Dogecoin – Assessing memecoin sector’s latest reaction to DOGE’s price hike

- Dogecoin (DOGE) outperformed major cryptocurrencies this past week with gains of 5.63%

- A hike in social media buzz and speculations around the memecoin have fueled Dogecoin’s rally

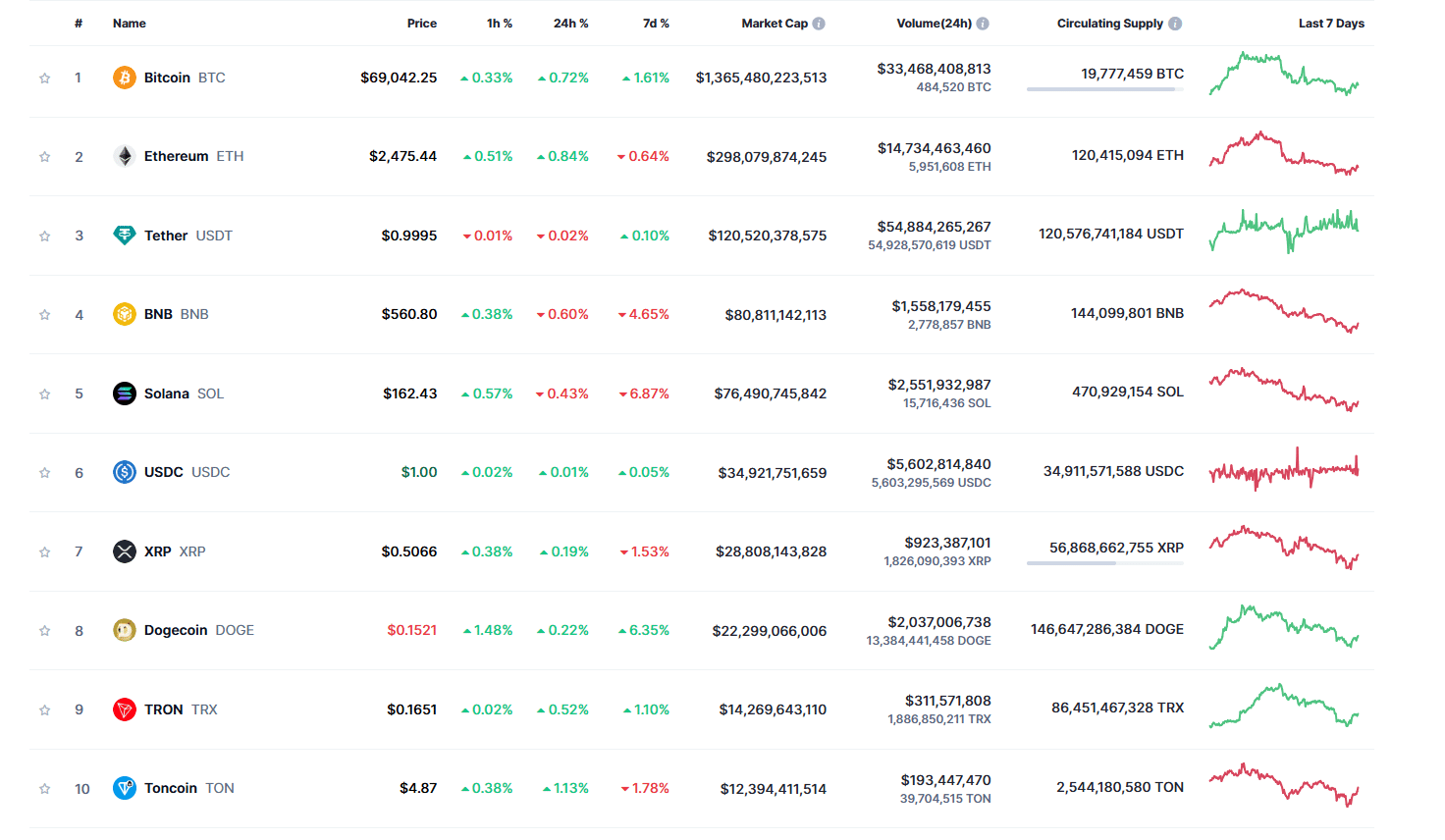

Dogecoin (DOGE) recently emerged as the top weekly performer among the market’s major cryptocurrencies, recording gains of almost 6% in just one week.

