Does Dogecoin present a buying opportunity on its latest dip?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Dogecoin traded within a month-long range.

- A deviation beneath the range low followed by a reversal would be a buying opportunity.

Bitcoin visited the $21.4k area in recent hours but bounced to $21.6k once more. This level is a critical support level for Bitcoin.

The $21.2k-$21.6k area has acted as resistance in August and early November. If January’s rally is to continue, ideally BTC would see a recovery from this zone.

In light of this information, the fact that Dogecoin also sat atop month-long support suggested that buyers are likely to have their eyes on DOGE in the next couple of days.

Read Dogecoin’s Price Prediction 2023-24

If Dogecoin recovers, it can make gains of 15% northward before meeting significant resistance. On the other hand, heightened selling pressure could see sharp losses for the meme coin.

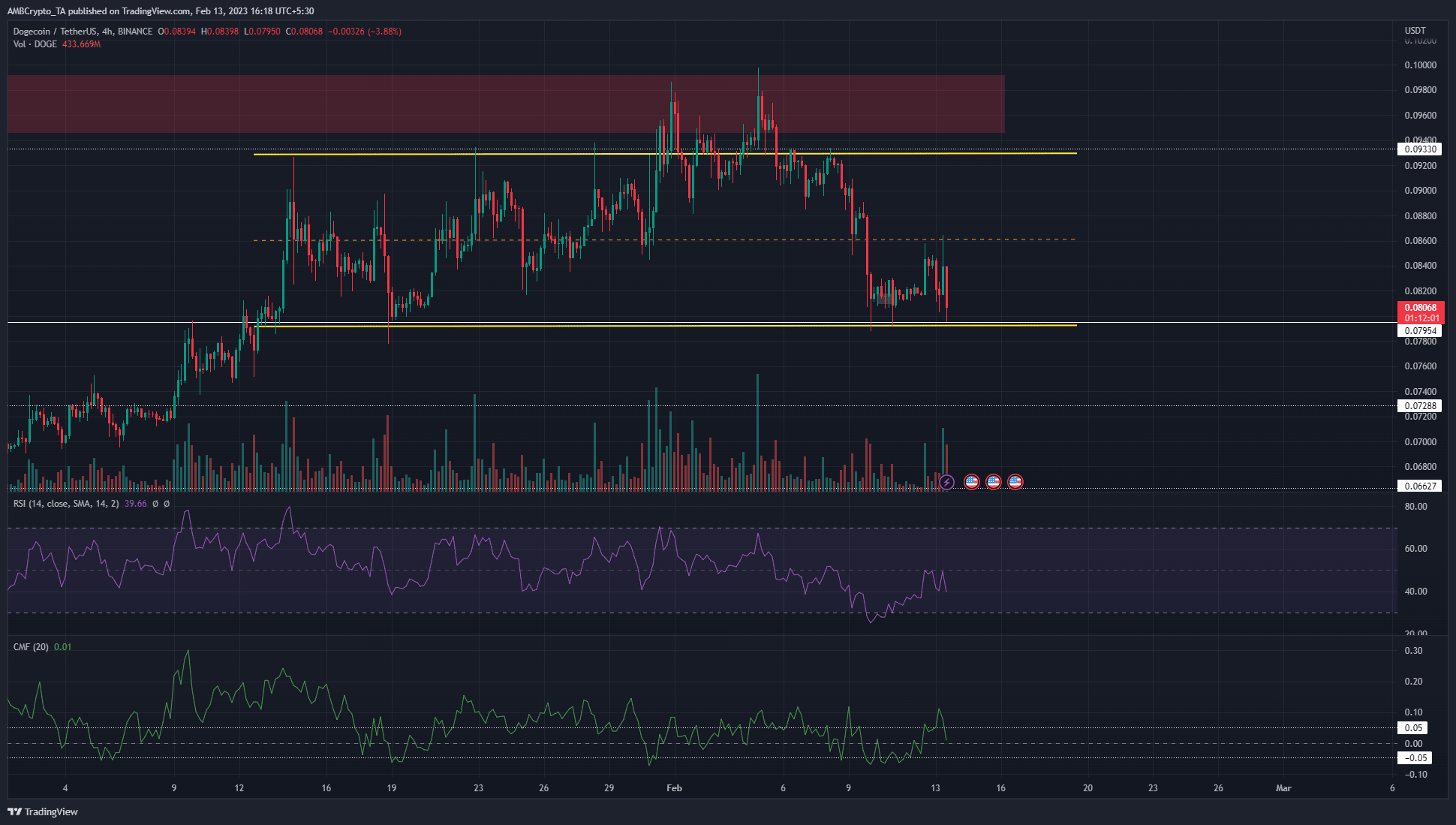

Dogecoin rally retraces after running into a 12-hour bearish order block

The red box highlighted a 12-hour bearish order block just below the $0.1 level. Dogecoin rallied from $0.067 to $0.099 in early February. This represented gains of 48% in five weeks. However, the $0.1 is a psychological and technical area of resistance.

