Decoding why BTC, XRP, ADA-focused investment products saw ‘pity’ inflows

Investors in the cryptocurrency universe went scrambling after the dramatic crash of the stablecoin TerraUSD. This sudden fall triggered a sell-off and chaotic situation within the crypto market. Despite the traumatic turn of events, investors may still have faith in digital assets as digital asset investment products are witnessing inflows.

Year’s highest inflows

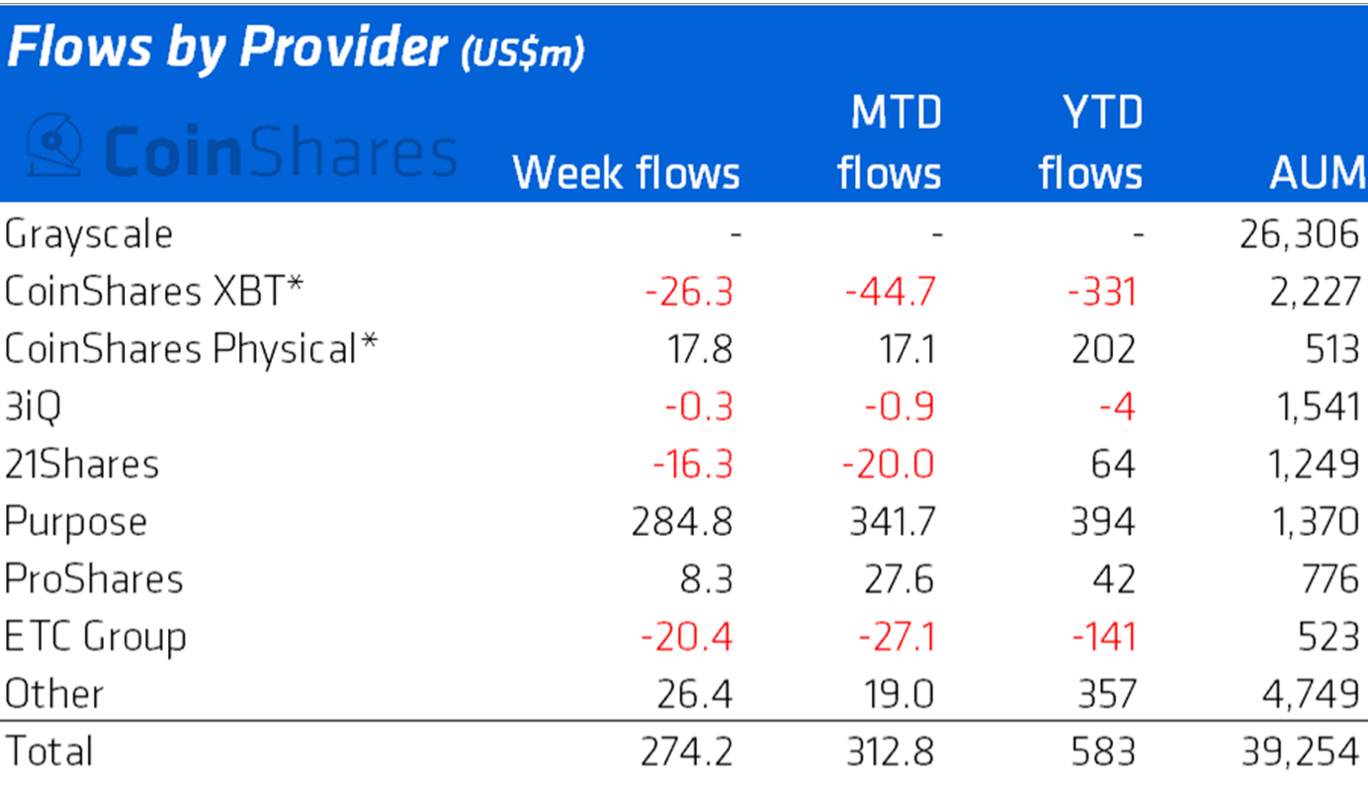

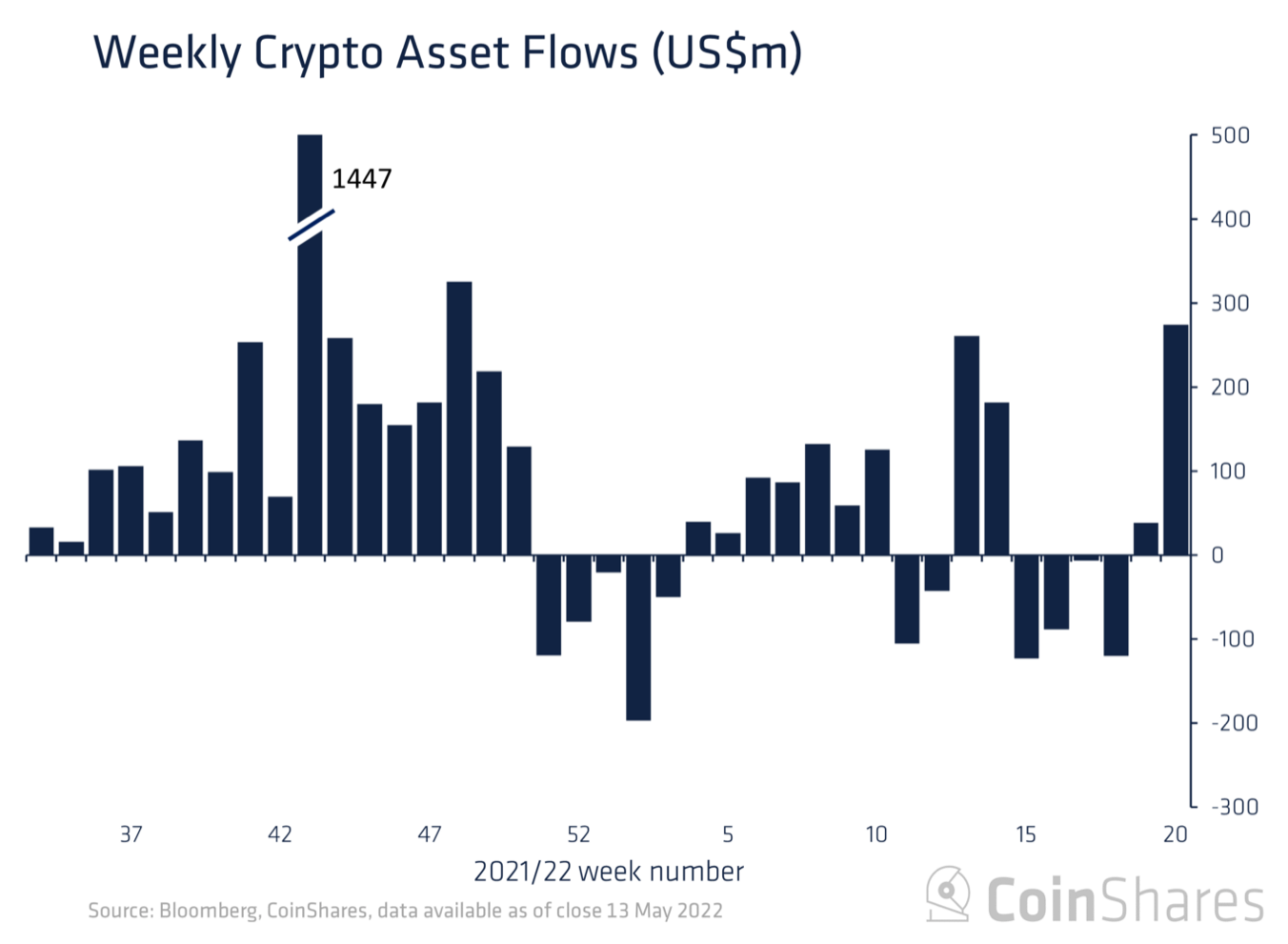

Last week, digital-asset funds netted their highest inflows since late 2021 as investors bought into market panic as per the latest Digital Asset Fund Flows weekly report. Coinshares stated that digital asset investment products saw record weekly inflows for this year, summing up to $274 million as of last week. This is the highest level since the start of 2022.

Source: CoinShares

Given the distress caused by the UST fiasco, investors saw the associated broad sell-off as a buying opportunity. Consider this: UST, the stablecoin at the epicenter of this recent price correction, saw the AuM fall by 99% over the week. Despite this, some intrepid investors added $0.043 million to positions.

Geographically, North American investors saw inflows of approximately $312 million. On the contrary, European investors carried a polarized sentiment but in aggregate witnessed outflows of $38 million in totality.

Brick-by-brick

Bitcoin remained the primary benefactor, with inflows of $299 million last week, suggesting that investors were flocking to the relative safety of the largest digital asset. In fact, Short-Bitcoin (selling coins) saw minor inflows of $0.7 million, which is a slow-down from previous weeks.

However, altcoins, especially Ethereum continued to see a depressing outcome as outflows stood at $27 million last week, bringing ETH’s total yearly outflows to $236 million. Multi-asset digital investment products, or those investing in more than one crypto, took $8.6 million of inflows last week. XRP, Cardano [ADA], Litecoin [LTC], and Tron [TRX]-focused investment products had less than $0.5 million in inflows during the same period.

Nothing without a ‘Purpose?’

The situation remains uncertain given Blockchain equity investors’ panic sentiment. As per the report, outflows accounted for $51 million, which is the third-largest outflow on record.

Source: CoinSharesThe main inflow of funds this time was the Purpose ETF, with a total inflow of about 285 million. But there has been a large amount of capital outflow from the Purpose ETF on 13 May. Excluding the capital flow of Purpose, the capital inflow and outflow last week would remain flat. Not to forget, Purpose is the provider of the largest Bitcoin exchange-traded fund listed in Canada.