Decoding the not so obvious reason behind Bitcoin [BTC] logging heavy network traffic

![Decoding the not so obvious reason behind Bitcoin [BTC] logging heavy network traffic](https://ambcrypto.com/wp-content/uploads/2023/05/Bitcoin-1.jpg)

- On 1 May, 60% of all transactions on Bitcoin used Taproot, hitting an all-time high.

- Bitcoin network also recorded $3.5 million in transaction fees, reaching a 2-year high.

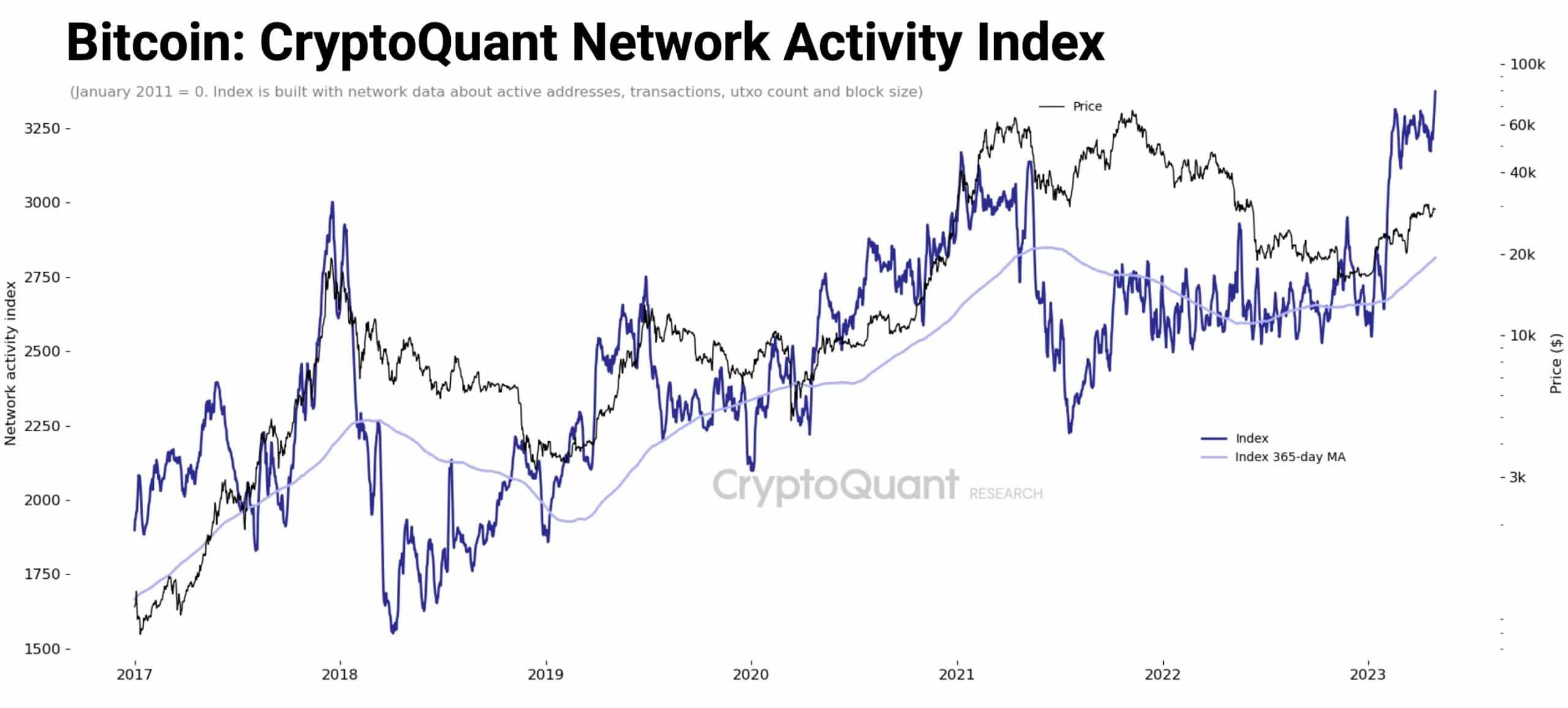

The bull market of 2o23 has led to a sharp spike in network activity on the Bitcoin [BTC] chain. The number of daily transactions and unique active addresses have grown steadily over the last four months.

Read Bitcoin (BTC) Price Prediction 2023-24

Blockchain analytics firm CryptoQuant devised a Bitcoin Network Activity Index to capture the burgeoning activity on the chain. The index takes into consideration key indicators like transactions, addresses and demand for block space.

Interestingly, the primary reason behind the rise in network traffic was transactions driven by Taproot addresses, as underlined by CryptoQuant CEO Ki Young Ju.

