Despite sell offs, here is why Lido DAO’s [LDO] price action turned bullish

![Despite sell offs, here is why Lido DAO [LDO] price action turned bullish](https://ambcrypto.com/wp-content/uploads/2023/04/LDO.png)

- LDO’s 4-hour chart revealed the possibility of a continued price pump.

- Lido’s revenue and TVL surged, while most metrics remained in the bulls’ favor.

Lido Dao [LDO] has been facing trouble over the last week as its price declined by more than 7%. A Lookonchain tweet pointed out yet another LDO sell off, which looked concerning for the token as it could further decline LDO’s price.

Dragonfly Capital transferred 461,000 $LDO($1.05M) to #Binance 1 hour ago.

And currently holds 8.62M $LDO($20M).

If you want to short $LDO, pay attention to Dragonfly Capital's address, selling will make the price of $LDO fall.https://t.co/1pBg0I3Ict pic.twitter.com/fPzKnIbpwL

— Lookonchain (@lookonchain) April 12, 2023

According to the tweet, Dragonfly Capital transferred LDO worth $1.5 million, which could add to the selling pressure. However, the situation ended up differently in this case. Is this because of the ongoing bullish market condition? Or were the metrics and indicators supporting the surge?

Read Lido DAO’s [LDO] Price Prediction 2023-24

LDO price is pumping

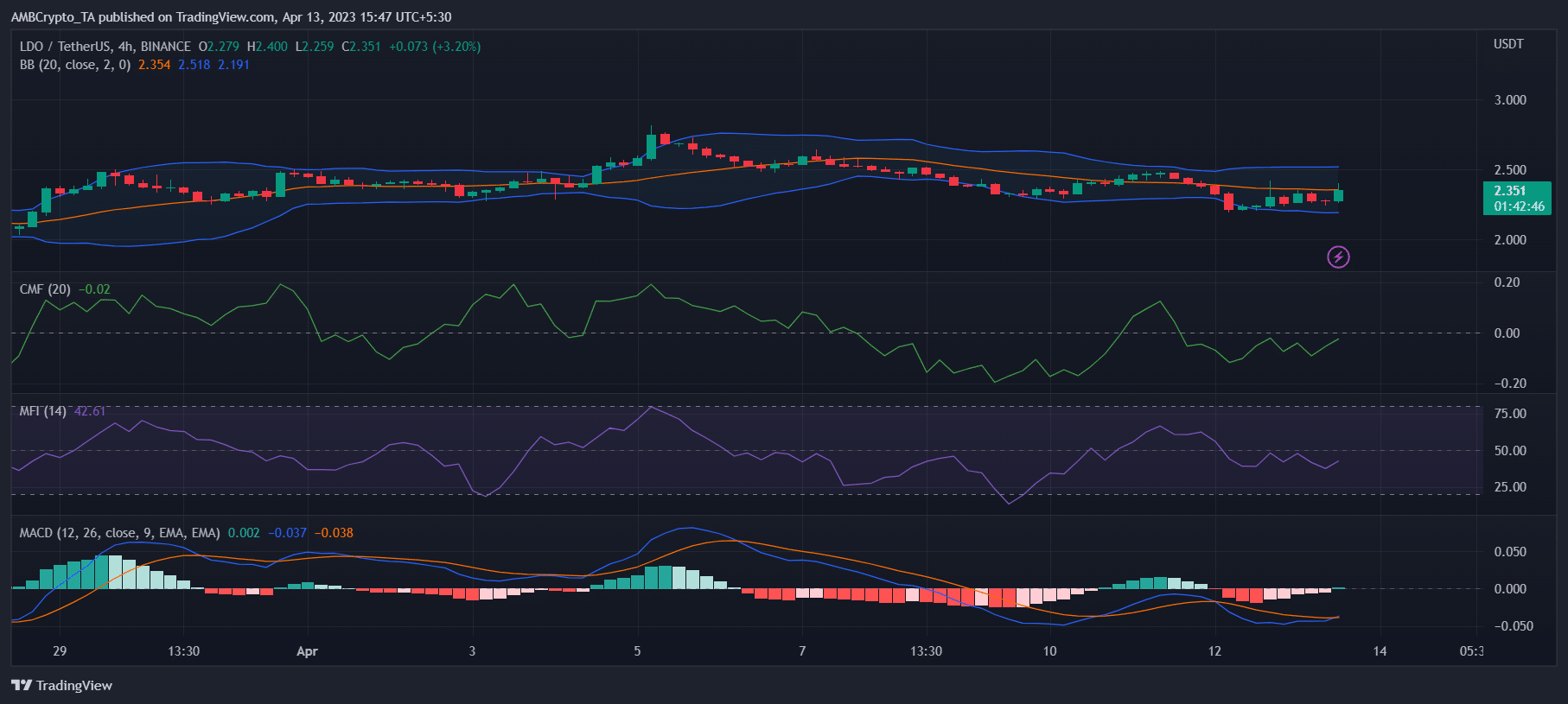

Interestingly, LDO’s price increased by more than 7% in the last 24 hours. At press time, it was trading at $2.38 with a market capitalization of over $2 billion. A look at LDO’s four-hour chart suggested that the uptrend could continue further. For instance, LDO’s Chaikin Money Flow (CMF) registered a sharp uptick and was headed towards the neutral mark.

