Despite Solana staking developments, SOL is unaffected – Why?

- SOL staking volume rose to around $52 billion.

- SOL is on its way to its sixth consecutive day of decline.

The Solana staking landscape has experienced some notable developments in the past 24 hours, with various exchanges hinting at introducing new SOL staking features.

This news initially positively impacted Solana’s [SOL] price, briefly lifting market sentiment.

However, despite the initial enthusiasm, the price of SOL eventually succumbed to a downtrend. In addition to the price fluctuations, there has been an increase in the volume of staked SOL.

Solana staking causes buzz

On the 29th of August, three major cryptocurrency exchanges—Binance, Bybit, and Bitget—posted cryptic yet similar messages on their X (formerly Twitter) pages.

These messages fueled speculation about upcoming Solana staking features.

Binance teased,

“BNSOL… Coming soon.”

Bybit hinted at a new addition, saying,

“We are welcoming a new baby to the family bbSOL.”

Also, Bitget shared,

“Something BG is coming BGSOL.”

These posts were all met with a response from the official Solana X handle, further stoking speculation that these exchanges are preparing to launch Solana staking features.

The posts garnered positive reactions from the community, indicating strong anticipation for the potential introduction of SOL liquid staking options on these platforms.

Liquid staking allows users to stake their tokens and earn rewards while maintaining liquidity, as they receive a derivative token that can be traded or used elsewhere.

Solana staking volume sees an increase

According to a recent analysis, the volume of staked SOL saw a significant increase by the end of trading on the 29th of August.

This growth coincided with Solana staking developments teased by major exchanges such as Binance, Bybit, and Bitget.

The data from Staking Rewards indicates that as of the 28th of August, the total staked SOL was around 378.3 million. However, by the 29th of August, this figure had risen to over 380 million SOL.

This increase means that approximately 65% of the total SOL supply is now staked, with the staking market capitalization reaching about $52 billion.

Furthermore, data from DeFiLlama showed that Solana’s Total Value Locked (TVL) was around $4.9 billion at press time.

Liquid staking platforms have significantly contributed to this TVL, with Jito, for example, having a TVL of over $1.7 billion.

SOL spikes for a bit

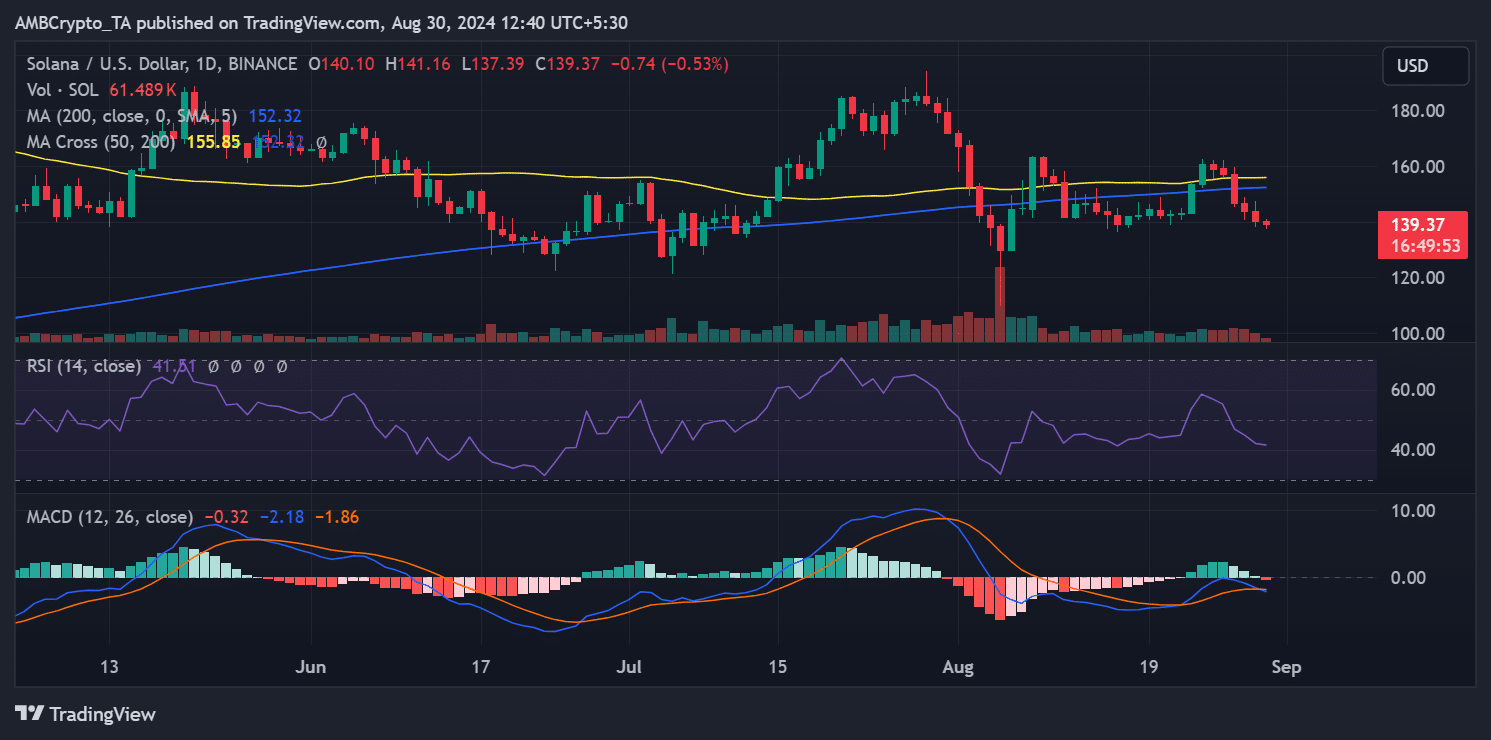

AMBCrypto’s analysis of Solana’s [SOL] price trend revealed a slight reaction to the recent staking developments on the 29th of August.

On that day, SOL’s price opened at around $144 and briefly reached a high of approximately $147. However, the price could not sustain this upward movement and eventually declined to around $140.

As of this writing, SOL is trading at approximately $139, marking a less than 1% decline.

Is your portfolio green? Check out the SOL Profit Calculator

This decline indicates that the initial excitement surrounding the staking developments was insufficient to maintain a lasting positive impact on SOL’s price.

Suppose SOL continues to trend downward in the current trading session. In that case, it will mark the sixth consecutive downtrend, highlighting ongoing bearish pressure.