DOGE bulls re-target $0.075 – Will they succeed this time?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls sought stealth re-entry at a price imbalance zone (FVG).

- Open Interest rates improved; volumes stagnated.

Dogecoin [DOGE] bulls don’t want to lose the $0.070 price zone. After faltering at $0.0751 on 15 July, they quickly regrouped and reclaimed the price zone again. At the time of writing, DOGE traded at $0.07097 and had mounted above a previous range-low.

Read Dogecoin’s [DOGE] Price Prediction 2023-24

The candlestick session close above the previous range-low emboldened DOGE to eye the previous range-high.

Meanwhile, Bitcoin [BTC] exhibited a sharp rebound from its range-low of $30k but was yet to cross the mid-range of $30.5k at the time of writing.

Can bulls clear the $0.0751 hurdle?

DOGE entered a range formation within $0.070 – $0.075 in May but later inflicted a bearish breakout in early June. However, it has recovered most of the losses incurred since mid-June.

Notably, DOGE made higher highs and higher lows since mid-June, allowing bulls to gain the edge. Although the recovery faltered at the previous range-high of $0.0751, bulls sought re-entry at the price imbalance and FVG (fair value gap) of $0.0694 – $0.0655 (cyan).

In most cases, the price always hits the FVG before embarking on its previous direction. So far, DOGE has seen two rebounds from the FVG. Besides, the FVG aligns with the ascending trendline support.

So, a price rejection at the previous range-high of $0.0751 could ease at the above confluence area. As such, the confluence area is a crucial interest to bulls as it could offer another buying opportunity.

Alternatively, a candlestick session close above the previous high of $0.0751 could further confirm bullish intent and likely retest of $0.081.

Meanwhile, the RSI rebounded from the mid-level – indicating improved buying pressure. But CMF (Chaikin Money Flow) moved sideways while the ADX (Average Directional Index) was below 20, indicating stagnated capital inflows and a lack of a strong trend.

How much are 1,10,100 DOGEs worth today?

Open Interest rates improved

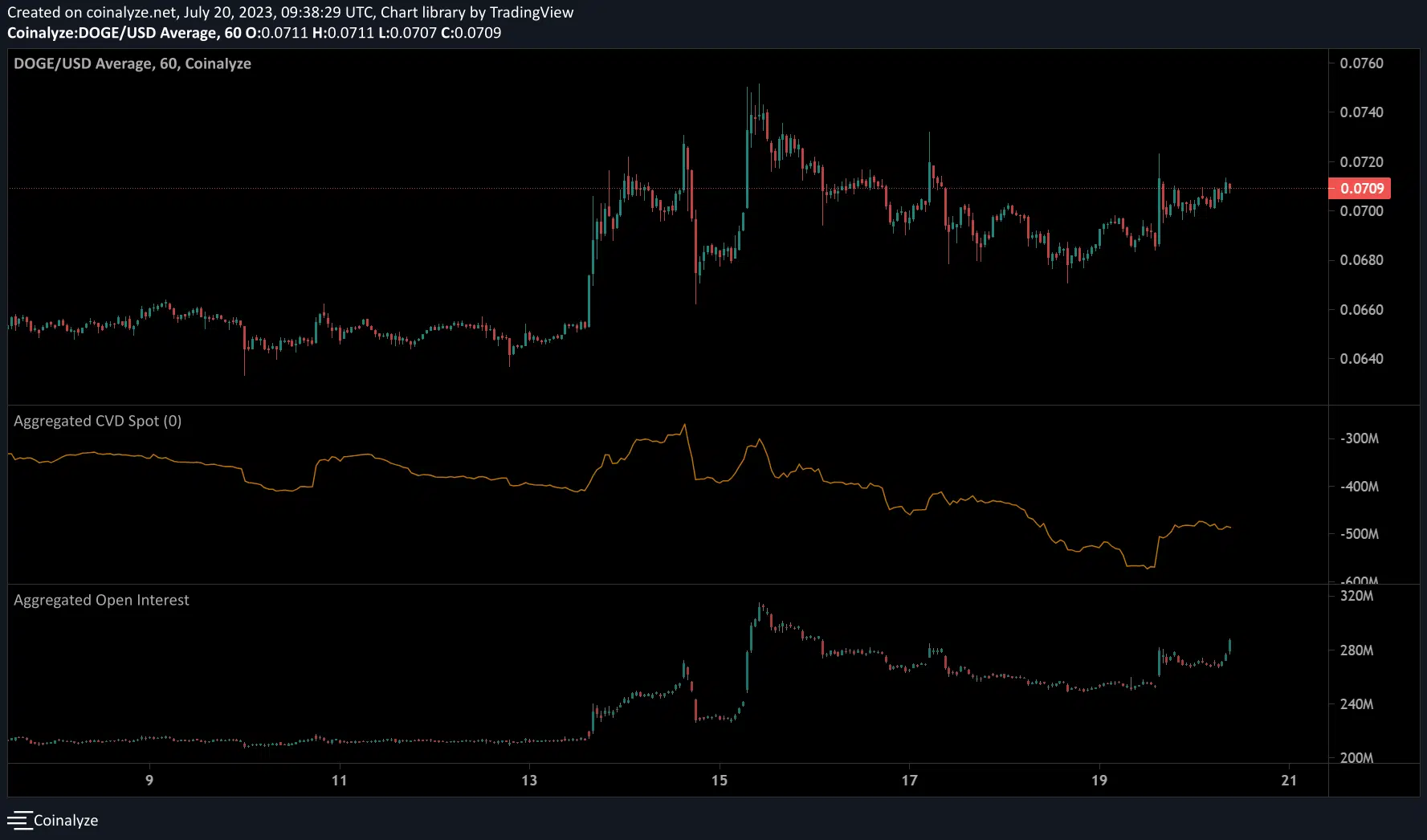

On Coinalyze’s 1-hour chart, the Open Interest (OI) rates, which track the number of opened contracts in the futures market, improved in the past few days. The OI has been making higher lows since 13 June, underscoring the recent future market demand.

But the CVD (Cumulative Volume Delta) stagnated after a recent positive slope, suggesting eased buying volumes. It could make the crossing above $0.0751 high more difficult. The range-low/FVG/ascending trendline confluence area could offer a reprieve if that’s the case.