The memecoin’s performance stood out, especially since the rest of the market went the other way on the charts. In fact, most large-cap assets, including Bitcoin (BTC) and Ethereum (ETH), saw smaller weekly gains of 2.22% and 0.34%, respectively.

Dogecoin’s rally is particularly significant in the current market climate, as it pointed to renewed interest in memecoins and community-driven tokens that often benefit from social media hype and online communities.

While Bitcoin and Ethereum have maintained their market dominance with stable performances, Dogecoin’s recent growth could indicate the possible resurgence of meme-based cryptocurrencies. This movement could have implications for other similar tokens, potentially marking the start of a trend in which community-driven assets gain more attention and market share.

Dogecoin leads market sentiment shift

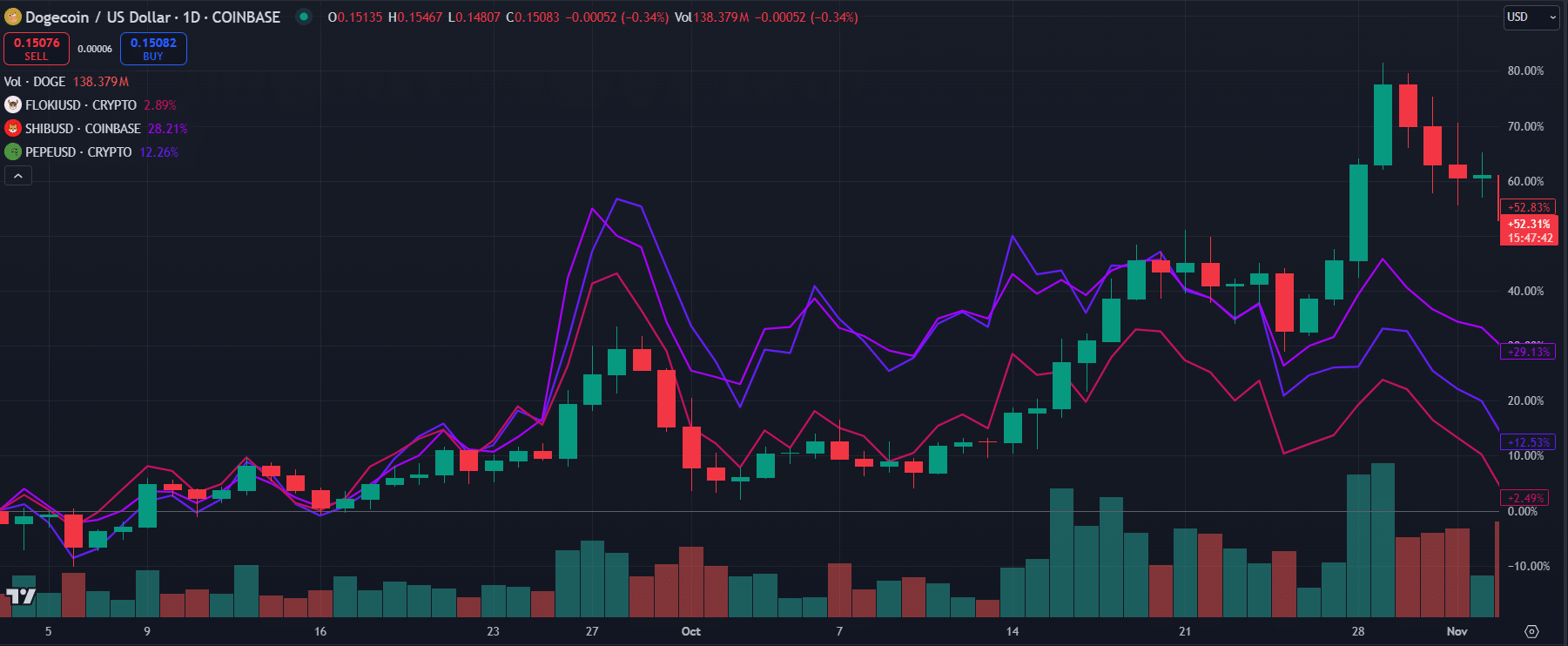

Over the last seven days, Dogecoin has seen major price fluctuations, closing out the week at $0.15 after briefly peaking near $0.17. In fact, the daily candlestick chart highlighted notable price movements and trading volume spikes – Particularly between 30 October and 02 November. This period saw a sharp hike too, one followed by a pullback as the trading week progressed.

