Decoding the state of Lido Finance’s node and validator operators

- Lido sustained positive validator growth in Q4 as well as healthy validator jurisdictional dispersion.

- A look at the impact of the recent market conditions on LDO and its TVL reveals some interesting facts.

Lido Finance just released its latest quarterly report revealing the state of node operators. The timely nature of the report may offer some insights into how Lido has been preparing for the aftermath of the Ethereum Shanghai upgrade.

Realistic or not, here’s Lido’s market cap in BTC’s terms

According to Lido’s quarterly report, the number of active node operators grew from 27 in Q3 to 29 in Q4. This was a minor change but validators have also been working towards more network diversification and performance improvements.

A good example to highlight this focus is that there were at least 1,000 validators on chainsafe ETH’s Lodestar. A 48% increase compared to the previous quarter.

? The latest quarterly update of Lido’s Validator and Node Operator Metrics (VaNOM) is available!

Check out the VaNOM report below for more insights, or browse through the highlights from Q4 22 ?https://t.co/6nrfxuBDbl

— Lido (@LidoFinance) March 2, 2023

The Lido Q4 update also disclosed the state of Lido validators’ jurisdictional dispersion. Most of the validator nodes are now distributed across major global regions.

They include Canada, the United States, Australia, Singapore, South Korea, and Hong Kong.

Aside from the quarterly report, Lido’s LDO token made its way into the list of the top most purchased tokens among the top 500 ETH whales. This occurred in the last 24 hours at the time of writing and may have a significant impact on LDO’s price.

JUST IN: $LDO @lidofinance is back on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs ?

Peep the top 100 whales here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see data for the top 500!)#LDO #whalestats #babywhale #BBW pic.twitter.com/8YYbCZbPzr

— WhaleStats (tracking crypto whales) (@WhaleStats) March 3, 2023

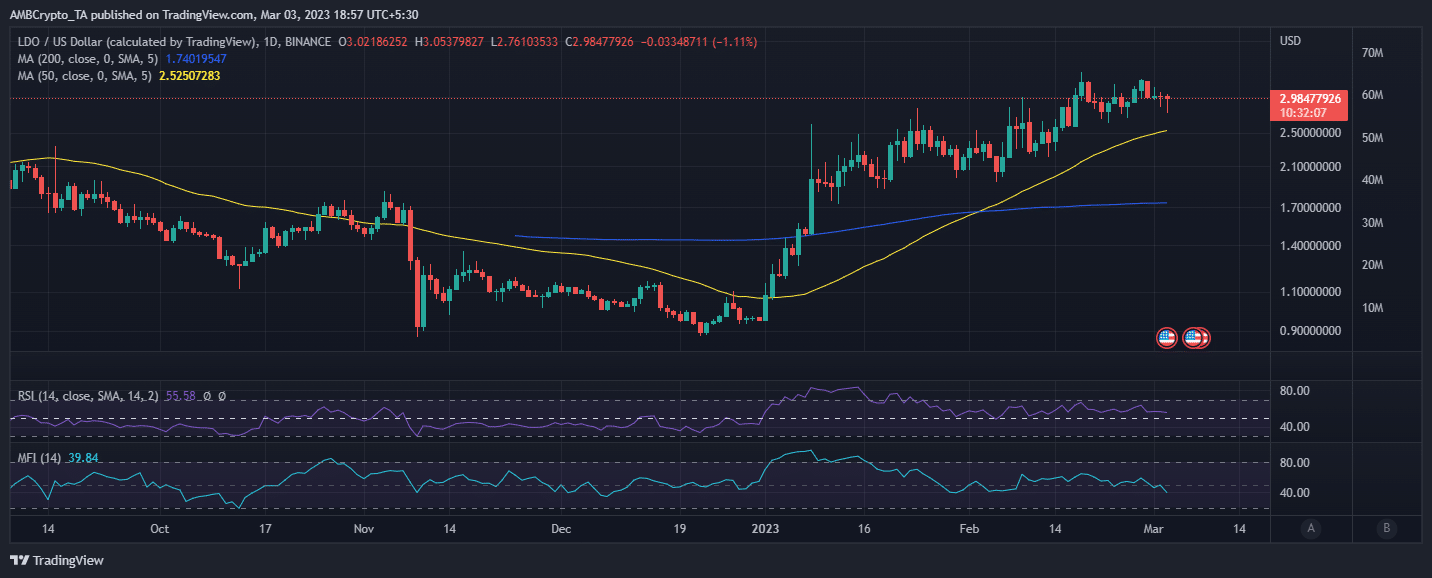

LDO happens to be one of the top tokens that have so far managed to hold on to most of the gains it achieved this year. For perspective, its $2.98 press time price was only down by 1.14% in the last 24 hours. In contrast, BTC fell by 4.6% and ETH by 4.78% during the same period.

It should be noted here that LDO is down by roughly 12% from its YTD peak despite the resilience against the selloff on 3 March.

