DeFi landscape makes a promising recovery in 2023, what’s ahead?

- Uniswap recorded its highest daily trading volume in history on 11 March.

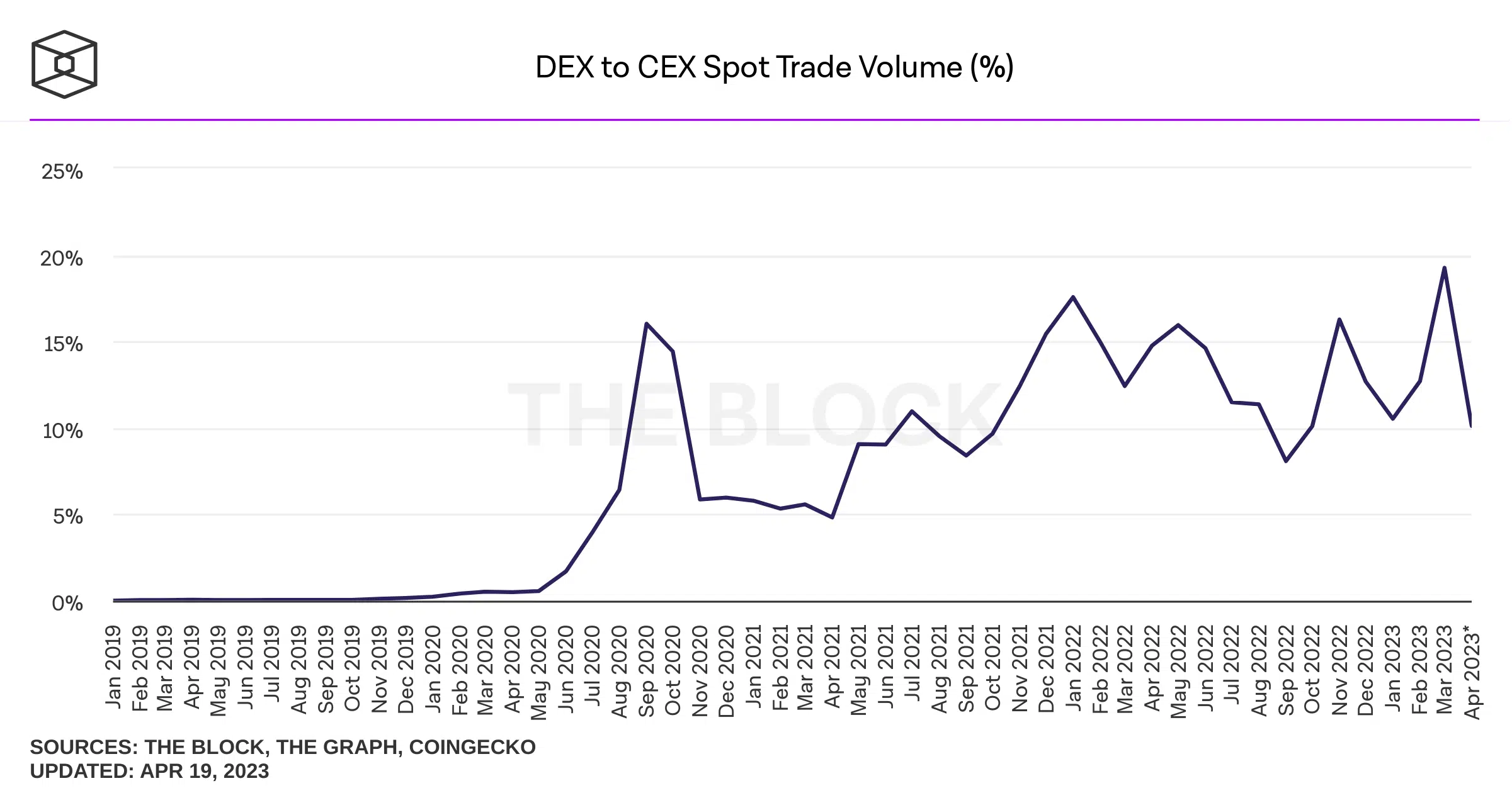

- The DEX to CEX spot trading volume indicator hit 19.26% in March 2023, its highest ever.

