Memecoins

DOGE surges by 10%: Thank you, Elon Musk?

DOGE’s price rises sharply after days of sideways movement, but this trend might not last.

- Dogecoin’s value pumped soon after Elon Musk created an XPayments account.

- Sentiment around DOGE turned bullish, but market indicators were bearish.

After several days of dormancy, the price of Dogecoin [DOGE], the world’s largest meme coin, suddenly erupted. Though there might be multiple reasons behind this, a critical one might be Elon Musk’s actions, yet again.

Dogecoin turns green!

AMBCrypto’s look at CoinMarketCap’s data revealed that, like most other cryptos, DOGE’s price chart also remained flat for several days. However, its value shot up by more than 10% in the last 24 hours alone.

This surge painted both its daily and weekly charts green. At the time of writing, DOGE was trading at $0.08648 with a market capitalization of over $12.3 billion.

The uptrend was also accompanied by a more than 200% rise in daily trading volume.

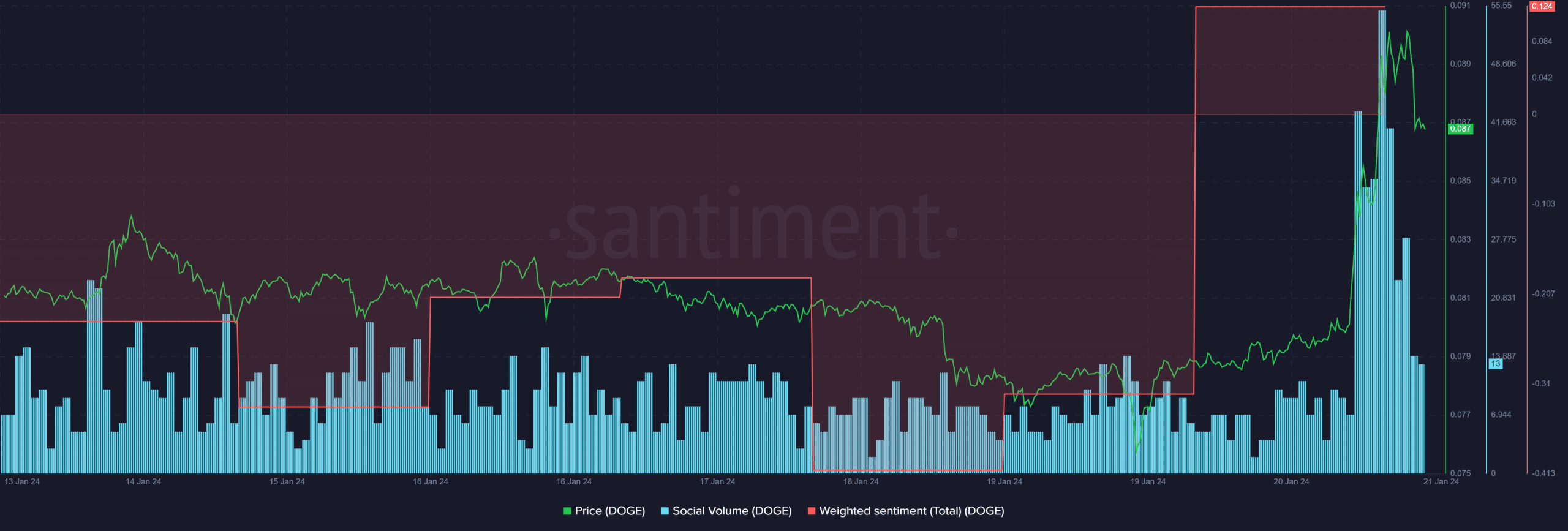

Thanks to the price uptrend, Dogecoin’s social volume spiked substantially on the 21st of January. Bullish sentiment around the meme coin became dominant in the market as well, as evident from the rise in Weighted Sentiment.

A major reason behind this latest uptrend could be Elon Musk’s latest decision. Notably, Musk’s X (formerly Twitter) recently launched its official XPayments handle.

Musk has always been an avid supporter of DOGE and has never missed an opportunity to create hype around it. In fact, when

Musk had previously announced his plans to integrate Dogecoin and X, the meme coin’s price had skyrocketed as well.Will the hype around XPayments be enough for Dogecoin?

DOGE’s current price uptick was enough to get investors hyped, prompting AMBCrypto to take a more nuanced look into the metrics. Our analysis revealed that DOGE’s MACD displayed a bullish crossover, hinting at a further uptrend.

Realistic or not, here’s

DOGE’s market cap in BTC’s termsHowever, the rest of the indicators looked bearish. For example, DOGE’s price touched the upper limit of the Bollinger Bands.

Its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered downticks as well, indicating that the northward price movement might come to an end sooner than expected.