Dogecoin: 2 reasons why DOGE could remain bullish

- Dogecoin has surged 8% in two weeks, with bullish signals from key technical indicators.

- Whale transactions have increased, indicating growing interest from large holders.

As the broader cryptocurrency market shows signs of recovery, Dogecoin [DOGE] is riding the wave of bullish momentum.

Over the past two weeks, the popular memecoin has seen an 8% increase, with a further 2.1% rise in the last 24 hours.

This upward trend brings DOGE’s current trading price of $0.1065, indicating a potential breakout on the horizon.

Dogecoin’s upward momentum

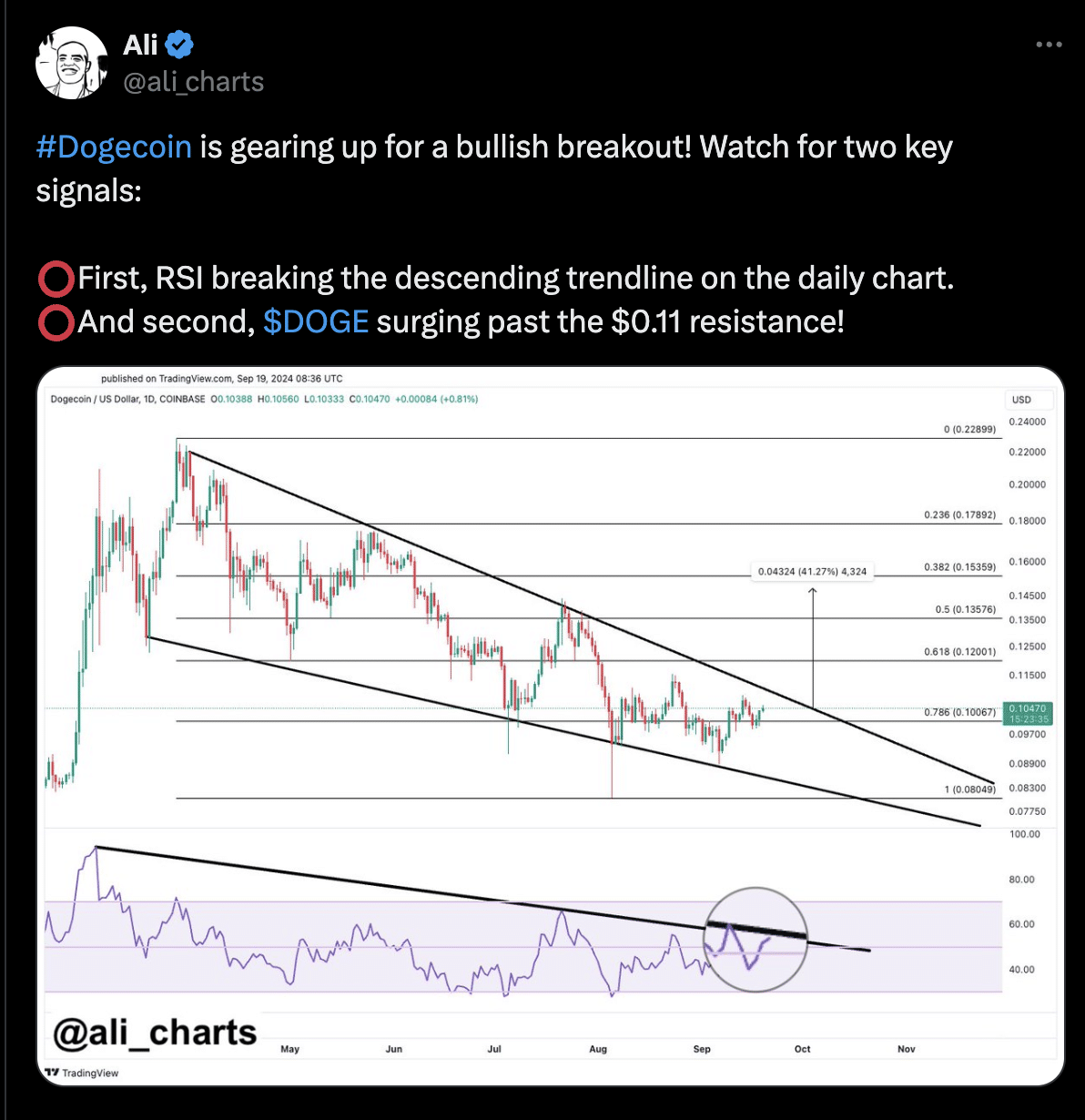

Amid this price surge, prominent crypto analyst Ali has outlined two critical indicators that could signal a continued bullish movement for DOGE.