According to a report by Web3 development platform, Alchemy, Q1 2023 recorded a 19% quarter-on-quarter (QoQ) growth of decentralized finance (DeFi) applications and decentralized exchanges (DEXs), showing an increasing tendency among users to lean towards self-custody.

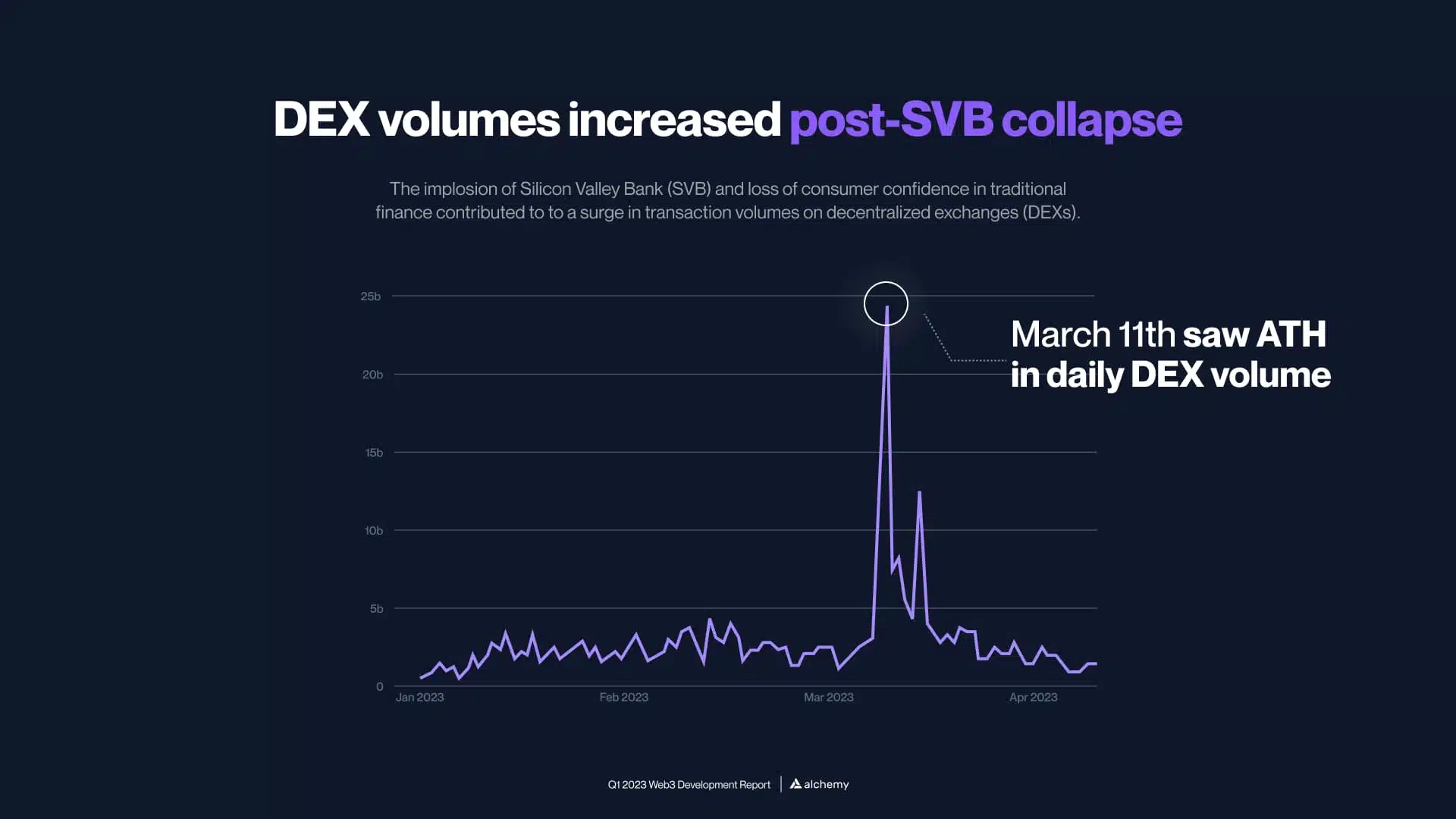

The report highlighted that incidents following the collapse of Silicon Valley Bank (SVB) in March contributed to record trading volumes across DEXes.

