DEEP crypto surges 550% in 7 days: What’s driving the surge?

- DEEP surged over 550% in its debut week.

- Can the Sui-based altcoin’s uptrend amid mixed signals?

On the 14th of October, DeepBook version 3 (V3), a new and reportedly revolutionary DEX (decentralized exchange), debuted on the Sui [SUI] network.

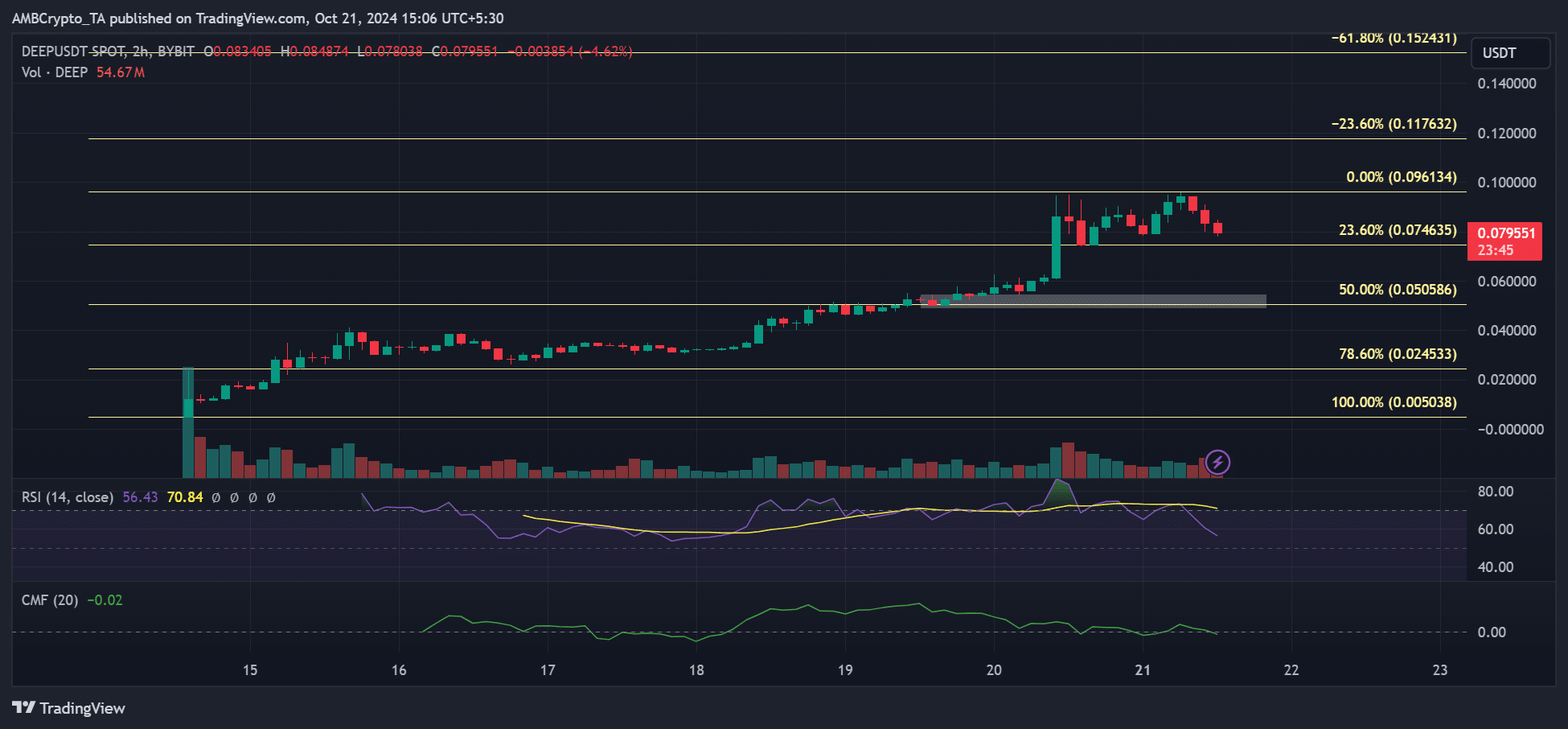

Its native token, DEEP, was also launched on the same day and gained over 550% last week. The altcoin jumped from $0.016 to $0.09, a wild 5x rally, but was defending $0.08 at press time.

According to the team’s announcement, one of DEEP’s positive price catalysts could be its wide use case within the Sui DeFi system.

It’s the protocol’s governance token but can also be staked for rewards and trading fee rebates.

“DEEP can be used to pay trading fees, with users receiving fee discounts the more they trade, incentivizing more participation. Together, these functions enhance liquidity and make trading on DeepBook more efficient.”

Besides, the DeepBook DEX leverages CLOBs (central limit order book) to keep fees low on top, tapping on Sui’s high-performance design.

Per the team, this rivals common DEX, which leverages AMM (automated market makers) like Uniswap.

“AMMs gave DeFi a head start, but with CLOBs, we are here to improve the DeFi game. Built to last. Lower slippage, deep liquidity, and precision—just the way you like it”

Will DEEP’s rally continue?

On the 20th of October, the token exploded by 49%, adding to its impressive debut week performance.

Despite the slight pullback at press time, crowd sentiment on CoinMarketCap was overwhelmingly bullish on the token.