In a recent post on X (formerly Twitter), Ali stated that traders should watch for two specific developments: the Relative Strength Index (RSI) breaking its descending trendline on the daily chart and DOGE surpassing the key resistance level of $0.11.

The RSI, a momentum oscillator, typically signals overbought or oversold conditions.

A break above the descending trendline indicates increasing buying momentum, suggesting that DOGE could be poised for a sustained rally.

Moreover, if Dogecoin manages to overcome the $0.11 resistance, it would signal a clear bullish breakout, possibly triggering further price gains.

Both these signals are crucial to monitor in the coming days, as they could determine DOGE’s next significant price move.

Growing strength

Dogecoin’s fundamentals were also showing signs of strength at press time.

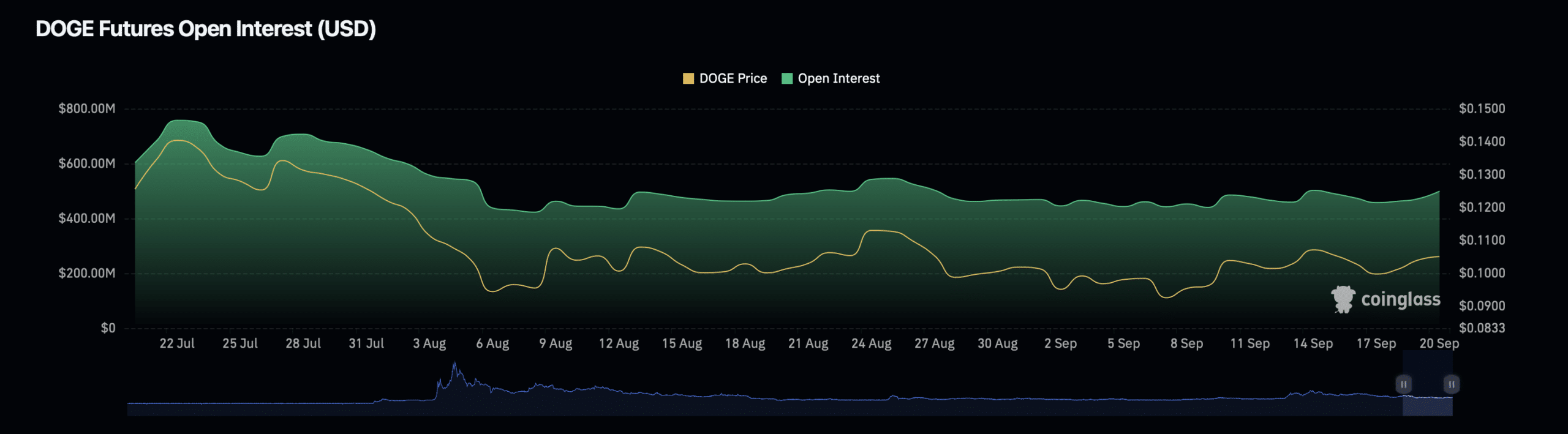

Notably, the asset’s Open Interest, which represents the total number of active futures and options contracts, has risen by 5.20% to $506.41 million at press time, indicating that more traders are taking positions in the market.

However, the Open Interest volume, which measures the total amount of contracts traded within a specific timeframe, has dipped by 2.26%, was sitting at $986.60 million at press time.

This divergence between rising Open Interest and falling volume suggested that while more traders are entering the market, they were doing so cautiously, possibly waiting for further confirmation of a bullish trend before committing larger volumes.

This trend could signal that DOGE is gearing up for a significant move, depending on how the market reacts to these indicators.

Another bullish signal comes from whale activity, which refers to large transactions typically valued at over $100,000.

Data from IntoTheBlock showed that Dogecoin had seen a notable increase in whale transactions in recent weeks. After a brief dip below 600 whale transactions last week, the number has now surged to nearly 1,000.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

This increase in whale activity often points to greater institutional or high-net-worth investor interest, which can provide additional liquidity and upward pressure on prices.

The rise in whale transactions suggests that major players are accumulating DOGE, possibly anticipating further price increases in the near future.