Decoding what USDT’s supply hike on exchanges could mean for investors

The global cryptocurrency market cap fell 2.7% to $1.09 trillion on 9 August evening as investors awaited key consumer price index data. Needless to say, major coins across the market fell as uncertainty/fear struck again amongst traders.

Bold significance

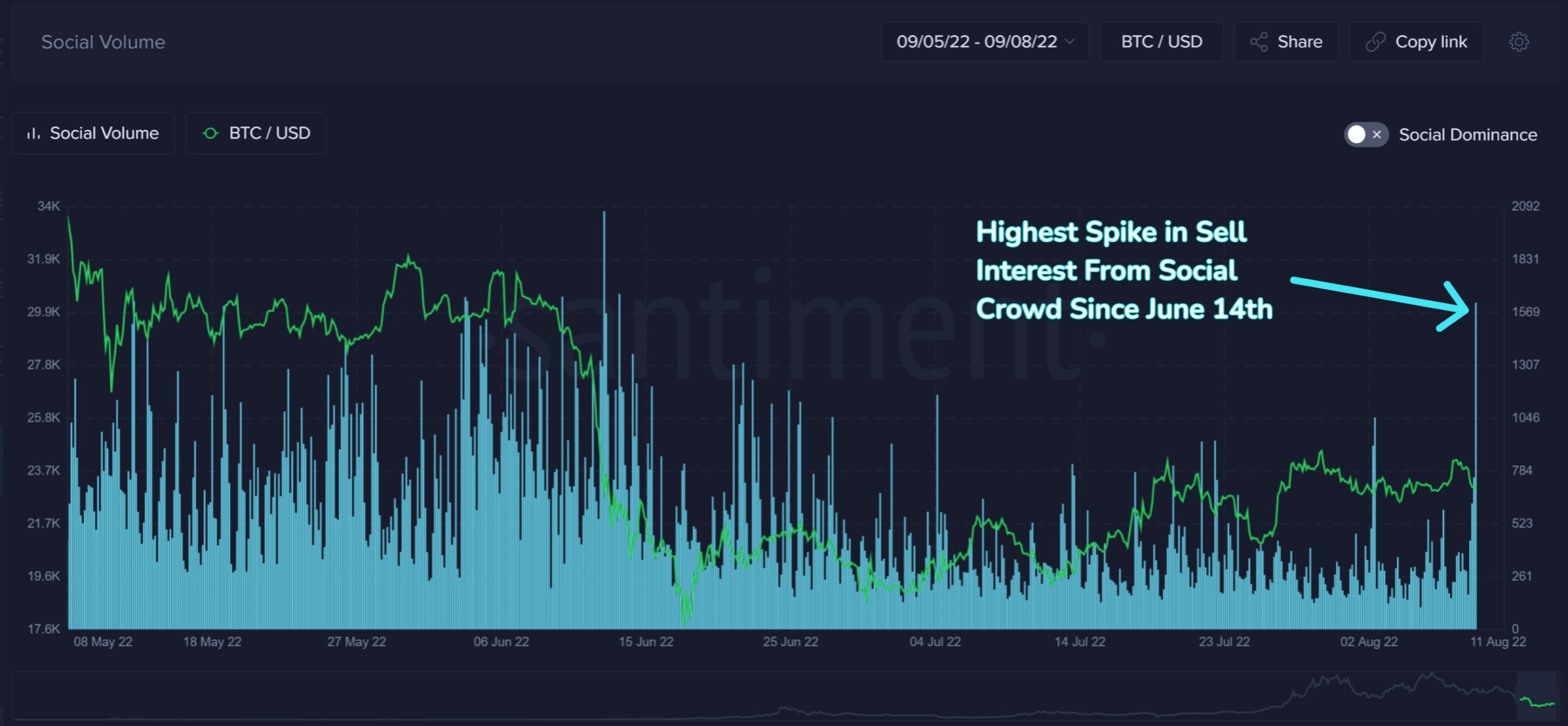

In fact, the crypto community’s comments related to ‘selling’ seems to have registered intense traction on Santiment, the analytics platform.

This is evident by the frequency of sell mentions on Twitter, Reddit, and Discord. The spike in sell interest hit a 2-month high as seen in the graph below.

