Digital asset products buck losing streak to record weekly inflows

- Inflows were attributed to the recent market rally and macroeconomic catalysts from the U.S.

- Ethereum continued its slide while Solana emerged as the oasis of growth in the altcoin market

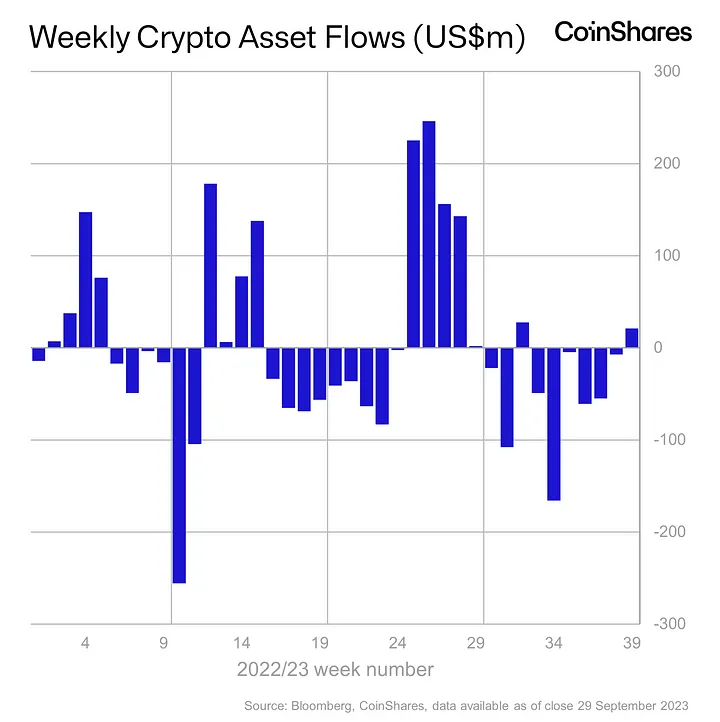

According to the latest report by crypto asset management firm CoinShares, digital asset investment products snapped their six-week bearish streak to record net inflows last week.

Institutional investors amassed cryptocurrencies worth $21 million as buying pressure trumped sell-offs in the market.

CoinShares stated that the inflows could be attributed to the recent market rally along with macroeconomic catalysts like the U.S. government funding impasse and rising U.S. government bond prices.

These factors played a part

The U.S. government was locked in a political deadlock over demands from the opposition to curb public spending. In fact, the government narrowly avoided a complete shutdown of the federal services last week. Had it materialized, the shutdown would have caused a major blow to the economy.

To add to this, the 10-year U.S. Treasury yield surged to a 16-year high, indicative of increased expectations of a recession and economic crisis ahead.

Together, these triggers could have spurred interest in institutional crypto products although there was no telling evidence to confirm the correlation.

Winners and losers

Majority of inflows centered around world’s largest crypto asset Bitcoin [BTC], totaling $20 million, representing about 71% of the total assets under management ( AuM). On a year-to-date (YTD) basis, Bitcoin saw aggregated capital infusion of $168 million.

On the other hand, the altcoin space continued to disappoint. The largest altcoin by market cap, Ethereum [ETH], ironically earned the moniker of the “least-loved altcoin” by CoinShares.

This was owing to its lackluster performance, which resulted in net selling for the seventh consecutive week, reaching $1.5 million, and YTD total outflows of $114 million.

The oasis of growth turned out to be Solana [SOL]. The native asset of the popular smart contracts network clocked its 27th week of inflows when compared to just four weeks of selloffs in 2023.

Regional divergence seen

The report reaffirmed geographical variations in investors’ sentiment. While U.S. witnessed outflows of $19 million last week, Canada and Europe recorded robust inflows of $23 million and $17 million respectively.

The global crypto market cap was $1.09 trillion, marking a 1.87% decline in the last 24 hours, per CoinMarketCap. Bitcoin’s move past $28,000 turned out to be short-lived as the crypto retreated back to $27,603 as of press time.