Despite Solana whale’s $2.9 million dump, SOL analyst eyes $180

- SOL looks bullish and could regain the $180 level in the coming days.

- SOL’s trading volume has increased by 14%, indicating a higher participation from traders.

The overall cryptocurrency market has once again experienced an upside momentum, with top assets like Ethereum [ETH], Binance Coin [BNB], and Solana [SOL] seeing impressive price surges.

Amidst this, a Solana whale was found dumping a notable 20,000 SOL worth $2.9 million, according to the on-chain analytic firm Lookonchain.

Whale offloads 20K SOL

According to the X (formerly Twitter) post, this whale dumped 10,000 SOL worth $1.45 million to Binance and another 10,000 SOL worth $1.45 million to OKX.

Since the 15th of January 2024, this whale has dumped over 614,000 SOL worth $89 million to different Centralized Exchanges (CEXes).

However, the recent dump likely occurred during a period when SOL was consolidating in a tight range between $142 and $144. Additionally, it didn’t have any impact on the SOL price.

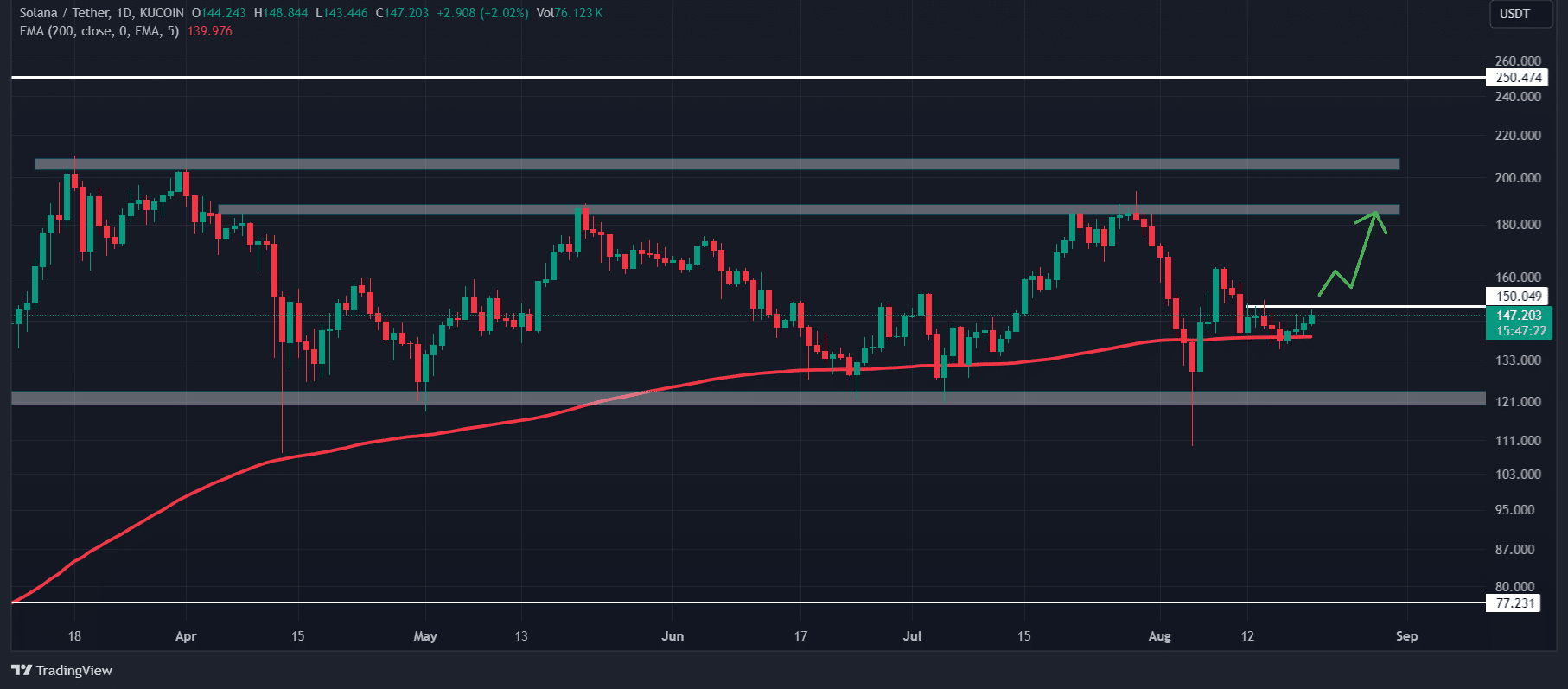

Solana price analysis

At press time, SOL was trading near $148.5, having experienced a price surge of over 4.5% in the last 24 hours. Its trading volume has increased by 14% during the same period.