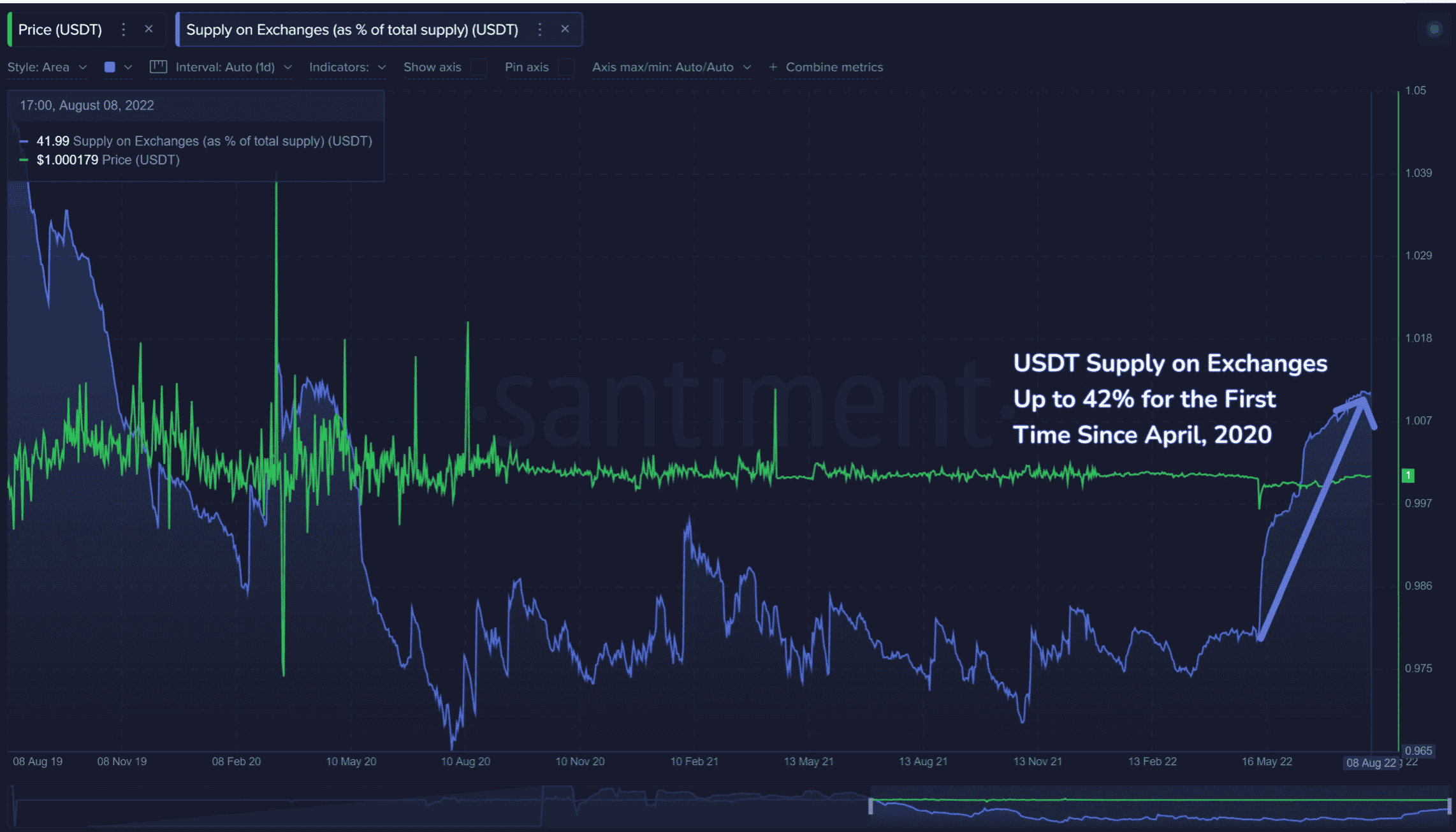

Now, given the bearish narrative, one thing led to another. And, it surely did as stablecoin supply on exchanges witnessed an unprecedented hike on the platform.

It’s here to be noted that the stablecoin supply on exchanges tends to increase significantly when uncertainty hits the market.

Tether, the largest stablecoin by market capitalization, had twice its supply sitting on exchanges compared to just three months ago.

Herein, the ratio of USDT’s supply on exchanges surged from 19.7% on 9 May to a whopping 42.0% three months later. As per Santiment,

“This can be viewed as both a signal that traders have taken profits as prices have rebounded, as well as a sign of a 2-year high in buying power.”

A change in the stablecoin’s supply was expected due to the witnessed wide market correction and subsequent liquidations. A large number of traders closed their positions and held large positions in USDT.

