Analysis

DOGE: Key levels to consider as bulls look to continue uptrend

The memecoin’s 3.7% gains over the past 24 hours reinforced the bullish conviction of DOGE, despite the recent retracement.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls rebounded from 38.2% Fib level to maintain uptrend.

- Rising Open Interest re-echoed short-term bullish sentiment.

Dogecoin [DOGE] bulls rallied strongly to maintain its bullish uptrend. This came after its price had fallen to a mild retracement after the failure of buyers to push past the $0.083 resistance level.

Is your portfolio green? Check out the DOGE Profit Calculator

The memecoin’s 3.7% gains over the past 24 hours reinforced the bullish conviction of DOGE, despite the recent retracement. Furthermore, it highlighted the memecoin’s price action decoupling from Bitcoin’s [BTC] with the king coin remaining stuck at $29k over the same period.

Bullish conviction justified

DOGE’s recovery hit a bearish roadblock at the $0.083 price level. Despite the pullback, the underlying price action and indicators flashed bullish signals to re-echo the bullish sentiment in the market.

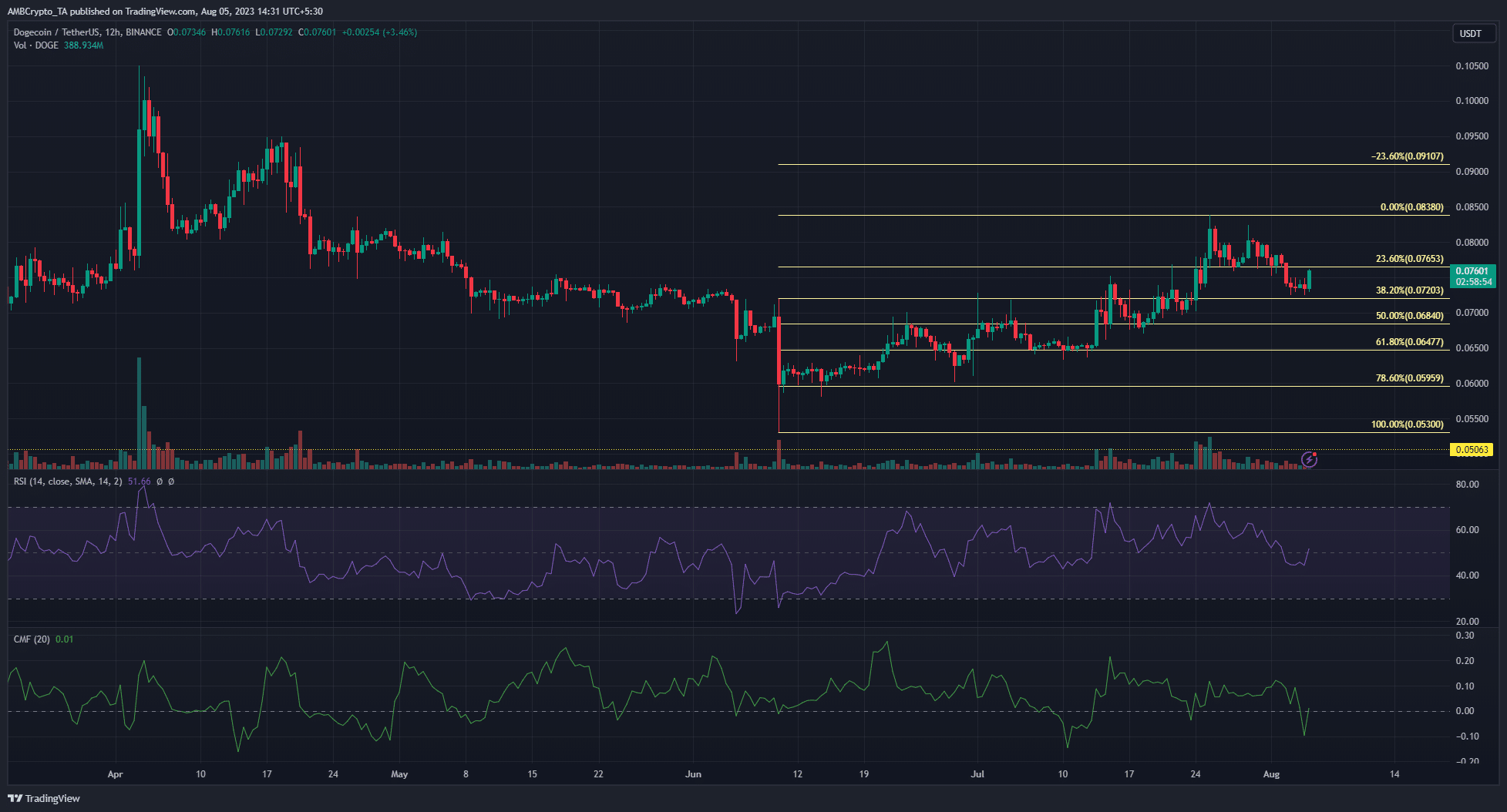

A recent price report highlighted the 23.6% Fib ($0.076) and 38.2% Fib ($0.072) levels as potential areas for bulls to repel the retracement and continue the upward trend.

With bulls rebounding from the 38.2% Fib level on the 12-hour timeframe, near-term targets will lie at $0.076 and $0.083. If bulls successfully flip the $0.083 price level, further gains could be realized at $0.091.

Meanwhile, the Relative Strength Index (RSI) rose above the neutral 50 to highlight the growing demand. Similarly, the Chaikin Money Flow (CMF) turned positive to signal good capital inflows.

Rising Open Interest spur buyers’ confidence

How much are 1,10,100 DOGEs worth today?

The price chart in the one-hour timeframe showed DOGE had broken out of a falling wedge. This was reflected in the Open Interest rising by $32 million, per Coinalyze

.An increase in open interest along with an increase in price typically hints at the continuation of an upward trend. Likewise, the Funding Rate remained positive to reinforce the bullish narrative. This could lead to further gains for buyers in the short term.