DeFi protocol GNS sees growth in trading fees – Will users make a beeline for it

- Gains Network registered a sharp uptick in trading fees.

- The protocol’s native token was up by 7% at press time.

Gains Network [GNS], a decentralized perpetuals exchange, was making rapid strides in the DeFi ecosystem. According to a post by Wu Blockchain on 24 January, Gains Network touched a cumulative transaction volume of more than $1 billion over the past week, recording a jump of around 78%.

Gains Network, a GMX-like on-chain derivatives protocol based on Polygon and Arbitrum, had a transaction volume of more than $1 billion last week, with fee of $690,000, its Token GNS once exceeded $4.7, both hitting record highs. https://t.co/YL41pMsjFg

— Wu Blockchain (@WuBlockchain) January 24, 2023

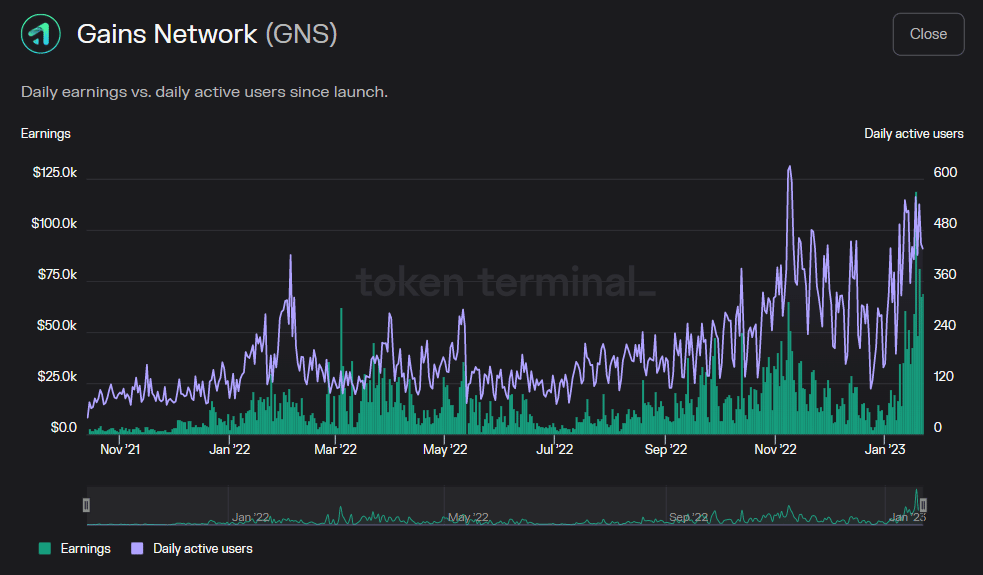

The sharp increase in trading fees was also highlighted, and the data was backed up by on-chain analyst ‘Patrick | Dynamo DeFi’ on Twitter. Patrick posted a snippet from Token Terminal to show that fees paid by traders on the Gains Network exceeded its previous peak in March 2022.

Gains Network is having its best week for fees ever, surpassing it's previous peak in March of last year. pic.twitter.com/CsBmXfQArA

— Patrick | Dynamo DeFi (@Dynamo_Patrick) January 23, 2023

How many are 1,10,100 GNS worth today?

Rapid ‘Gains’ were seen

Gains Network, built on Polygon [MATIC] and Arbitrum, was launched in 2021. A perpetual-focused protocol similar to that of dYdx and GMX, GNS recorded a surge in most of its key performance indicators.

As per Token Terminal, the daily active users grew three-fold since the start of 2023. The earnings of GNS token holders have exploded in recent days. Notably, the value hit an ATH of $119k on 18 January.

Still very much a David pitted against the Goliaths, GNS has managed to break into the list of top 10 decentralized exchanges (DEX). As highlighted above, much of it has been powered by an increase in trading fees. In fact, the network saw the highest growth in trading fees over the last seven days.

Native token in advantage

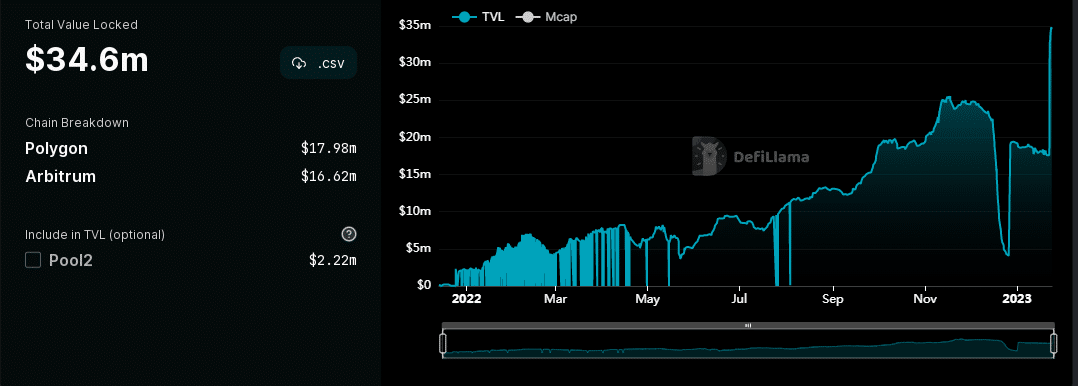

The total funds locked into the protocol’s smart contracts jumped to its ATH, as per data by DeFiLlama. The chart showed an almost vertical uptick in TVL over the past one week. This added more evidence to GNS’ increasing stature in the DeFi ecosystem.

Is your portfolio green? Check the GNS Profit Calculator

The temptation of high trading fees and increased earnings might have fueled the demand for the network’s native token GNS. At the time of writing, GNS exchanged hands at $4.71, a jump of about 7% from the previous day, per CoinMarketCap.

The token has expanded by almost 50% over a week’s time, indicating that price has reacted to the growth of indicators in the same time period.