Analysis

DOGE stalls at $0.07000: Bulls can re-enter here

DOGE hit a familiar cross-road and obstacle on the H4 chart – which route will it take?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- DOGE recovery hit a key bearish order block near $0.07000.

- Funding rates were relatively positive and favored bulls.

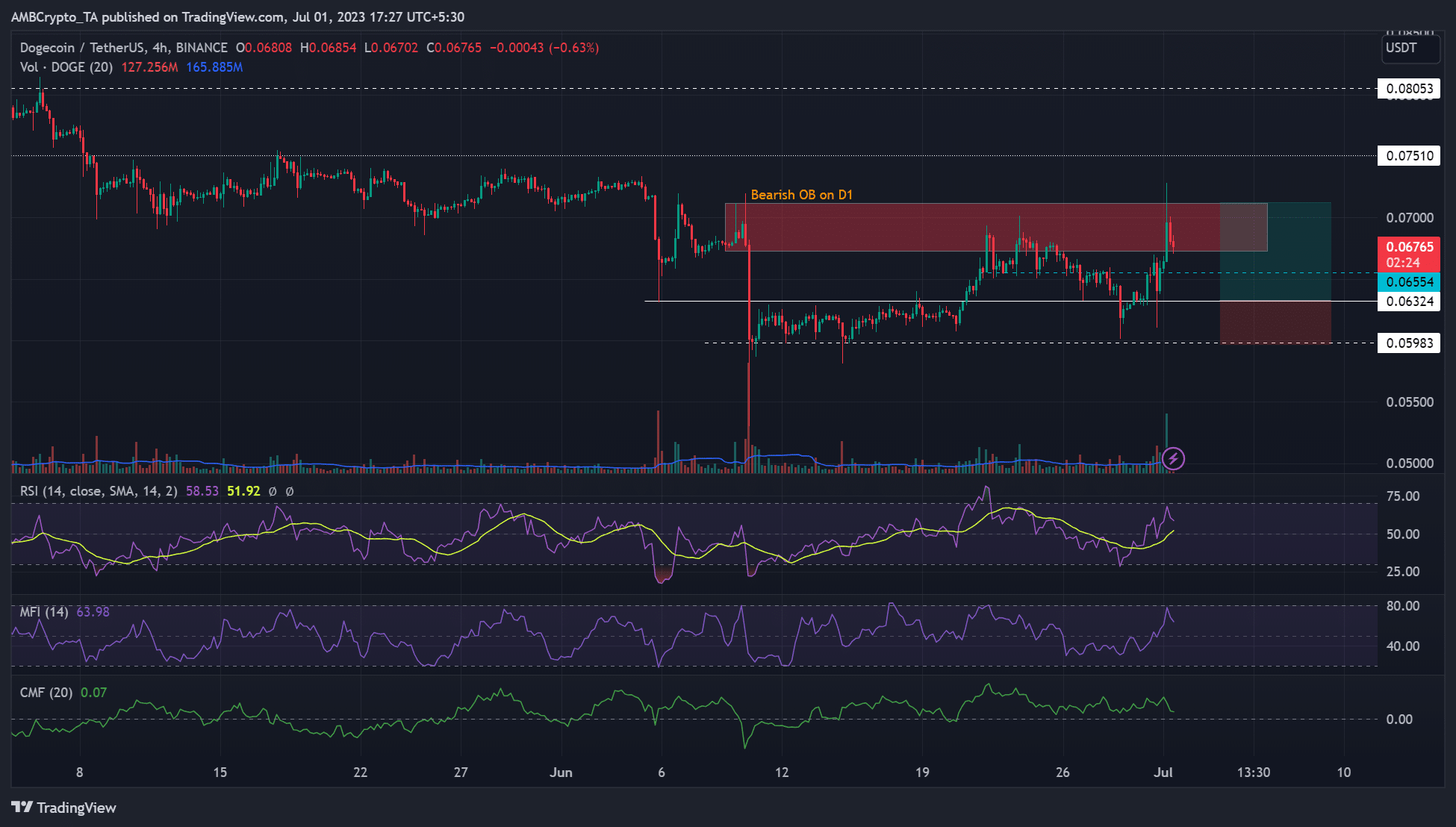

Dogecoin [DOGE] has struggled to swing beyond $0.07000 since 22 June decisively. Further upside beyond $0.07000 has been consistently stopped by the bearish order block (OB) of $0.06729 – $0.07120 (red) on the daily timeframe.

How much are 1,10,100 DOGEs worth today

?In the meantime, Bitcoin [BTC] maintained a hold of $30k into the start of Q3 2023, reinforcing bullish sentiment. But DOGE’s H4 structure was still bearish at the time of writing unless it clears the bearish OB.

Further retracement on the cards?

A previous retest of the bearish OB of $0.06729 – $0.07120 (red) between 22 – 25 June saw DOGE breach the immediate short-term support of $0.06554, only to see a sharp rebound after reclaiming another support level of $0.06324.

Technical indicators, RSI (Relative Strength Index) and MFI (Money Flow Index) hit overbought zones, indicating buying pressure increased alongside significant volumes. But they registered downticks at the time of writing, suggesting a potential pivot.

In addition, the CMF (Chaikin Money Flow) remained above the zero mark but eased southwards, denoting capital inflows eased but remained positive.

So, DOGE could retrace to lower levels – $0.06324 or $0.05983 if the roadblock at $0.07000 persists. Bulls can wait for the pullback retest on the above levels for buying opportunities. Secondary buying opportunities could suffice upon a decisive session close above bearish OB.

But a drop below $0.05983 will invalidate the bullish thesis and could expose DOGE to aggressive selling.

The funding rate was positive

Is your portfolio green? Check out the DOGE Profit Calculator

According to Coinglass, DOGE’s funding rates were relatively positive in the better part of 1 July. The metric has improved considerably from 29 June and could offer bulls an edge.

In addition, about $1.4 million in short positions have been liquidated in the past 24 hours. On the contrary, long positions suffered a $1.1 million wreckage, suggesting a bullish bias on the higher timeframe. But bulls will only gain an edge if they invalidate bearish OB.