Dogecoin approaches golden cross – A repeat of 2021’s price rally on the way?

- Golden cross pattern highlighted potential bullish momentum as DOGE prepared for a possible breakout

- Positive on-chain metrics and liquidation data supported a favorable outlook

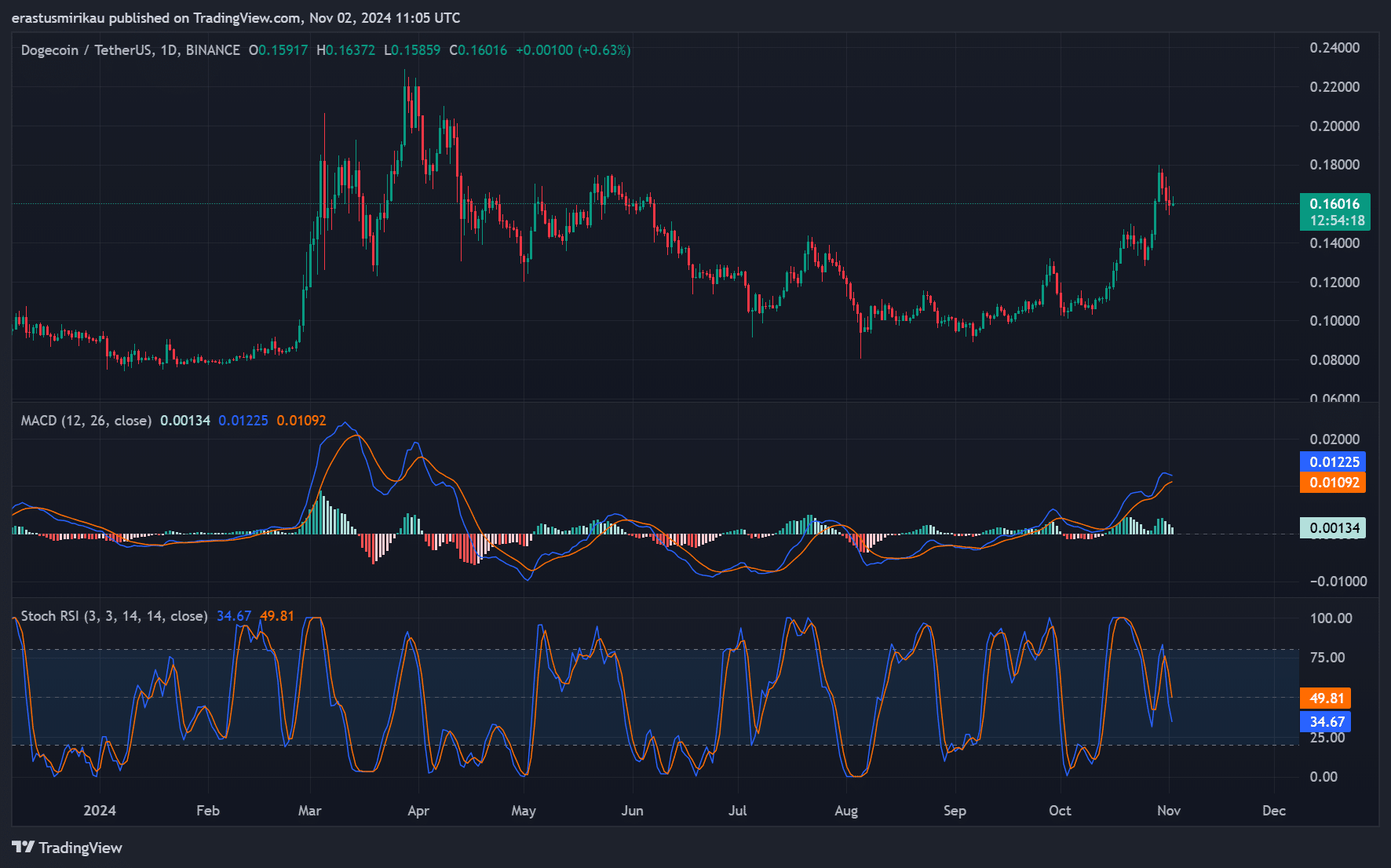

Dogecoin [DOGE], at the time of writing, seemed to be on the brink of a significant “Golden cross.” This a bullish technical pattern known for signaling positive momentum on the price charts.

This crossover, where the 50-day moving average rises above the 200-day moving average, often ignites excitement among traders. Trading at $0.1601, many in the memecoin’s community are now expecting significant gains to arise out of this potential breakout.

Can the Golden Cross trigger a new bull run?

The Golden Cross is a widely recognized bullish indicator. In 2021, this pattern sparked a massive 21,000% rally, propelling DOGE to unprecedented heights and drawing global attention to the memecoin. As expected, the possibility of another Golden Cross has fueled speculation that DOGE could be on the brink of another explosive run.