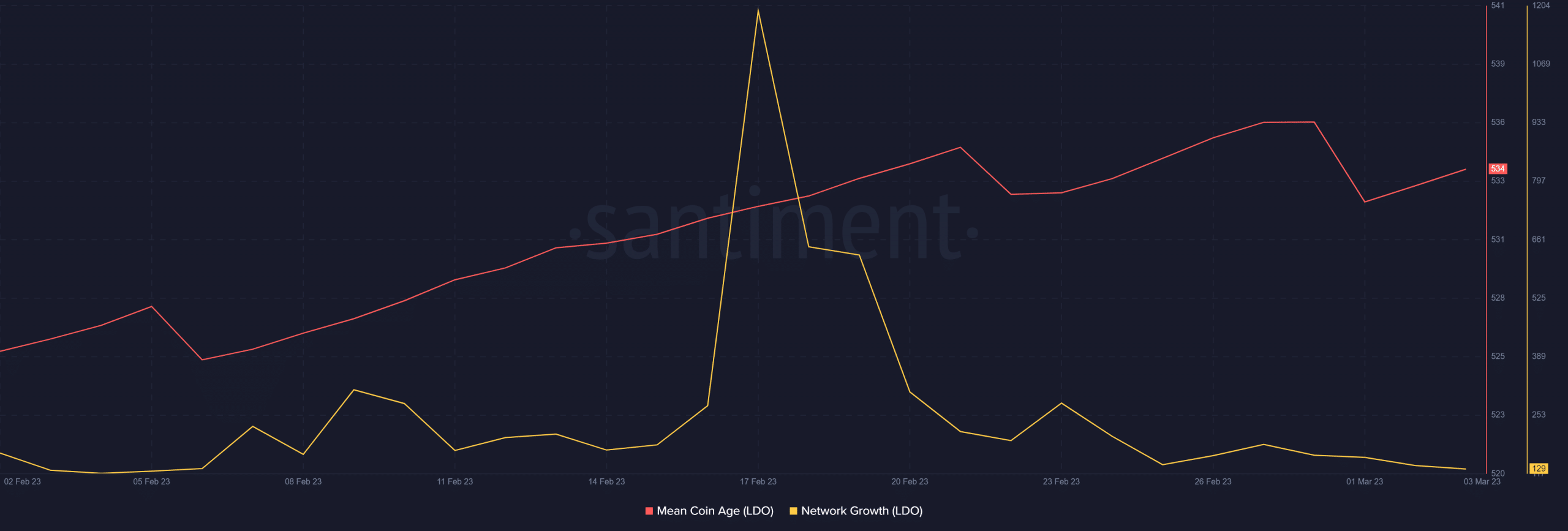

The token’s mean coin age is currently down from its February peak at 536.62 to its press time level of 534.45. The outcome confirms that some long-term holders are starting to sell.

The lack of favorable conditions to support network growth is evident in the slowdown observed in February as opposed to January.

Lido’s network growth has therefore taken a hit and is currently down to its 4-week lows.

How many are 1,10,100 LDOs worth today?

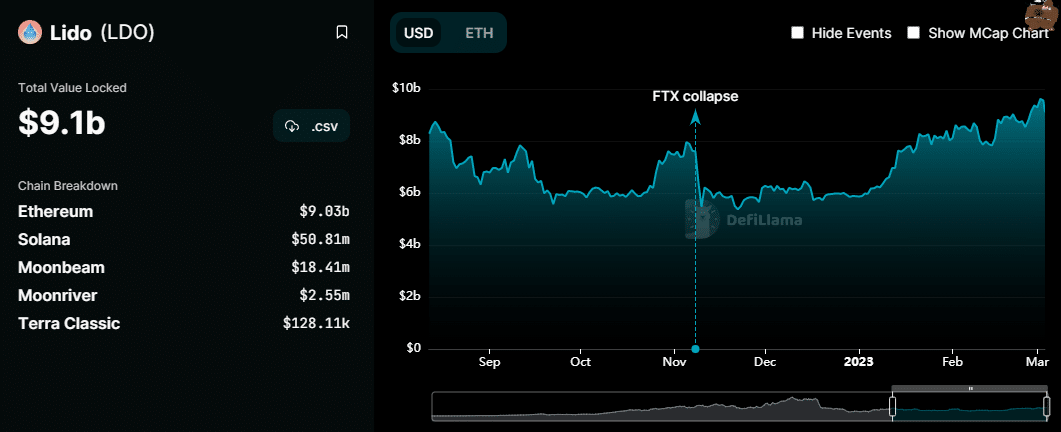

The latest market events also had a significant impact on LDO’s total value locked. It peaked at $9.62 billion on Thursday (2 March) but has since dropped to $9.1 billion.

Lastly, LDO’s TVL saw significant growth in the last six months. For perspective, it was as low as $5.5 billion in November, hence highlighting strong growth since then.