Dogecoin reclaims its January level- Are short-sellers subdued?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The 4-hour chart was bullish at press time.

- Bulls had slight hope based on the bullish pendant pattern.

Dogecoin [DOGE] saw a sharp rally after Twitter replaced its typical blue bird logo with an image of DOGE. The meme coin rallied 21% on 3 April but consolidated in the past few hours, hovering below $0.10000.

The overall price action chalked a bullish pendant pattern which could tip bulls for more upward traction.

Read Dogecoin [DOGE] price prediction 2023-24

On the other hand, the king coin, Bitcoin [BTC], continued with its sideways structure of $26.9K – $28.8K. The range trading could slow the strong uptrend DOGE witnessed in the past few hours.

A bullish pendant pattern – Can bulls sustain the uptrend?

DOGE saw a sluggish recovery from mid-March, crawling from around $0.06500. But the Twitter move boosted the recovery, pushing DOGE above the bearish order block of $0.0850. But it faced rejection at $0.10500, chalking a bullish pendant pattern.

Near-term bulls could push DOGE to $0.011247 if the $0.09294 support is defended. A key obstacle for near-term bulls to watch out for is the $0.10500. However, a breach and close below $0.09294 would undermine more upward momentum.

Such a downswing could attract more sell pressure and devalue DOGE to $0.08904 or $0.089496. The 50 MA could likely check the downward momentum and offer bulls a reprieve.

Meanwhile, the RSI retreated from the overbought zone at press time, showing buying pressure decreased slightly. On the other hand, the Directional Movement Index (DMI) showed +DMI was above -DMI, and the Average Directional Index (ADX), yellow line, surged upwards, showing the uptrend was still strong at press time.

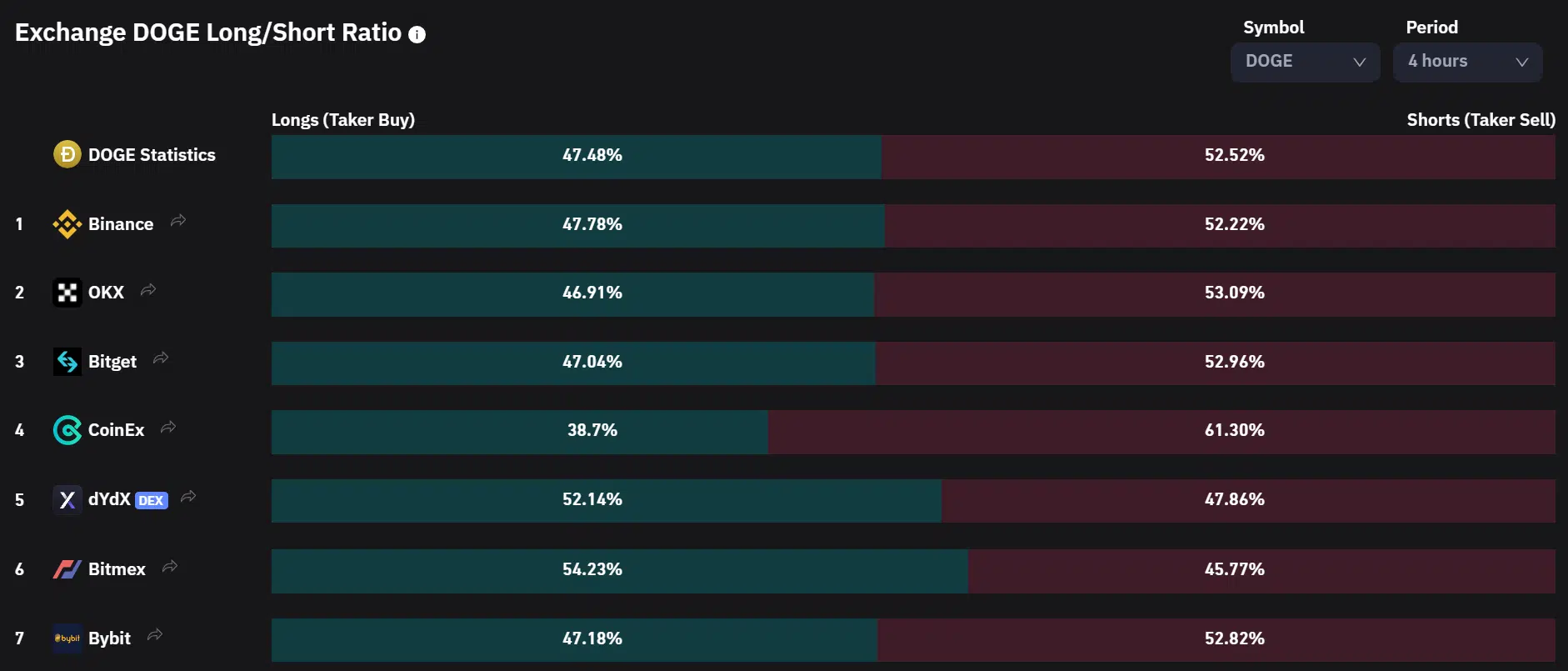

The long/short ratio leaned toward sellers

According to Coinglass, the exchange long/short ratio was 53% (shorts) against 48% for longs at the time of writing. It shows a significant number of investors were slightly pessimistic about the short-term prospects of the meme coin.

How much are 1,10,100 DOGEs worth today?

However, DOGE’s open interest rate continued to rise at press time. It shows a bullish sentiment in the futures market which could make bulls hopeful. But the conflicting metrics call for tracking of BTC price action for better trade moves.