This increase in trading volume indicated higher participation from traders amid potential market recovery.

However, SOL’s Open Interest remained largely unchanged in the last 24 hours. According to the on-chain analytic firm Coinglass, it has risen by only 1%.

Also, SOL looked bullish at press time, as it trading above the 200 Exponential Moving Average (EMA) on the daily time frame.

On a 4-hour time frame, SOL was forming a bullish inverted head-and-shoulder price action pattern.

Based on the historical price momentum, if SOL closes a daily candle above the $150 level, there is a strong possibility it could regain the $180 level in the coming days.

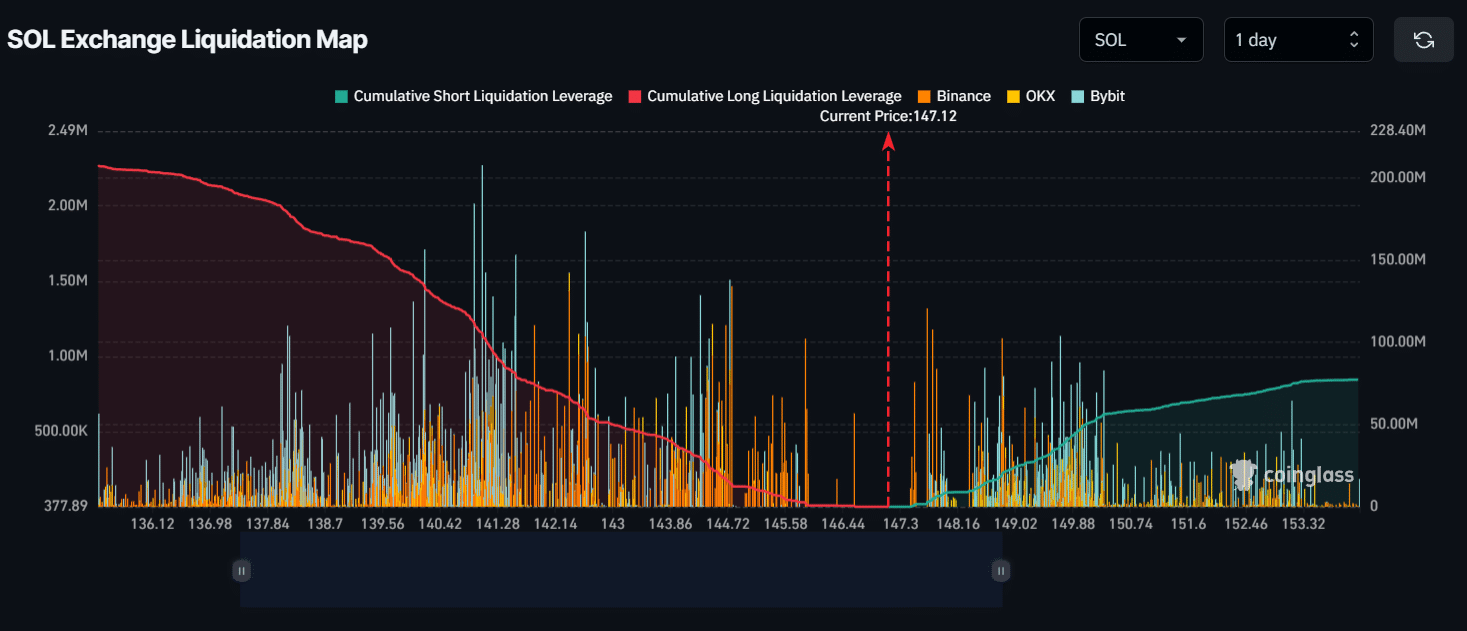

Major liquidation levels

As of press time, SOL’s major liquidation levels were near $141 on the lower side and $150 on the higher side, according to Coinglass.

If the market sentiment remains bullish and SOL rises to the $150 level, nearly $40.5 million of short positions will be liquidated.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Conversely, if the sentiment shifts and the price falls to the $141 level, nearly $103.4 million of long positions will be liquidated.

Data shows that traders have taken high leverage at these levels, making them susceptible to liquidation if the price moves significantly.