The Money Flow Index (MFI) also followed the same trend and went up, which looked bullish. LDO’s Moving Average Convergence Divergence (MACD) also displayed a bullish crossover. The Bollinger Bands showed that LDO was entering a high volatility zone, further increasing the chances of a continued northward price movement.

Lido’s network stats look promising

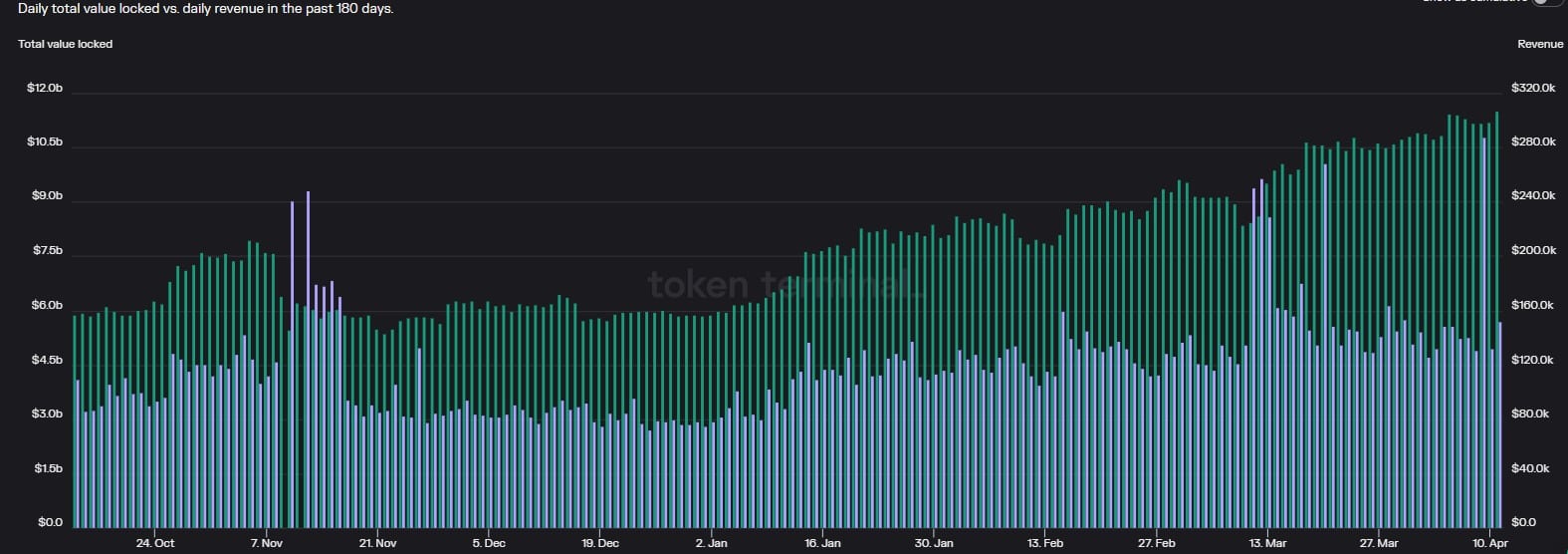

Token Terminal’s data revealed that quite a few factors were working in favor of Lido DAO, which can fuel further growth in the coming weeks. Lido DAO’s revenue has been increasing for quite a few weeks, suggesting increased usage. Not only that, but the network’s value also went up substantially, as evident from the rise in its TVL.

It was also interesting to note that after Ethereum [ETH] completed its Shanghai update, Lido withdrew a total of 63,695 ETH, accounting for 57.2% of Lido’s holdings.

