Despite Worldcoin’s 8-month slump, WLD eyes $4 – Here’s why

- WLD has come into focus as it nears the crucial $3 resistance, with the potential to pivot towards $4 next.

- However, given its historical price action, the odds remain uncertain.

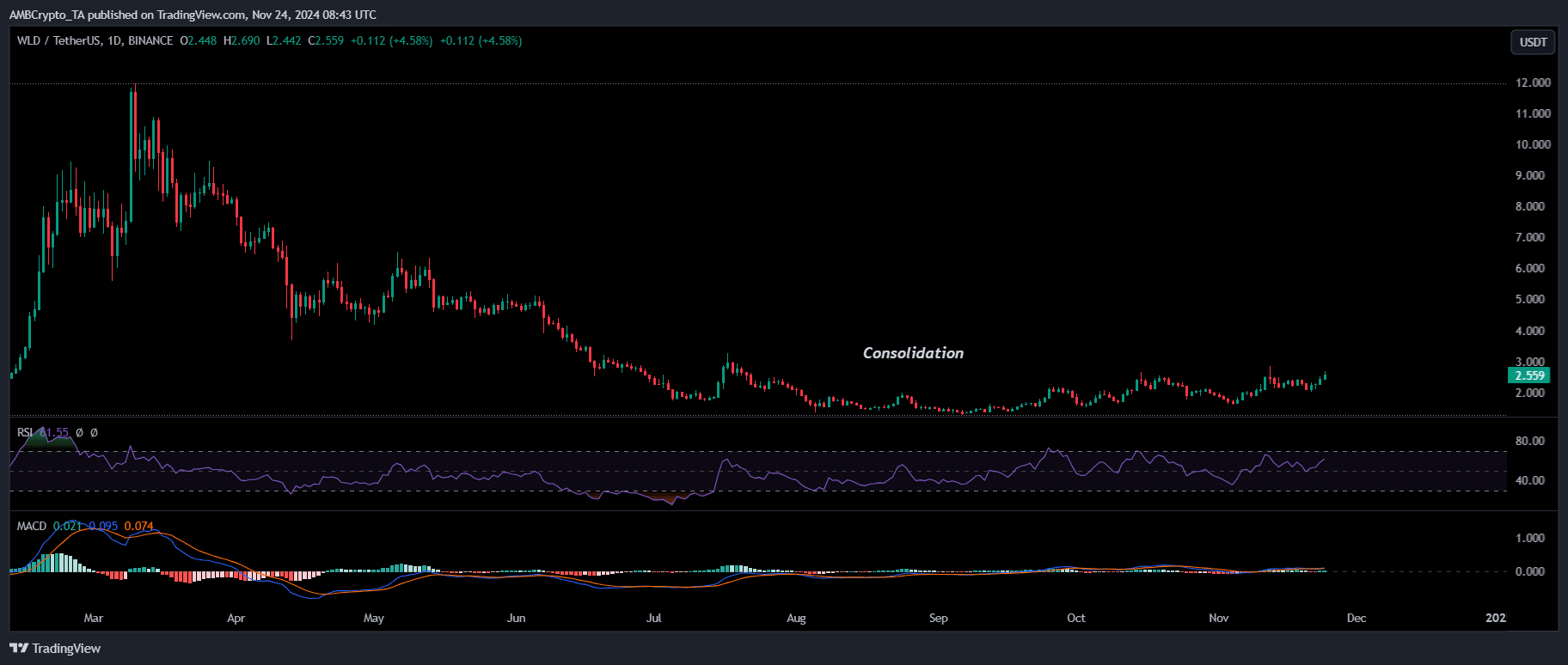

Worldcoin [WLD] has been in a prolonged consolidation phase for the past eight months, with the last four months marking a more intense stagnation.

Priced at $2.63 at press time, WLD remains far from its all-time high of $11, which was reached during Bitcoin’s [BTC] bull run in March.

However, optimism is beginning to build. A prominent analyst has speculated a potential breakout to $4. With its trading volume surging by 50% in the past 24 hours, WLD is nearing its previous $3 resistance.

This surge in volume and price action could signal that WLD is on the verge of breaking free from its prolonged slump, potentially marking the start of its recovery.

Could this be the turning point investors have been waiting for?

Bullish indicators signal untapped potential

Typically, a consolidation phase reflects a subdued capital influx, balancing buying and selling activity. Thus, to trigger a breakout, ramping up buying pressure becomes crucial.

Looking at the daily price chart, WLD shows a clear imbalance, with selling pressure consistently outweighing buying activity, keeping the coin confined within the $1–$2 range.

This is evident from the Relative Strength Index (RSI), which has remained in the underbought territory, signaling untapped upside potential.

Bulls appeared to be leveraging this opportunity, as evidenced by a surge in trading volume, contributing to a near 6% price jump in the last 24 hours.

While these bullish indicators could push WLD toward the $4 range with increased volatility, they are unlikely to be sufficient to propel it back to its all-time high.

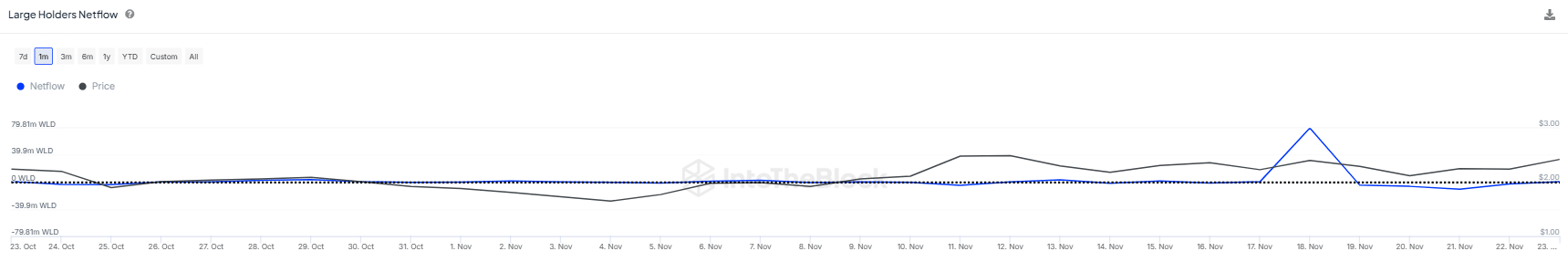

Achieving such a milestone would require significant participation from large HODLers to sustain momentum.

Whales must step in to balance WLD’s momentum

Over the past 30 days, large HODLers have primarily been in a distribution phase, with only one significant instance of substantial WLD withdrawals from exchanges. The transaction amounted to nearly 80 million tokens.

Yet, this activity failed to make a notable impact on its price action, suggesting that extreme volatility is preventing WLD from breaking out.

A more consistent and sustained accumulation effort may be required to offset the prevailing selling pressure.

Additionally, in the perpetual market, short positions have been dominating – a logical stance given WLD’s current market standing.

However, there is still a silver lining: increased trading volume and speculative interest could set the stage for a potential reversal if bulls regain control.

The reasoning is straightforward: A slight uptick in whale accumulation could disrupt the short-sellers who have established a strong position in recent months, preventing the price from rising.

If buying pressure intensifies, it could spark a short squeeze, forcing shorts to cover their positions. This could result in a temporary but significant upward movement.

Realistic or not, here’s WLD market cap in BTC’s terms

Thus, with the current imbalance between buying and selling pressure, a short squeeze appears to be the most likely catalyst to propel WLD out of its slump and potentially lead to a new all-time high.

But this depends on trading volume staying elevated and whales actively participating.