Trading volume was especially pronounced towards the start of the week, indicating strong buying interest and market excitement. However, as the days moved forward, trading volumes tapered off, reflecting a cooling phase as initial momentum subsided.

What this meant was that the early-week rally may have been fueled by a mix of speculative buying and trader-driven activity.

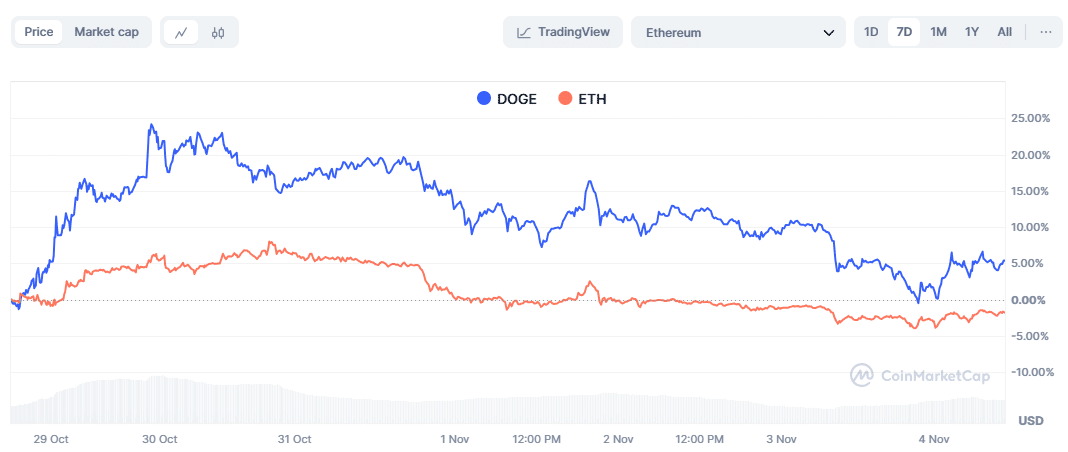

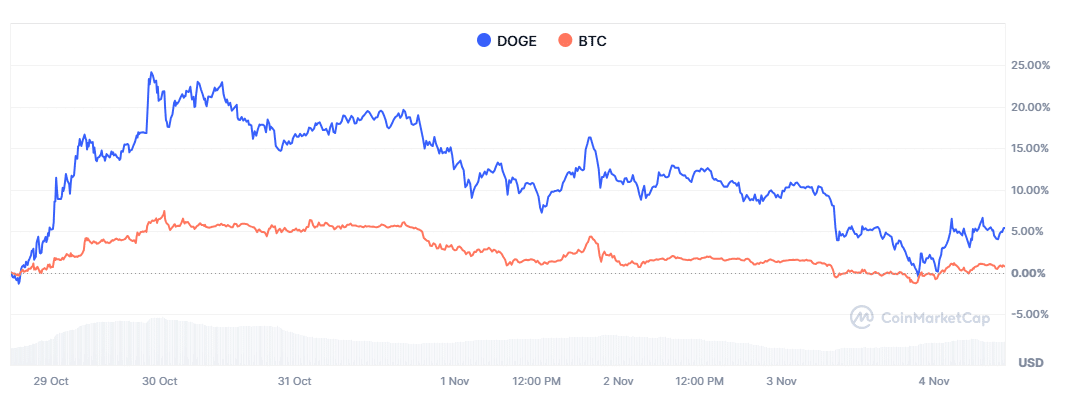

The weekly comparison charts for Dogecoin (DOGE) against Bitcoin (BTC) and Ethereum (ETH) underlined DOGE’s standout performance. Dogecoin hit an impressive peak of nearly 25% gains on 30 October, before stabilizing later. In stark contrast, Bitcoin and Ethereum remained largely flat.

Dogecoin’s sharp rally, followed by a moderated decline, kept it ahead in weekly gains relative to major cryptocurrencies.

This volatility and heightened trading interest, together, pointed to strong speculative activity, one likely fueled by social media buzz. Such a comparison cemented Dogecoin’s position as a top-performing asset this week.