A few metrics were against LDO

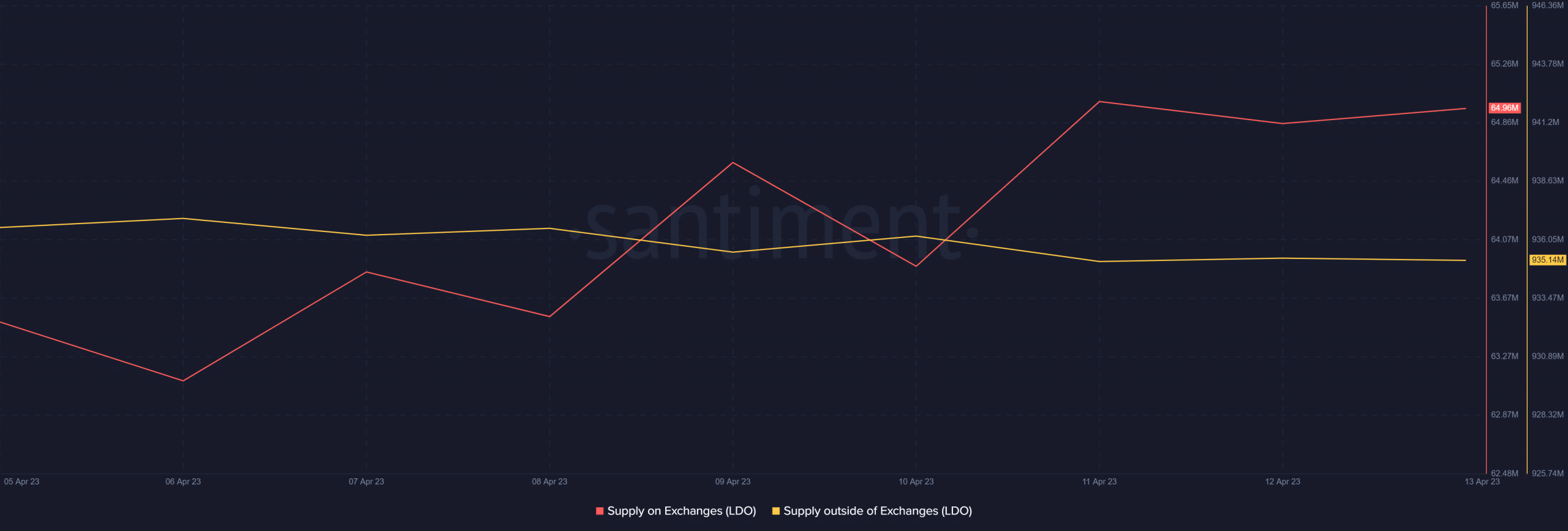

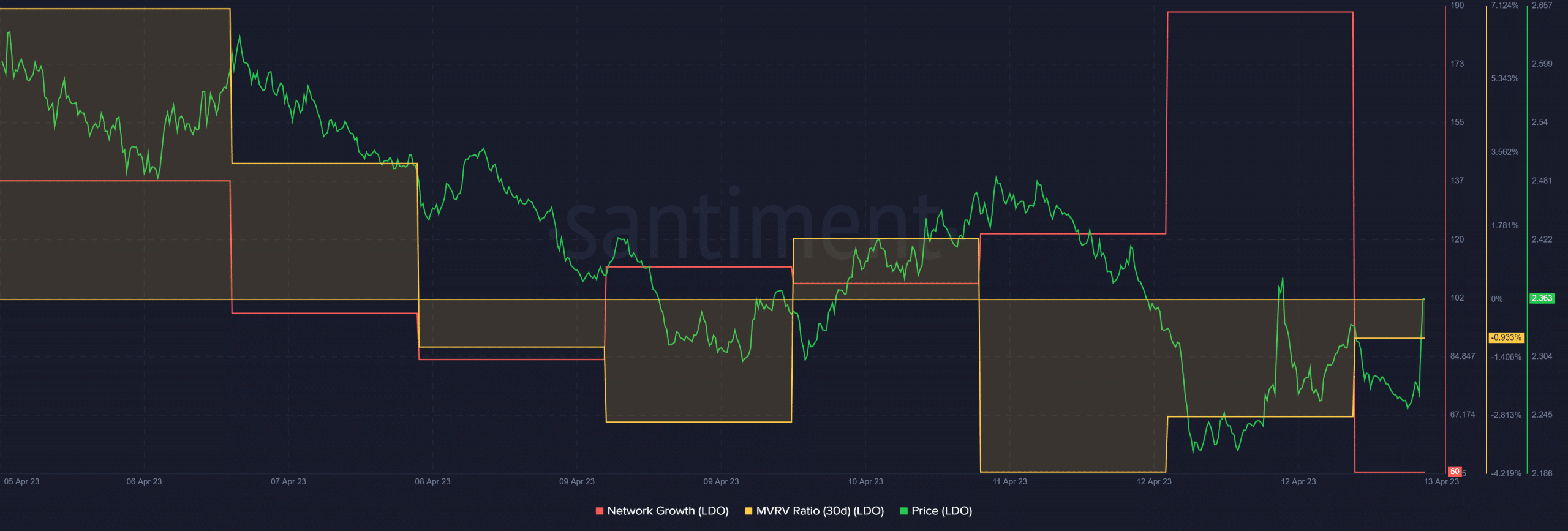

Though the market indicators and network statistics looked pretty optimistic for Lido DAO as a whole, LDO’s on-chain performance was not up to par.

Realistic or not, here’s LDO market cap in BTC‘s terms

For example, LDO’s supply on exchanges increased. This happened while its supply outside of exchanges declined marginally, which was bearish. Nonetheless, LDO’s Market Value to Realized Value (MVRV) Ratio recovered slightly, thanks to the latest price gains. Network growth was also up, suggesting more new addresses were used to transfer the token.