DOGE traders can use $0.09508, $0.08995, $0.07998 as short-selling targets if…

- DOGE was in a neutral market structure but bears had slight leverage.

- It could break below $0.09508.

- A break above the current resistance at $0.10728 will invalidate this prediction.

Dogecoin’s (DOGE) market structure has weakened since 1 December. At press time, the memecoin was trading at $0.09846 and warming up to retest the support level of $0.09508.

It is worth noting that the above support level was a pullback zone that could have provided the bulls with a rest zone for a rally. However, DOGE’s price recovery could be undermined due to the declining trading volumes and weakening buying pressure based on technical indicators.

If the bears maintain momentum at the time of publication, DOGE could fall to $0.09508 or within the 23.6% and 38.2% Fib pocket levels. This would provide traders with a shorting opportunity.

Will DOGE sustain a price move above the 3 EMA Ribbon?

DOGE traded within the $0.05685 – $0.07434 range between mid-June and late October, with false breakouts occurring in between. However, a convincing breakout to the upside from the range in early November was blocked by a market slump.

DOGE established strong support at 0.07434 and retested it twice since the crypto market collapse. Recently, the bulls of DOGE used the support to start a rally that has since allowed for an increase of over 40%, reaching a high of $0.11192 on 5 December.

However, another price decline brought DOGE back to the current support. Technical indicators show that DOGE could break below the support. In particular, the Relative Strength Index (RSI) has retreated from the upper range to a level slightly above the equilibrium point, suggesting that buying pressure has eased.

In addition, the Exponential Moving Average (EMA) Ribbon has acted as support for some time. Price action has been approaching this band, and a break below it would officially turn the DOGE’s market structure bearish.

In addition, On Balance Volume (OBV) has dropped from 513 billion to 508 billion, representing a drop in trading volume of about 5 billion between December 4 and 7. Therefore, DOGE could retest the current support at $0.09508 and break downwards.

Thus, investors can use $0.09508, $0.08995, and $0.07998 as short-selling targets if the bears fully control the market.

An intraday close above the 50% Fib level ($0.10728) would disprove this prediction.

Sentiment falls as development activity rise, but long-term DOGE holders saw gains

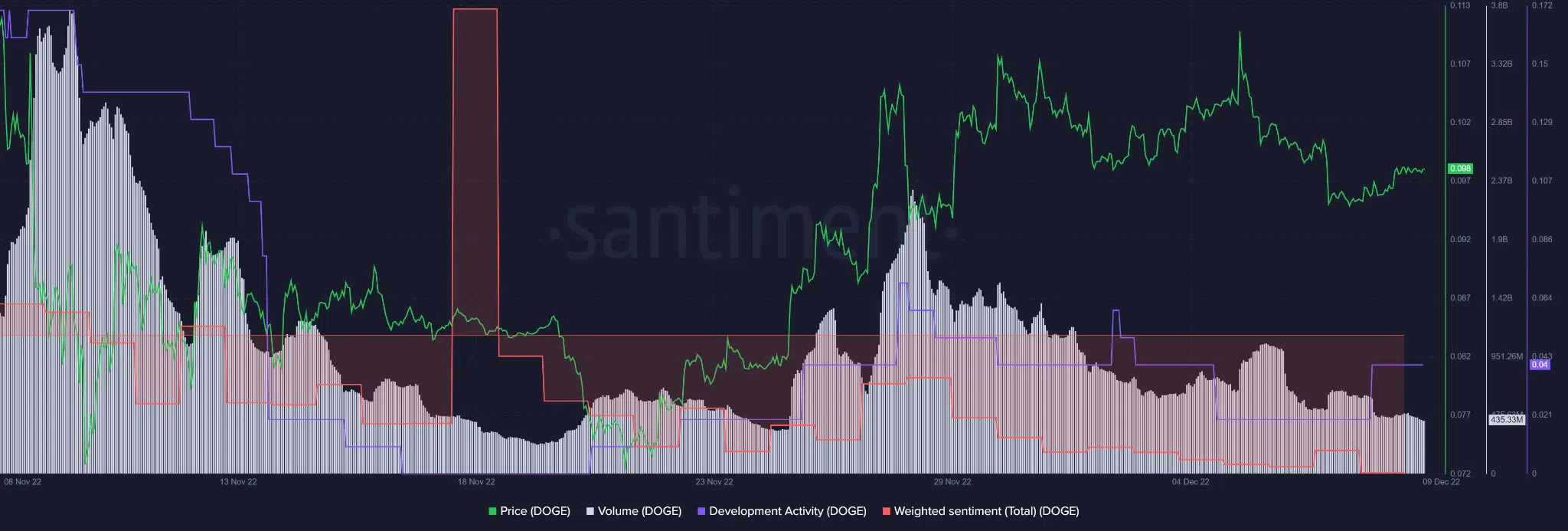

DOGE’s weighted sentiment has continued to tread in the negative territory since mid-November. However, an uptick in development activity during this period has prevented DOGE prices from being dragged down by poor sentiment.

Interestingly, the 365-day market value to realized value ratio (MVRV) has been in positive territory, suggesting that long-term holders of DOGE have posted gains since 27 November.

Thus, the on-chain metrics show mixed signals that could indicate a neutral market structure. It is, therefore, important to also consider the performance of BTC and memecoin’s socials before making any decisions.

![Why Chainlink [LINK] and Polygon [MATIC] are more similar than you realise](https://ambcrypto.com/wp-content/uploads/2024/04/Chainlink_and_Polygon-1-400x240.webp)