Decoding why BASE surged despite disconnection to Coinbase

- Despite Coinbase clarifying that it won’t be launching a token, the BASE token volume and price jumped.

- Base Protocol weighted sentiment remained positive despite several metric reversals.

After Coinbase made its Ethereum [ETH] layer-2 announcement, Base Protocol’s [BASE] volume jumped by 3600%. However, it was noteworthy to mention that BASE has no links with the “BuildonBase” project of the exchange. In fact, Coinbase had cleared the air that it was not issuing any token from the project.

How much are 1,10,100 BASEs worth today?

However, some crypto traders seemed to get wind of the clarification late as transactions within the Base Protocol ecosystem climbed. According to Santiment, BASE’s volume, which has been at unimaginably low levels for a long while, suddenly jumped to 1.29 million.

It was a similar case with its price, which increased to $6.87 But, on realizing that the token was not connected to Coinbase, traders exited their positions. This made the earlier spike within the token, whose market cap is less than $1 million, look like a pump-and-dump scheme.

BASE dormant network spikes in a trice

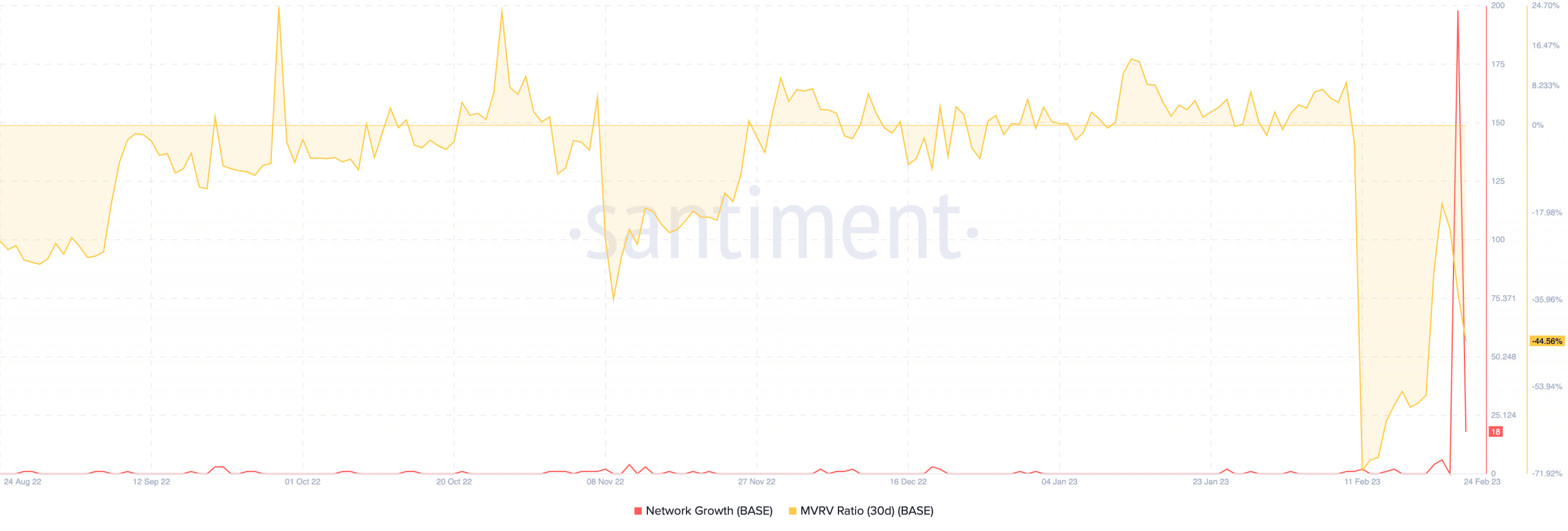

But the hike did not end at the price and volume alone. Santiment further revealed that Base Protocol’s network growth also rose to 198. The network growth serves as an illustration of the user adoption of a projection.