Source: CryptoQuant

Bitcoin reinvents itself

Up until 2023, Bitcoin’s reputation was restricted to being a peer-to-peer (P2P) payments network with not much real-world utility apart from settling transactions on the chain.

However, with the Taproot upgrade, Bitcoin started to position itself like other conventional layer-1 blockchains, enabling deployment of smart contracts on the chain and minting of Ordinals NFTs.

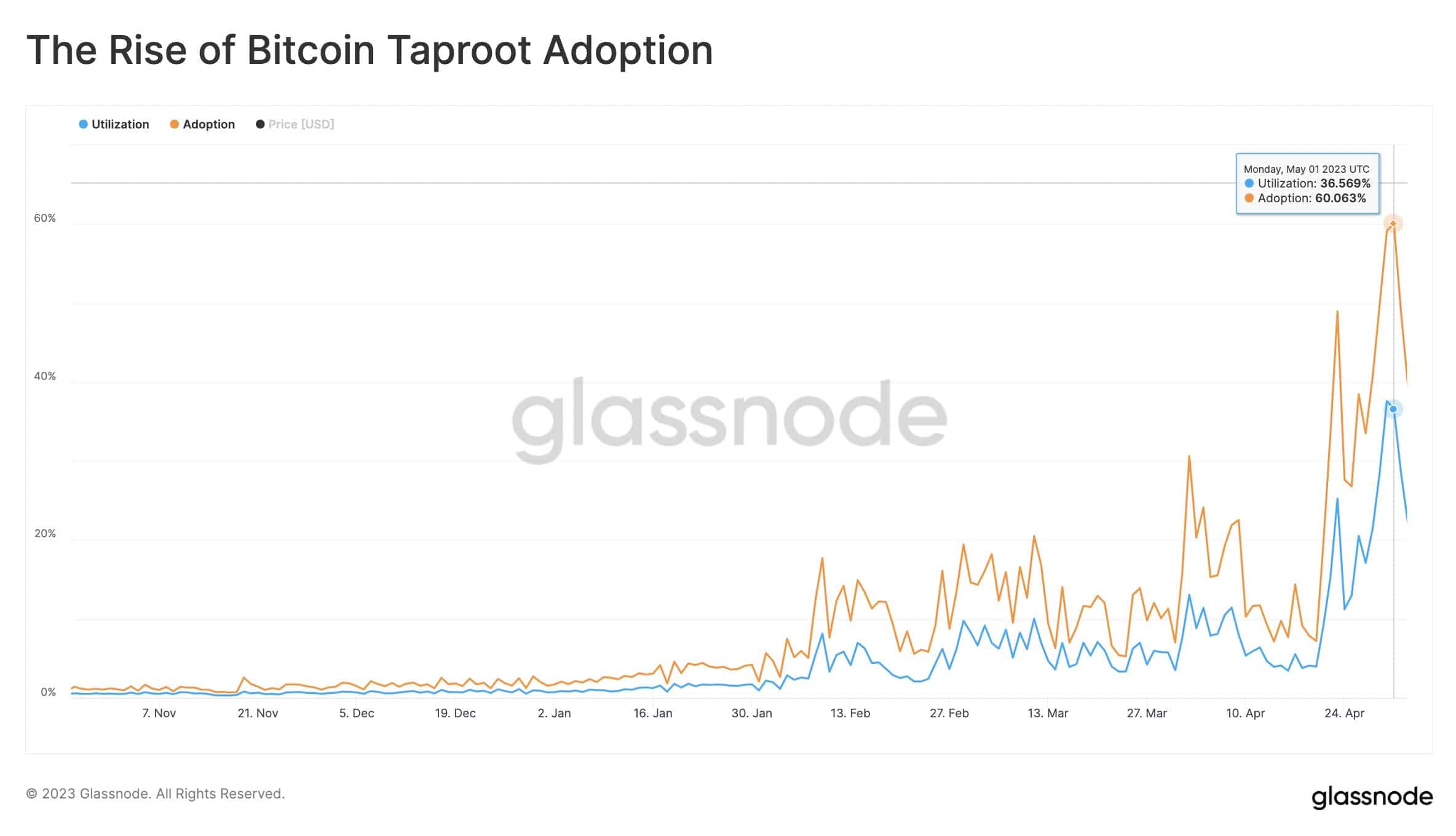

According to a data scientist from analytics firm Glassnode, Taproot transactions accounted for over 37% of spent outputs on the Bitcoin network. The demand for Taproot was also reflected through the adoption and utilization metrics.

The data showed that on 1 May, 60% of all transactions on Bitcoin used Taproot, hitting an all-time high.

Another notable trend which was worthy of attention was the growing dominance of text inscriptions over image inscriptions when it came to Taproot transactions. In fact, text inscriptions propelled more than 50% of all transactions on the Bitcoin network.

