Dogecoin up 5% in 24 hours: Thank you, social media?

- DOGE’s price has risen by over 5% in the past 24 hours.

- This rally may, however, be short-lived, as key indicators hinted at a decline.

Dogecoin’s [DOGE] price rose by over 5% in the past 24 hours due to a hike in its social activity within that period, data from crypto analytics platform LunarCrush revealed.

According to the data provider, individual interactions involving the meme coin, including socially driven engagements and actions such as likes, comments, retweets, and upvotes, totaled 30 million in the past 24 hours.

AMBCrypto found that out of the top 50 meme coins by market capitalization, DOGE witnessed the highest social volume during the period under review.

Trouble lies ahead?

An assessment of DOGE’s price performance on a 24-hour chart revealed that it may shed some of its gains in the coming days.

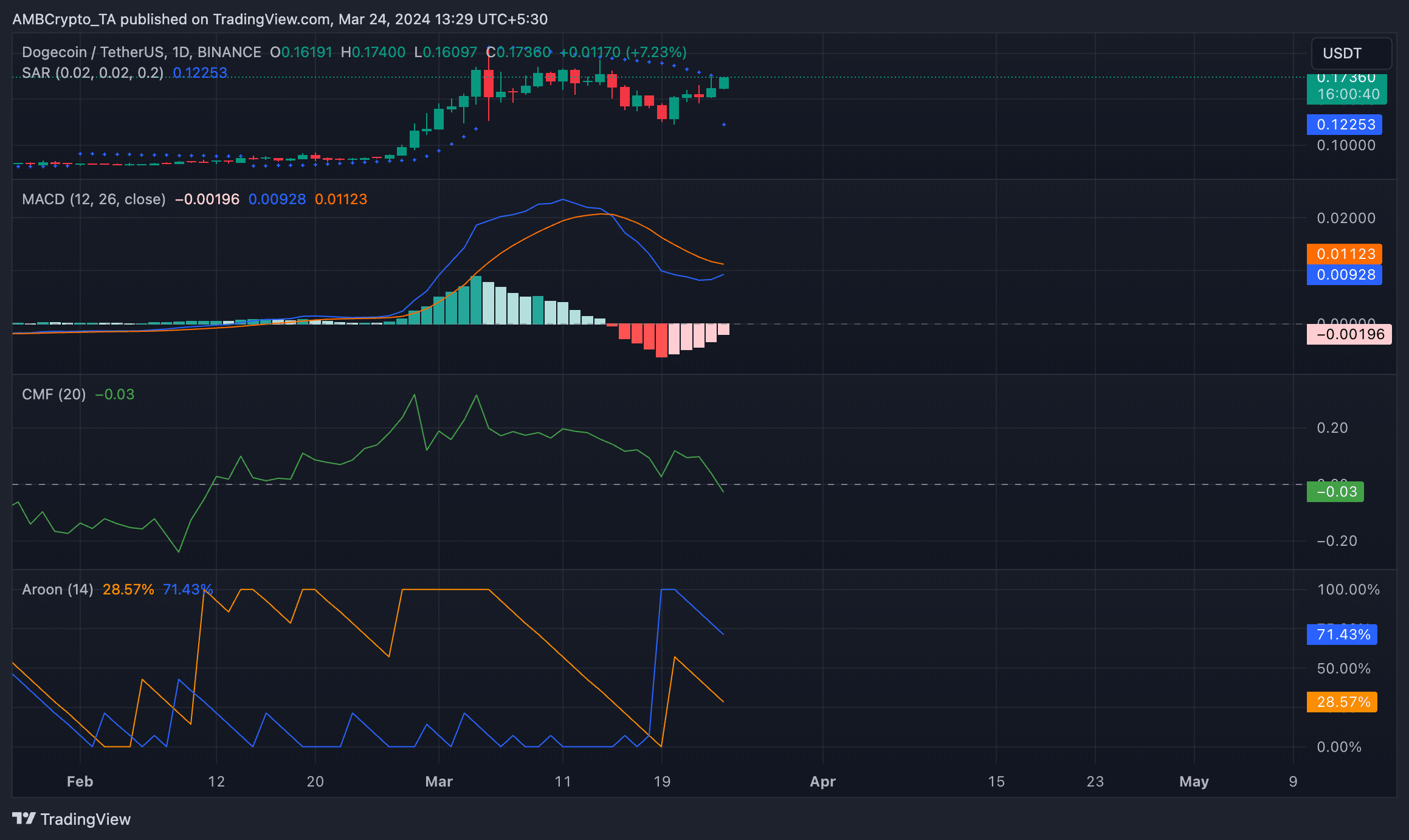

Firstly, the coin’s Aroon Up Line (orange) returned a value of 28.57% at the time of press. An asset’s Aroon indicator tracks its trend strength and potential trend reversal points in its price movements.

When the Aroon Up line is close to zero, the uptrend is weak, and a trend reversal is likely.

Also, DOGE’s Chaikin Money Flow (CMF) returned a negative value of -0.04. This indicator measures the flow of money into or out of an asset over a specified period.

When it is negative, as in this case, it indicates liquidity outflow from an asset and a rise in selling pressure.

A negative CMF value is a sign of market weakness and is often interpreted as a signal to take short positions.

Further, a look at DOGE’s Moving Average Convergence Divergence (MACD) indicator showed that the bearish sentiment was significant in the meme coin’s market.

Readings from this indicator revealed the MACD line crossed below the signal line on the 15th of March, marking the beginning of a bear cycle in the short term.

Confirming the bearish pressure on DOGE’s price, the dotted lines that make up its Parabolic SAR indicator rested above its price.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

This indicator identifies potential trend direction and reversals. When its dotted lines rest above an asset’s price, it is viewed as a sign that selling activity is high.

Traders take it as a signal to exit long positions or initiate short positions.