scale funds and investors.

This ain’t no ‘FUN’d anymore

Lookonchain’s data indicated that major investment firms such as Jump Trading, Wintermute Trading, and BlockTower Capital exchanged large amounts of USDC for USD through Circle and Coinbase.

But it wasn’t just the funds that were exiting their positions, the likes of Justin Sun also got involved.

According to the data, Justin Sun exchanged 127M $USDC for 126.96M $DAI.

On the other hand, investors such as Vitalik Buterin and firms like Taureon Capital, showed immense faith in the stablecoin and bought USDC at the bottom.

How will Funds respond to the $USDC depegging?

Panic selling $USDC or buying $USDC at the bottom?

1.?

Here are the operations of Funds?

Hope it can be helpful to you. pic.twitter.com/x4PYEyZbev

— Lookonchain (@lookonchain) March 11, 2023

Given the magnitude of the SVB incident, numerous prominent investors and venture capitalists have shared their perspectives on the issue. Notably, angel investor Naval Ravikant commented in a tweet that this event might motivate businesses to seek alternatives for depositing their funds, other than banks.

Startups who got their money out can put their first $250K into FDIC backed accounts or $1M into (Insured Cash Sweep) accounts.

Rest can go into https://t.co/3LFOsZE5uS or BTC / ETH if comfortable with crypto risk.

No point in taking bank risk until the Fed steps in.

— Naval (@naval) March 11, 2023