Taproot was an upgrade to improve the privacy, scalability, and security of Bitcoin. It introduced new signature schemes and a flexible transaction structure, to make transactions more efficient and cheaper.

Miners rake in the moolah

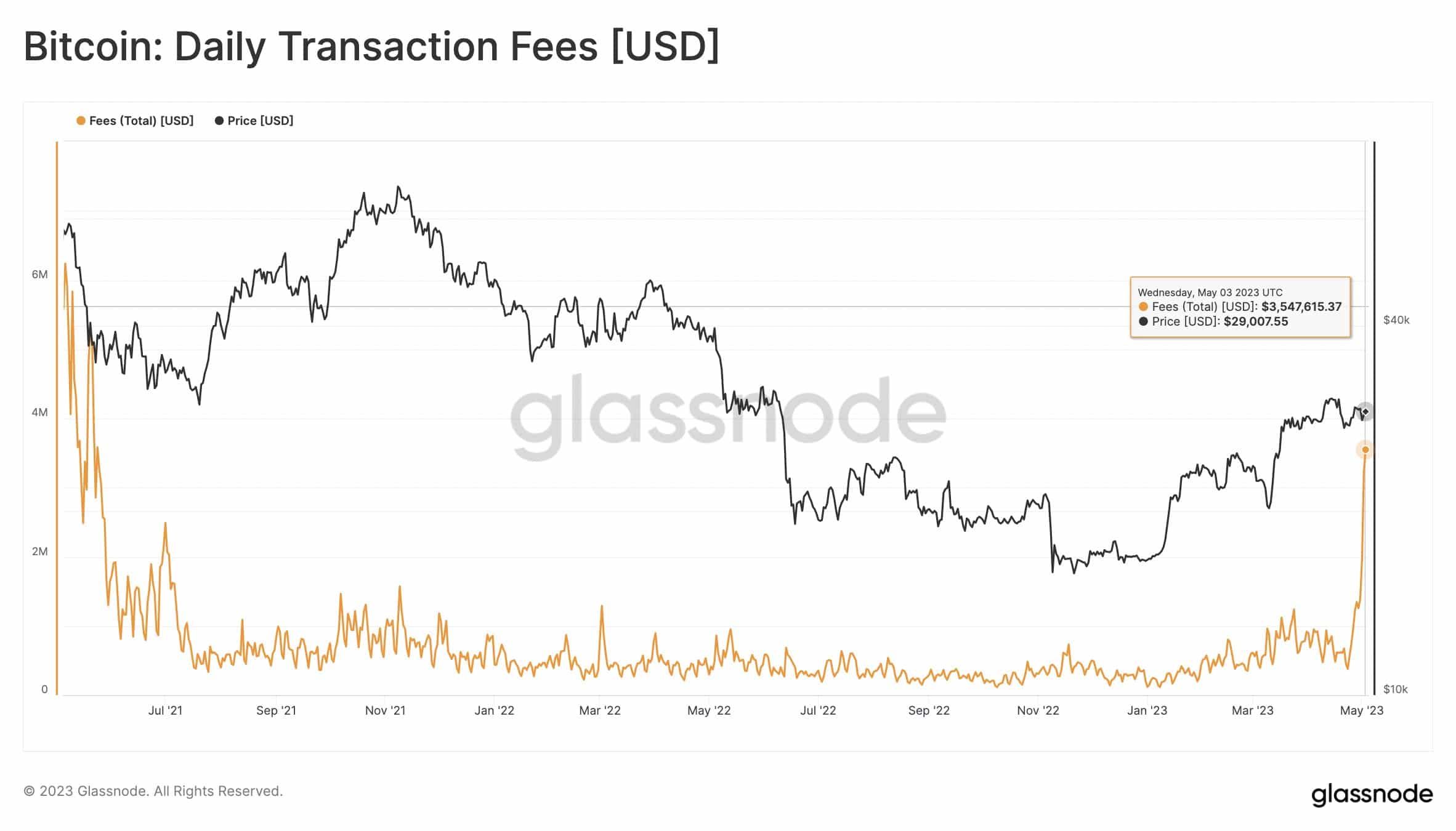

Due to the rise in network traffic, miners managed to collect huge transaction fees. Users were willing to shell out more to get their transactions validated quickly. On 3 May, Bitcoin network recorded $3.5 million in transaction fees, hitting a 2-year high.

On expected lines, Ordinals accounted for a significant chunk of the total fees paid to miners, averaging nearly 21% over the past week, data from a Dune dashboard showed.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The crypto community has a divided stance on Ordinals, and in general the idea of smart contracts on Bitcoin. The naysayers object to its non-financial use case which would congest the network and drive up fees on the chain.

At the time of writing, BTC exchanged hands at $29,240, marking a marginal increase of 0.37% in the last 24 hours, as per CoinMarketCap.