Does Solana’s recovery mean good news for SOL’s price action too?

- Solana seems to be showing signs of recovery after cooling off in Q3

- Hence, it’s worth assessing the possibility of SOL adopting a similar recovery trend

Solana saw a notable decline in network activity after July, an outcome that had an impact on SOL’s demand owing to their correlation. However, recent findings suggest that the network’s activity is finally on a revival track. Could this set the pace for SOL’s recovery on the charts?

Solana’s on-chain volume cooled down between July and early September. For perspective, the network’s daily volume peaked above $2 million USD in July. Conversely, the same daily volume dropped below $1 million in late August and early September.

We also observed that Solana TVL was also significantly disrupted over the same period. For example, it peaked above $5.6 billion towards the end of July, before pulling back as low as $3.8 billion in the first week of August.

Although it recovered slightly shortly after, the TVL remained within the $4.6 billion range up until the first week of September.

Solana TVL has since then embarked on a significant recovery, even pushing close to its recent 2024 high. Based on these observations, it is clear that confidence and on-chain activity have been making a comeback.

Can SOL benefit from improving Solana sentiment?

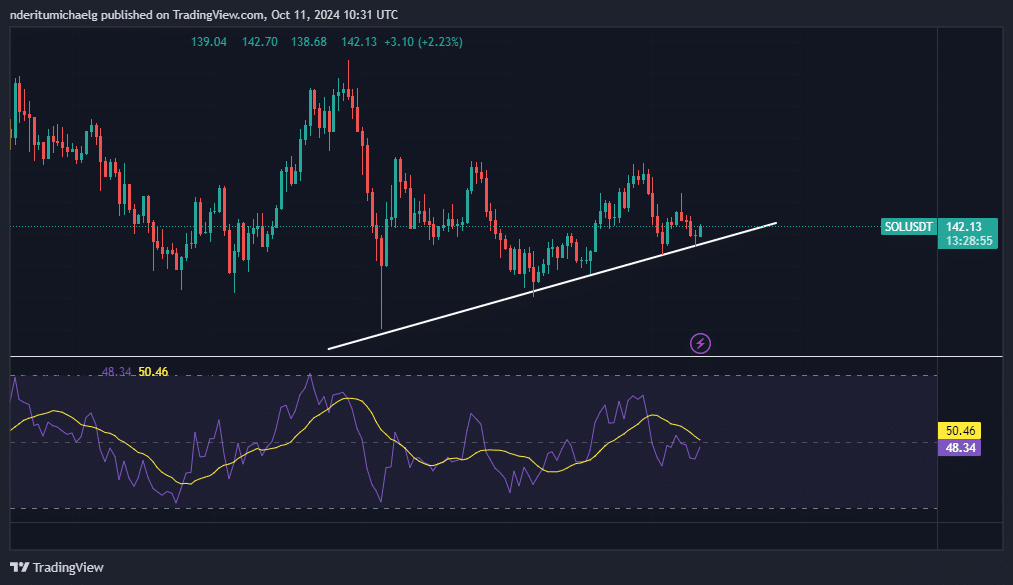

Renewed Solana network activity should, in theory, lead to more demand for SOL. In fact, a look at its price action revealed that this may already be playing out. The cryptocurrency’s bottom range has been moving within an ascending support line too.

SOL has retested the same support line twice so far this month, with the latest retest occurring in the last 24 hours.

The support level highlighted a noteworthy probability that the price may adopt more upside over the weekend. The RSI had already pivoted towards the mid-range at the time of observation, but remained below the same zone.

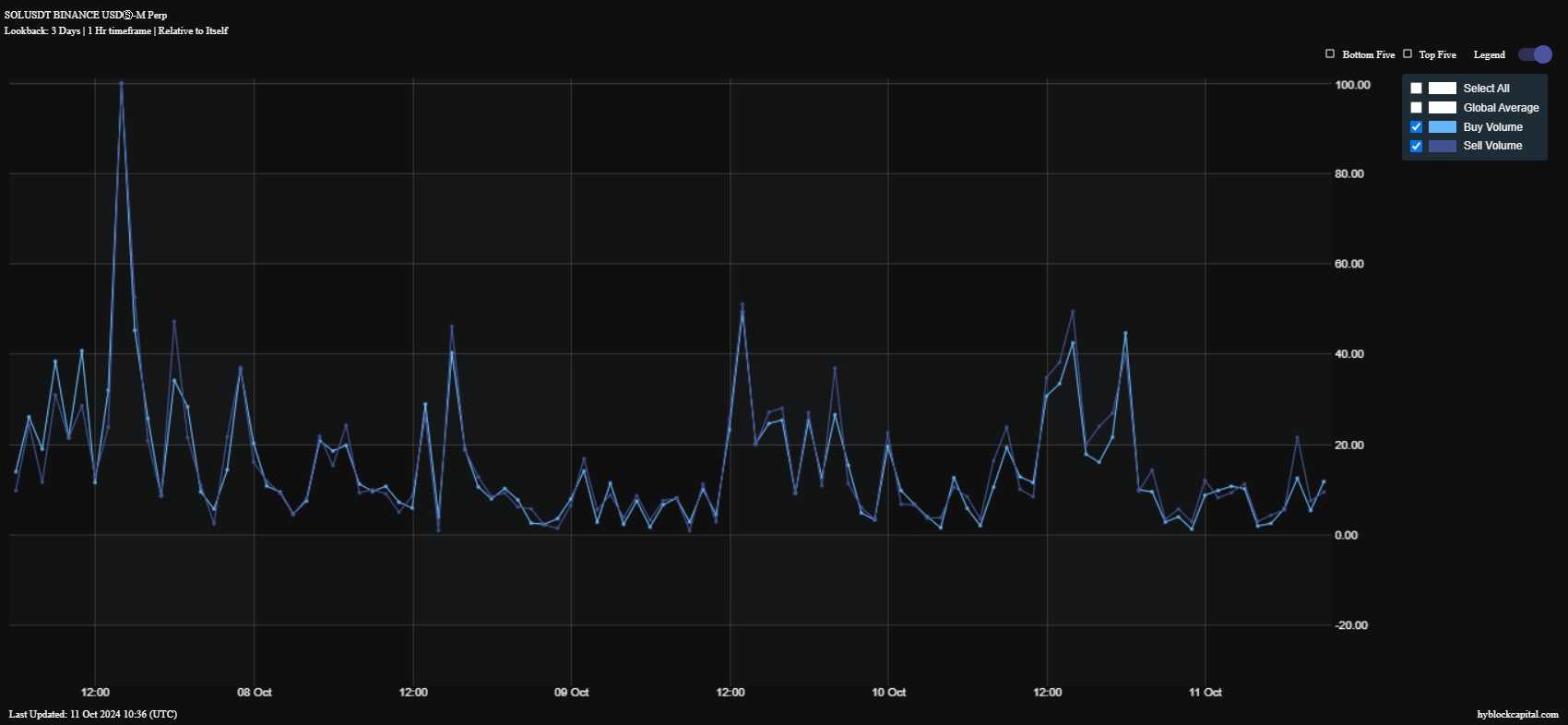

An assessment of on-chain buy and sell volumes revealed a dip in the last 3 days on both sides. This was likely because of bearish exhaustion, combined with a lack of strong demand to take over. Despite these observations, however, both bullish and bearish volumes appeared evenly matched, making it difficult to draw a clear distinction.

Finally, the buy-sell volume profile confirmed that there was still a lot of directional uncertainty.

In other words, SOL may look bullish now courtesy of the ascending support and Solana’s performance. Nevertheless, there is still a significant risk that it could slide below the same support line.