Analysis

DOGE: As prices drop, why predictions foretell a 10% loss

DOGE’s RSI shows early signs of a shift in momentum- but should you rely on it?

- DOGE has a bullish structure, but buying pressure has dwindled.

- If Bitcoin’s prices recover, DOGE would likely follow.

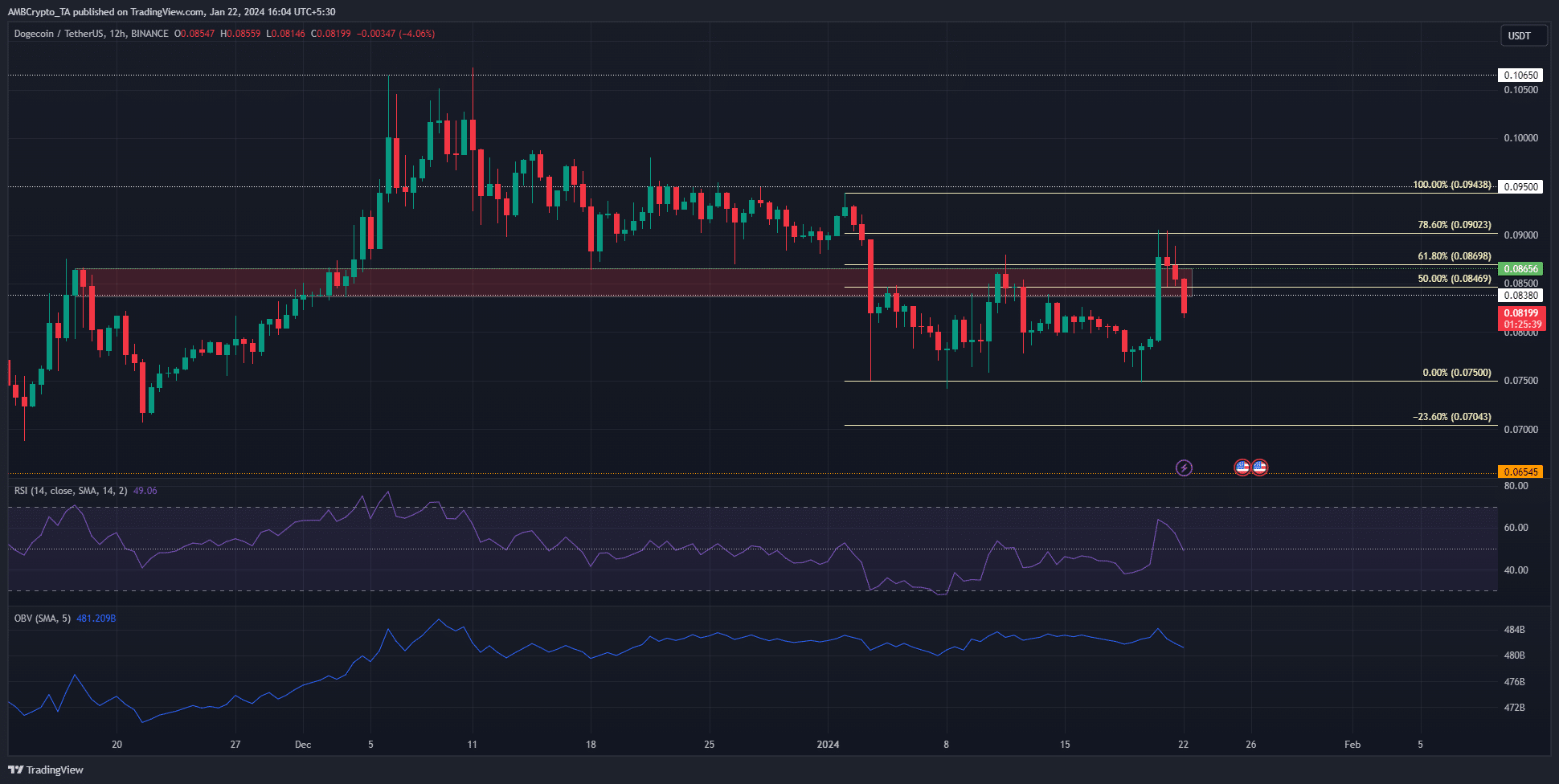

Dogecoin [DOGE] reached a high of $0.0905 on the 21st of January. This was a critical resistance zone, and even though the market structure was bullish, a drop to the local lows was possible.

The recent gains to reach $0.09 came after X (formerly Twitter) recently launched its official XPayments handle.

At press time, the price of the meme coin was at $0.0838, just above the $0.081 zone of support. The technical indicators do not point toward a deep drop in prices, but the liquidity charts suggest otherwise.

The $0.085 support zone was breached yet again

The RSI at press time on the 12-hour chart was at 49. It was an early signal of a shift in momentum, but the most recent trading session has not yet closed.

Hence, there is a chance that the bulls can hold off the bearish pressure over the coming hours.

The OBV saw a large dip in the past few sessions. It highlighted seller dominance in recent days. As noted already, the market structure was bullish.

This raised the possibility that the recent dip was to fill the imbalance on the chart. That is, a retest of the $0.0795 level, followed by a sharp rebound, is also a possible scenario that could unfold.

The rejection from the 78.6% Fibonacci retracement level was a strong sign that a downtrend was in progress.

Alternatively, Bitcoin [BTC] was near the lows of a seven-week range, meaning a bounce in prices could drag DOGE higher as well.

The lack of a bullish reaction soon could see a further 10% drop

Source: Hyblock

AMBCrypto looked at the estimated liquidation levels heatmap from Hyblock. The lookback period of the past three months showed that there were scant liquidation levels between $0.082 and $0.073.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Therefore, if the bulls can’t hold on to the $0.0795 level (the lowest part of the imbalance) a drop to the $0.073 area would become likely. Hence, traders need to exercise caution.

The lower timeframe price charts showed that a drop below $0.0809 would signal bearish intent. Until then, buyers could be getting some discount on Dogecoin, whose prices are due for recovery.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.