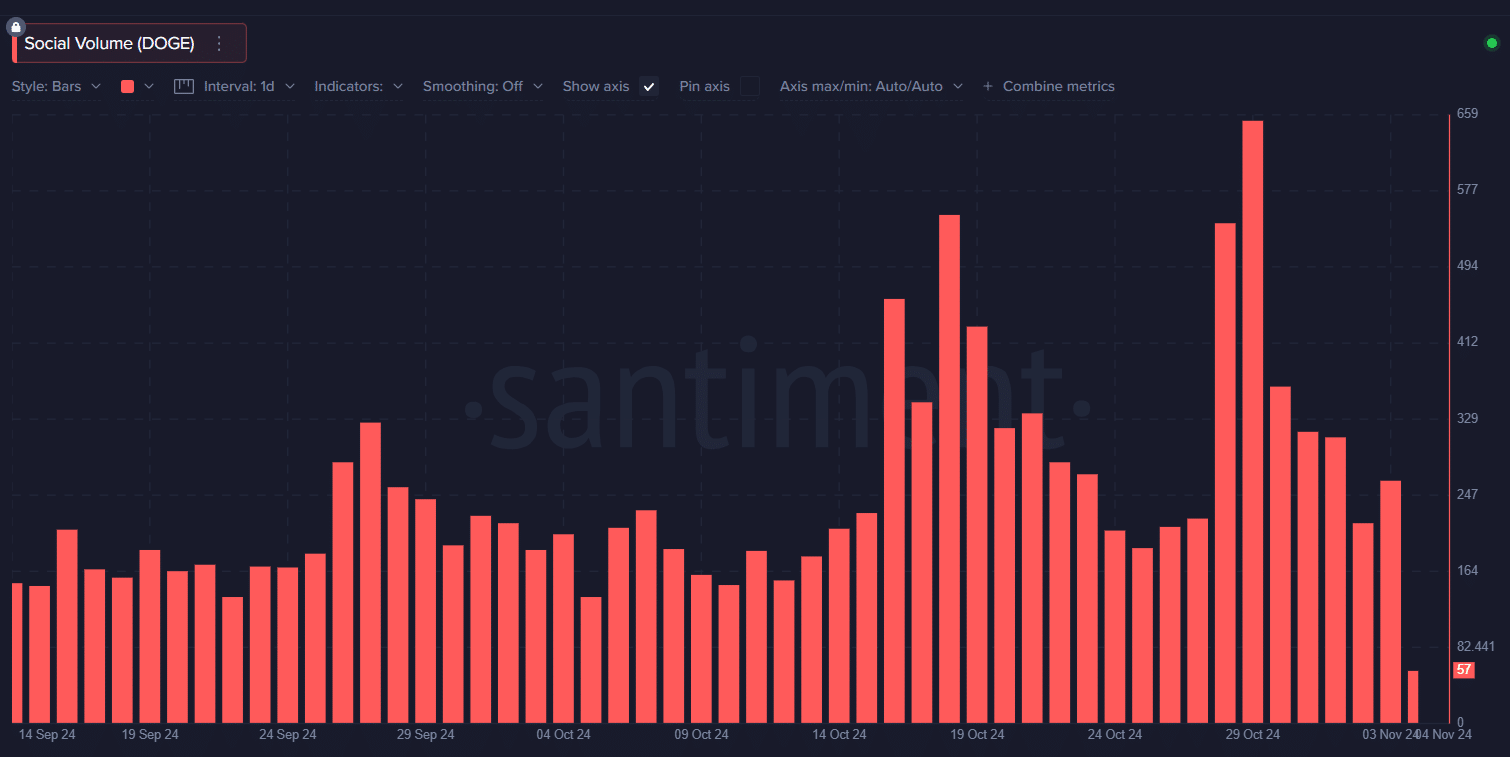

Dogecoin’s social media engagement saw considerable peaks too, aligning with its price movement. The social volume chart revealed a substantial hike in mentions and discussions starting on 29 October and hitting a high on 31 October. This period corresponded with Dogecoin’s price rally – A sign that heightened online attention likely played a role in propelling the asset’s value.

The spike in social volume may have been driven by Elon Musk’s recent comments that X (formerly Twitter) could become half of the global financial system. Dogecoin, closely tied to Musk and X due to his past advocacy for it as a payment method, often reacts to his remarks.