However, market conditions are different now, and cautious optimism is advised. Although this setup creates an ideal atmosphere for speculation, investors should wait for confirmation of a breakout before making any significant moves.

Technical indicators – MACD and Stochastic RSI suggest consolidation

Examining Dogecoin’s technical indicators revealed a mix of signals. The MACD, while positive, seemed to lack strong divergence and urged caution. Additionally, the Stochastic RSI seemed to be nearing the neutral 50-level, reflecting neither overbought nor oversold conditions.

Consequently, these indicators hinted at a consolidation phase, with DOGE potentially building pressure for a decisive move.

However, this consolidation could also lead to heightened volatility as DOGE tests key levels. Therefore, while a breakout is possible, traders should remain vigilant.

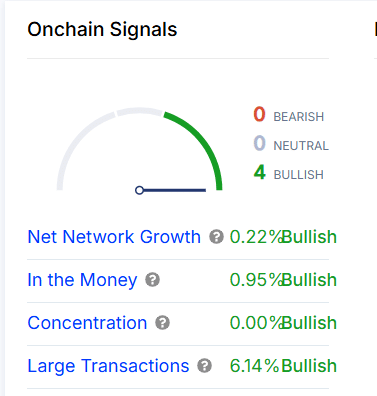

On-chain signals reinforce bullish sentiment

The memecoin’s on-chain metrics lent strength to the bullish narrative. Net network growth rose by 0.22%, suggesting steady expansion in the Dogecoin ecosystem. Additionally, the “In the Money” metric, revealing 0.95% of holders in profit, signaled positive sentiment among investors.

Large transactions surged by 6.14% too, indicating significant interest from large players or “whales.”

Therefore, the combined impact of network growth and whale activity is likely to create a supportive backdrop for DOGE’s potential appreciation.

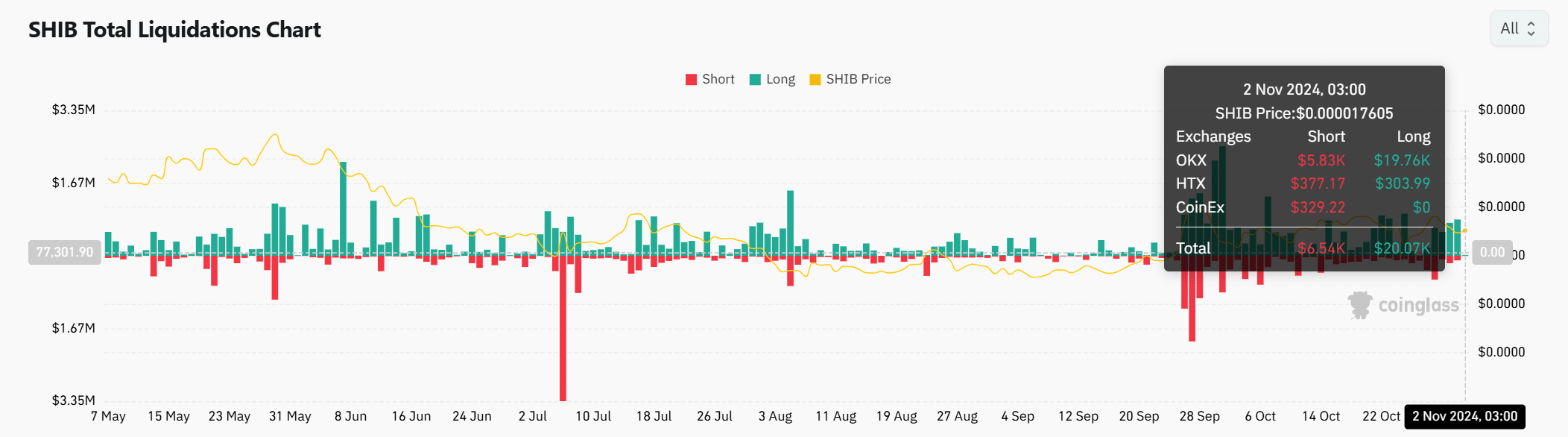

DOGE liquidations reveal short squeeze potential

Finally, DOGE’s recent liquidation data revealed an imbalance, with $6.54k in shorts compared to $20.07k in longs.

This meant that some traders have been betting against Dogecoin. However, this setup could lead to a short squeeze, where rising prices force short-sellers to buy back positions, potentially fueling an accelerated rally.

Read Dogecoin’s [DOGE] Price Prediction: 2024-2025

Is a DOGE rally on the horizon?

DOGE’s potential golden cross, coupled with strong on-chain metrics, pointed to a promising setup for a rally. Although the technical indicators signaled consolidation, the combination of whale activity and short squeeze potential might fuel bullish momentum.

Therefore, if the golden cross is confirmed, Dogecoin may indeed be poised for a significant rally.