Did United States-based CEX capitalize on banking turmoil? Report suggests…

- Despite the spate of regulatory crackdowns, the volume on centralized exchanges registered only a slight drop since March.

- Around 87% of all trades on centralized exchanges were denominated in USD-pegged stablecoins.

According to market data provider Kaiko, volumes on U.S. centralized crypto exchanges (CEX) reached their four-month high in March. The fact that this came amidst the banking crisis in the U.S. hinted that more investors were shifting funds into the crypto economy.

Moreover, Kaiko’s report from 19 April revealed that despite the regulatory crackdowns, the volume on the exchanges registered only a slight drop since March.

Despite an ongoing regulatory crackdown, U.S. exchange trade volumes have only experienced a slight drop since March. ⚖️

During the banking crisis, volume soared to 4-month highs. pic.twitter.com/jyLARzfHTA

— Kaiko (@KaikoData) April 19, 2023

Stablecoins dominate on CEXs

Around 87% of all trades on centralized exchanges were denominated in USD-pegged stablecoins with the dominance of USD falling to 13%.

The stablecoins’ share on CEXs is expected to increase further with firms like Binance getting cut off from fiat payment rails.

Is opportunity getting missed?

Conon Ryder, an analyst, who is a part of the Kaiko research team, made an interesting observation on the market share of top exchanges.

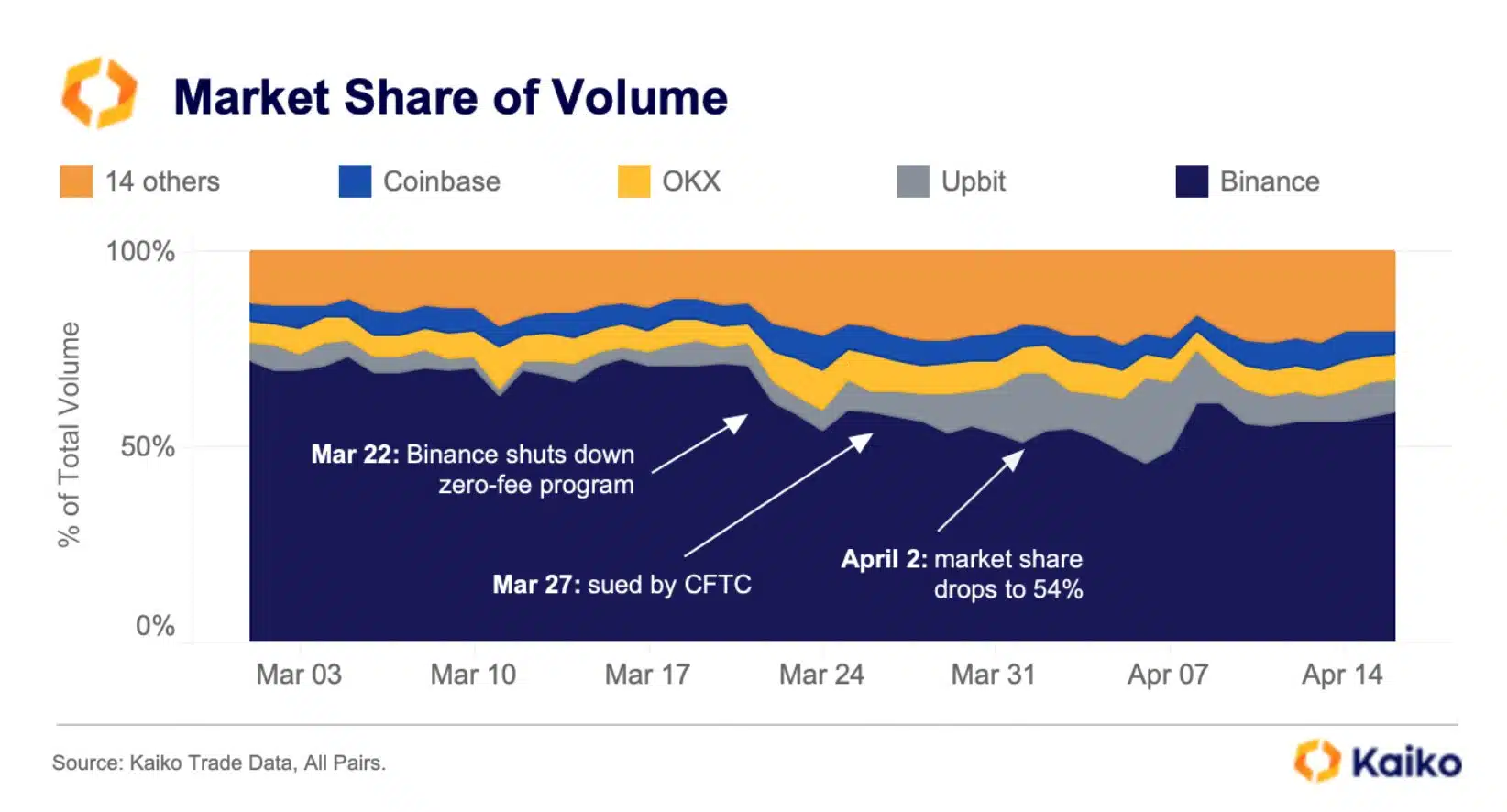

He noted that Binance, the world’s largest exchange by trading volume, lost 20% of its market share since March. The reason was Binance halted its no-fee trading program on 22 March.

As per an earlier report, zero-fee trade volume made up the bulk of the total volume on Binance, nearly 66%, until mid-March 2023.

This major development along with the lawsuit by U.S. CFTC against Binance played a big part in leveling the playing field for other exchanges.

However, most of the market share went to overseas exchanges like Upbit and OKX [OKB] instead of U.S. exchanges like Coinbase.

Meanwhile, with the growing uncertainty, crypto exchanges were contemplating moving their operations away from the United States. Coinbase CEO Brian Armstrong said that relocation of the exchange’s headquarters to the UK was “on the table” if the U.S. regulatory situation does not improve.

Rising competition from DeFi

The dominance of CEXs was increasingly threatened by decentralized exchanges (DEXs), which registered impressive growth in Q1 2023. This was seen in the record trading volumes across DEXs in the aftermath of the collapse of Silicon Valley Bank.

It is to be noted that more and more users are leaning towards self-custody. Hence, it remains to be seen how centralized exchanges would maintain their grip on crypto trading in the U.S.