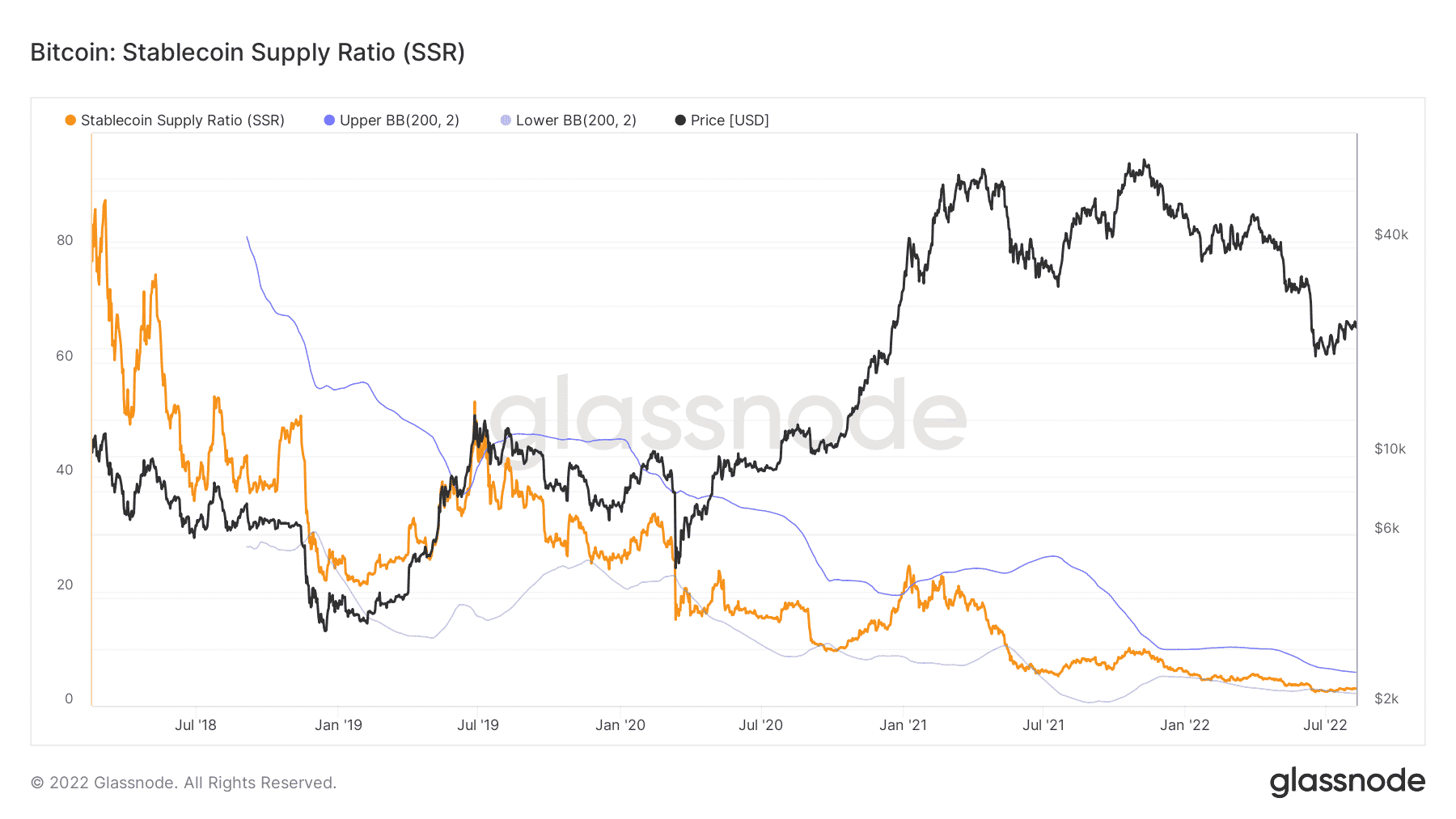

Indeed, maintaining a neutral stance. However, seeing the stablecoin supply ratio (SSR) could help us get more clarity on the current market situation.

When the ratio is high, the market has less purchasing power, and the buying pressure for BTC decreases.

BTC’s SSR is the ratio between the Bitcoin supply and the supply of stablecoins denoted in BTC — Bitcoin’s market cap divided by stablecoin market cap.

At press time, the current stablecoin supply ratio (2.99) possesed more purchasing power to acquire Bitcoin. Thereby, showcasing a bullish signal.

This could mean that users awaited for the macro factors to change from a risk-off to a risk-on environment. Thereby, storing their wealth in cryptocurrencies pegged to fiat currencies but didn’t convert it into fiat.

Well, let’s wait and watch what unfolds as the crypto market showcased some recovery.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)