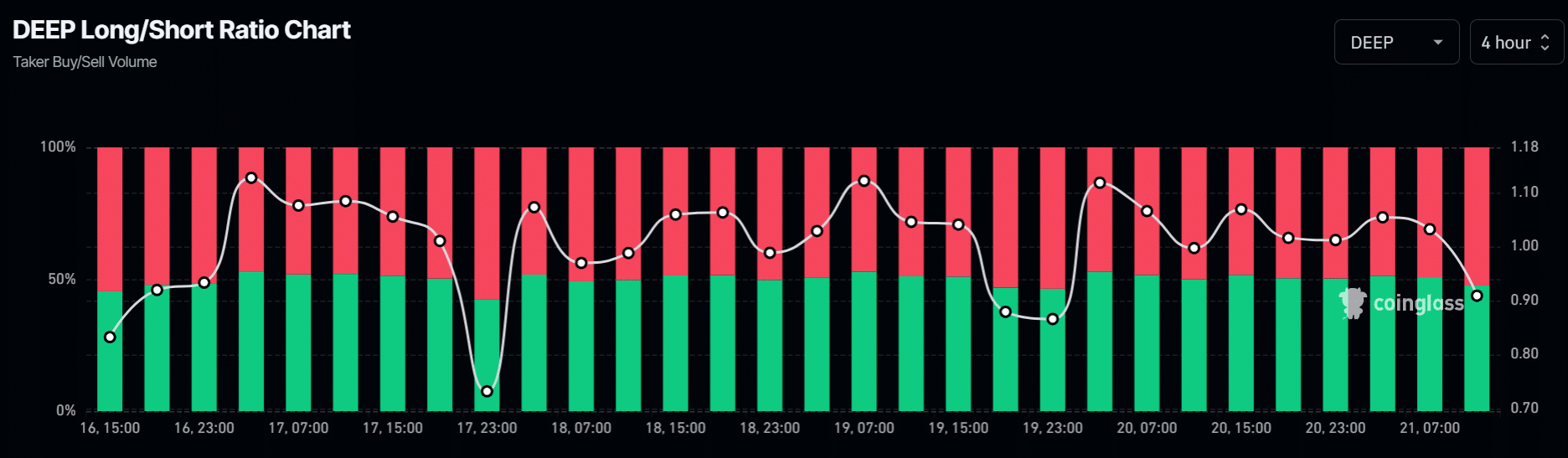

However, traders’ positioning showed significant speculators were shorting the asset. Per Coinglass’s Long/Short ratio, 52% of positions were shorting DEEP, reinforcing a slightly bearish tilt.

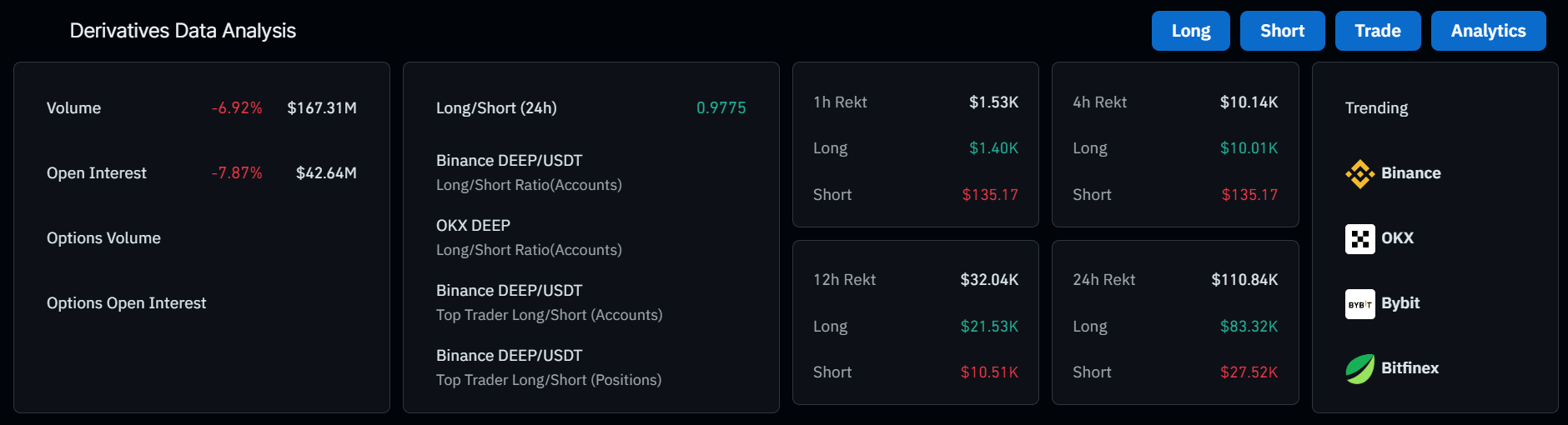

A similar short-term bearish sentiment was evident, as seen by a decline in Open Interest (OI).

It was down nearly 8%, reinforcing the capital outflows from the DEEP Futures market.

By extension, a drop in OI also signals waning interest in the asset amongst speculators. This could fuel the pullback and drag DEEP prices lower.

Additionally, there were more liquidations of long positions than shorts, further supporting the short-term bearish outlook.

Read DeepBook [DEEP] Price Prediction 2024 – 2025

If the bearish trend persists in the short term, DEEP could ease towards $0.05 (50% Fib level), especially if it cracks below $0.08.

However, another leg of the rally could push it towards $0.11. So, $0.05 and $0.11 were key levels to track in the short term.

![Movement [MOVE] fails to reclaim key levels - Sell-offs incoming?](https://ambcrypto.com/wp-content/uploads/2025/01/Movement-Featured-1-400x240.webp)