Sellers proved their strength once more as DOGE retested the $0.09-$0.1 zone. At that time, a bearish divergence was seen as well. In yellow, a range from $0.079-$0.092 was highlighted. It can be seen that the mid-point of this range, at $0.086, has acted as support and resistance over the past month.

This highlighted the credibility of the range, despite the deviation toward $0.1 earlier this month. At the time of writing, the price was back at the range lows. The RSI has made a series of higher lows over the past couple of days, while DOGE remained flat at $0.082.

How much is 1, 10, 100 DOGE worth?

The CMF was in neutral territory, but it has already been highlighted that both BTC and DOGE traded just above significant support levels.

From a risk-to-reward perspective, buying DOGE in the $0.078-$0.082 area can be profitable over the next week or two. Bulls can look to book profits at the mid-range mark and the range high at $0.086 and $0.092 levels respectively.

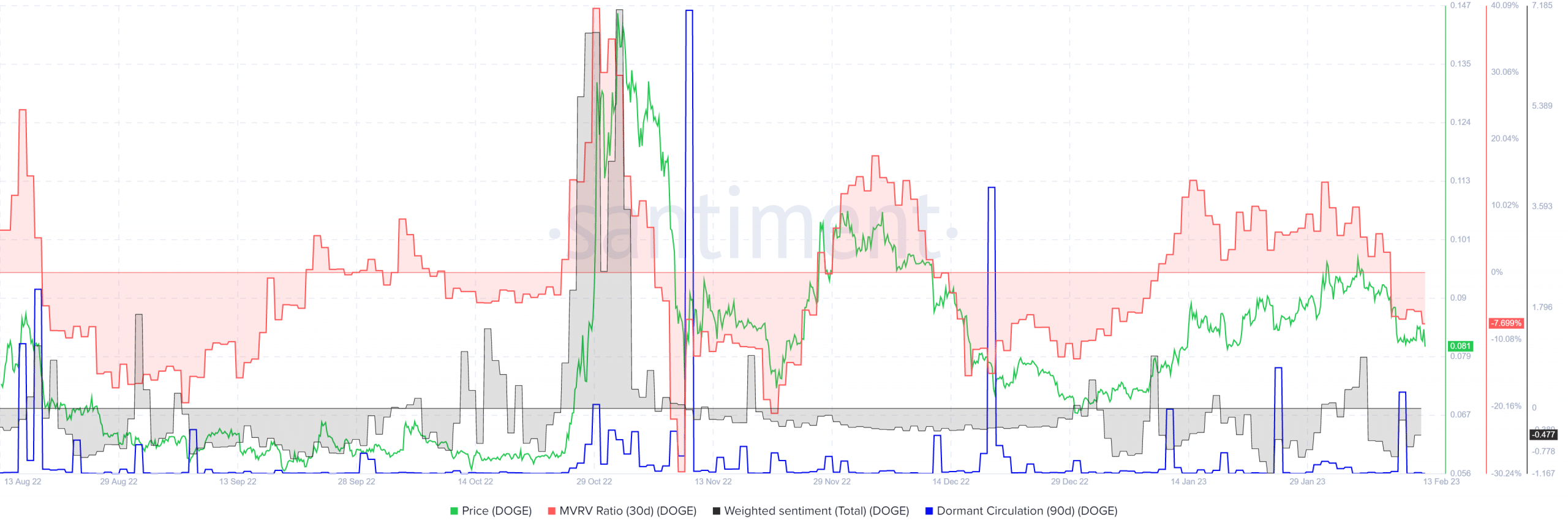

MVRV and weighted sentiment highlight the selling pressure of the past two weeks

Source: Santiment

The 30-day MVRV ratio dipped below zero as selling pressure intensified over the past few days. A spike in the 90-day dormant circulation of DOGE was also seen. This suggested a moderate amount of DOGE was moved, which reinforced the idea of selling pressure.

Another interpretation of this data is that short-term holders have finished taking a profit, and the price was ripe for another move upward. Combined with the technical findings, this seemed the more likely conclusion.

Yet, a drop beneath $0.078 would be a stern warning sign to buyers that bears have seized control once again.