DeFi on Bitcoin? Here’s what devs are doing these days

- OP_NET testnet’s launch is expected to happen on Wednesday

- Development expected to push Bitcoin into “programmable future”

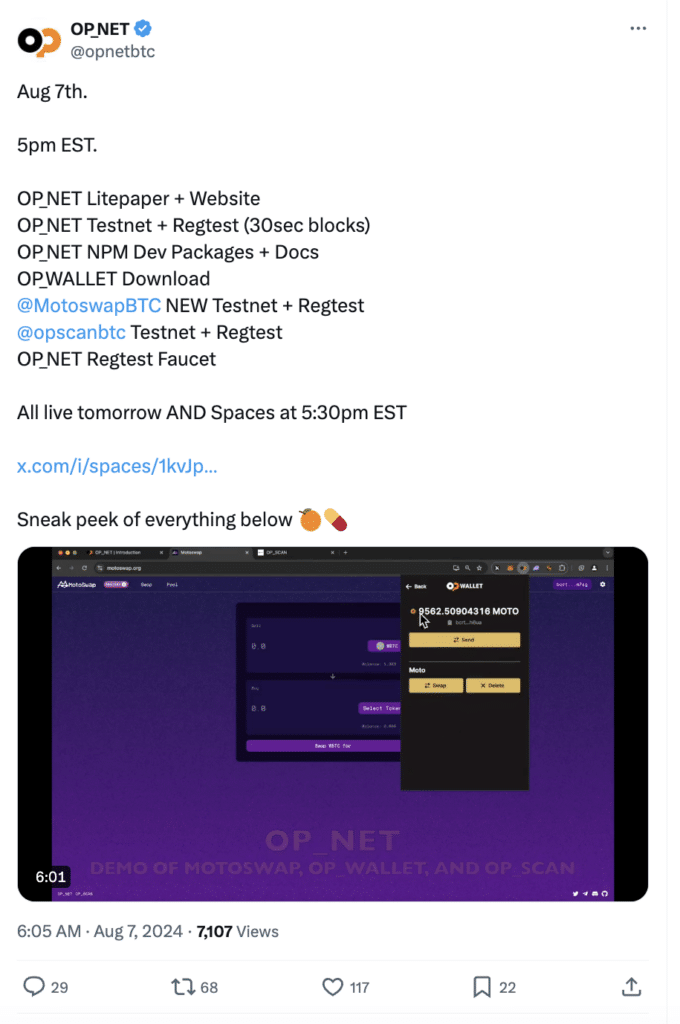

A new DeFi solution may soon debut on Bitcoin’s blockchain, aiming to leverage Bitcoin’s robustness for decentralized finance applications. A set of developers led by Co-founder Chad Master is set to launch the OP_Net testnet on 7 August.

They believe this will propel Bitcoin into the “programmable future,” offering capabilities beyond its current use as a digital currency.

This testnet incorporates elements of the Taproot upgrade, an enhancement that has already improved Bitcoin’s privacy and scalability.

The mainnet launch is expected sometime in late September.

Source: X

Unlike other DeFi platforms that utilize sidechain tokens for transactions, OP_Net will require Bitcoin itself to pay transaction fees. Additionally, the testnet will provide access to both fungible and non-fungible tokens (NFTs), broadening the range of financial instruments available to users on Bitcoin’s blockchain.

Speaking to Decrypt, Chad Master suggested that the OP_NET virtual machine will operate like an EVM.

Here, it’s worth pointing out that the exec is expecting there to be some scams and ponzi schemes going ahead owing to the nature of the protocol. According to him,

“We don’t want to be responsible for launching those, but we need to be able to have the environment where those things can launch.”

The excitement surrounding Bitcoin’s foray into DeFi stems from its potential to build on previous successes and learn from past challenges. The Taproot upgrade, for instance, was hailed as a significant step forward for Bitcoin, improving transaction efficiency and privacy.

However, the likes of Ordinals and Runes had mixed results. Ordinals aimed to enhance Bitcoin’s scripting capabilities, but faced issues with adoption and complexity. Similarly, Runes, which introduced token issuance on Bitcoin, struggled to gain traction due to limited functionality compared to other blockchain platforms.

DeFi’s the next step?

Despite these challenges, the crypto-community remains optimistic about Bitcoin’s DeFi prospects. Bitcoin’s strong security model and widespread recognition make it an attractive foundation for decentralized applications.

In fact, many believe that integrating DeFi functionalities directly onto Bitcoin’s blockchain could offer a more secure and robust alternative to existing platforms, which often rely on less secure sidechains or alternative blockchains.

The anticipation is also fueled by the broader success of DeFi on other blockchains, such as Ethereum. Ethereum’s DeFi ecosystem has demonstrated the transformative potential of decentralized finance, offering decentralized lending, borrowing, trading, and yield farming.

If Bitcoin can successfully integrate similar functionalities, it could tap into a vast market of users who prefer Bitcoin’s security and brand recognition.