6/ Silicon Valley Bank's collapse pressured traders to swap stablecoins ?

Contributing to record DeFi trading volumes, including:@uniswap’s highest volume day in history ($11.8B) ? pic.twitter.com/4PGbpSaEri

— Alchemy | The web3 developer platform (@AlchemyPlatform) April 18, 2023

Read Uniswap’s [UNI] Price Prediction 2023-24

DeFi takes center stage

On 10 March, USD Coin [USDC] lost its dollar peg on some exchanges, over concerns that reserves backing the stablecoin were stuck in SVB. Owing to the FUD, most centralized exchanges (CEXs) paused USDC conversions.

This is when DeFi came into the picture. Daily transaction volumes on DEXs reached nearly 25 million on 11 March, a day after the drama started to unfold.

In fact, Uniswap [UNI] recorded its highest daily trading volume in history on 11 March, with trades worth $11.8 billion getting settled on the DeFi behemoth. The total trading fees earned by liquidity providers in March reached $77 million.

Moreover, Curve Finance [CRV] also witnessed a similar spike in trading volume and clocked an all-time high of nearly $8 billion on 11 March.

On expected lines, the increased volumes on these DEXs were mostly driven by traders selling USDC and buying other stablecoins like USDT [Tether] and DAI.

The growing prominence of DEXes was exemplified by the DEX to CEX spot trading volume indicator, which reached its highest value of 19.26% in March.

Is your portfolio green? Check out the Curve Profit Calculator

Ecosystem witnesses sharp growth in TVL

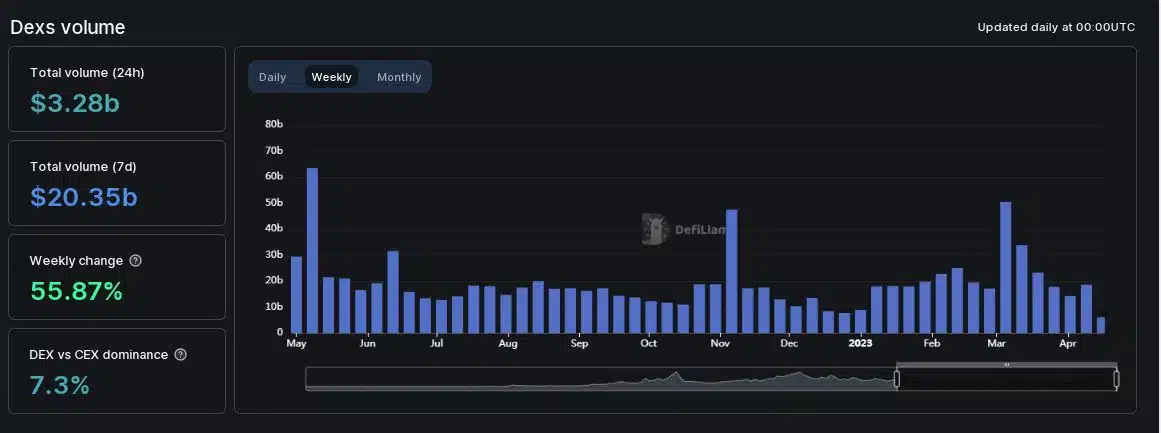

At press time, the total volume across all DEXes over the last seven days was $20.35 billion, marking a weekly increase of over 55%, as per DeFiLlama.

Since the sharp spike of 11 March, trading activity has returned to its normal levels. It was interesting to note that before the USDC depegging saga, the other noticeable jump was observed on 6 November, at the peak of the FTX liquidity crisis.

Additionally, the DeFi landscape recovered handsomely after suffering numerous blows during the crypto winter of 2022. The total value locked (TVL) on the DeFi protocols broke through $60 billion at press time, recording a year-to-date (YTD) growth of more than 45%.