So, the initial spike implied that there were a lot of new addresses created on the Base Protocol network. However, data at press time showed that the metric had declined massively. This means that the project was no longer gaining traction like it did on 23 February.

The impact of the massive accumulation was also reflected in the BASE holders’ portfolios. This was because the Market Value to Realized Value (MVRV) ratio climbed from -70.68% to -16.10%. The MVRV ratio measures how much unrealized profits or losses holders of an asset have had.

However, the metric increase was only for a brief period, as it had dropped to -44.56% at press time. This decline means that BASE has left the overvalued region. But the dip may not be considered an opportunity for investors to accumulate, considering the BASE price performance over the last few months.

Weighted sentiment and social dominance

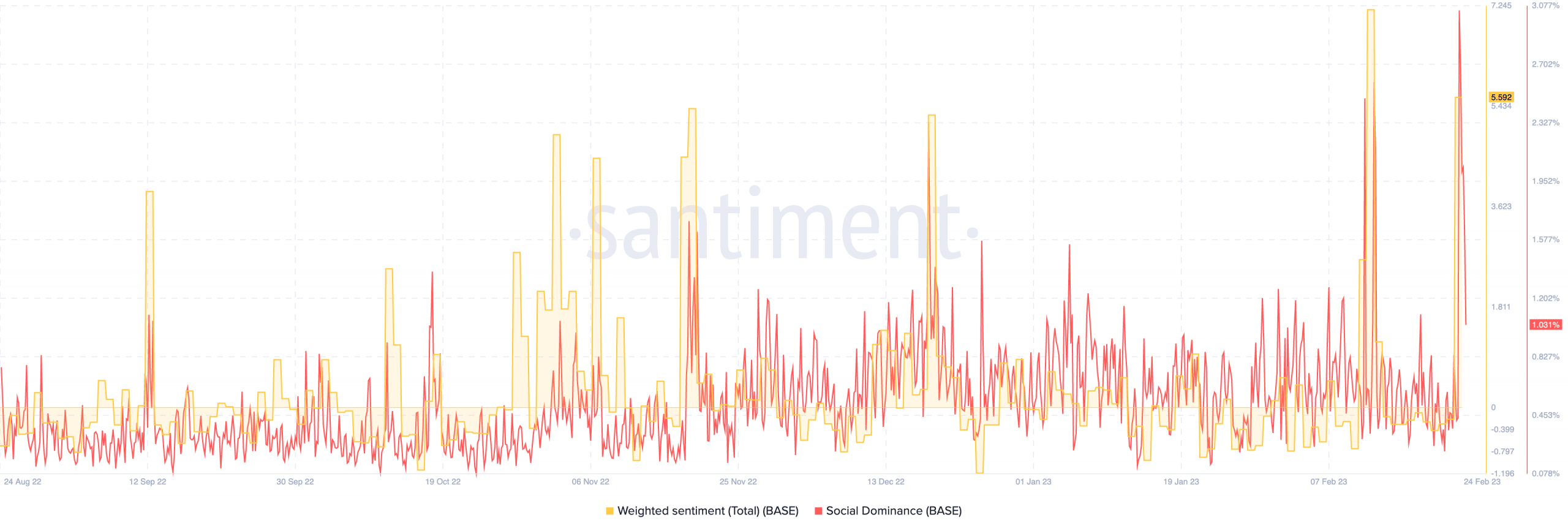

Furthermore, BASE’s weighted sentiment remained at 5.502 at the time of writing. The sentiment gauges the unique social volume of an asset. So, the state at press time meant that the perception towards BASE was still optimistic.

Meanwhile, BASE’s social dominance hit its highest in the last 365 days on the premise of Coinbase’s news. However, it had decreased to 1.031%, meaning that conversation around the asset had subdued.

![Base Protocol [BASE] volume and price](https://ambcrypto.com/wp-content/uploads/2023/02/Bitcoin-BTC-10.18.10-24-Feb-2023.png)