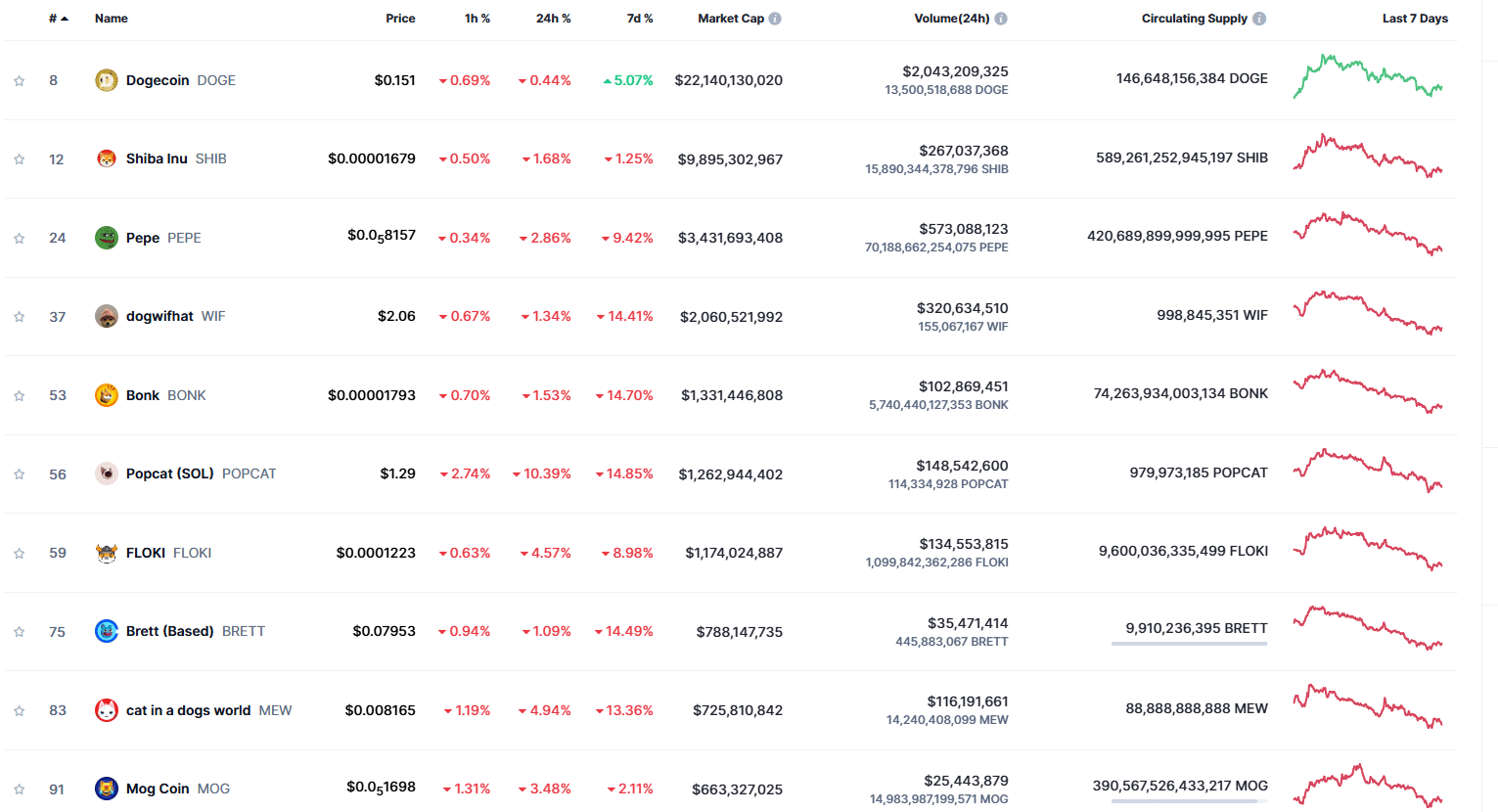

A look at the memecoin space

Finally, analyzing the market cap trends over the past week revealed that most memecoins such as Shiba Inu (SHIB) and Pepe (PEPE), declined. This meant that DOGE’s rise has been somewhat isolated, rather than part of a sector-wide trend.

This also implied that investor attention and capital flows were uniquely directed towards DOGE, reinforcing its standout performance within the memecoin market.

A closer weekly examination of price correlations between DOGE and other memecoins such as SHIB, PEPE, and FLOKI revealed their distinct price paths.

Is your portfolio green? Check out the Dogecoin Profit Calculator

According to the attached chart, for instance, SHIB and PEPE suffered drops of 1.25% and 9.42% over the past week, respectively. FLOKI’s correlation dropped down by around 8.98% too.

Such a negative trend among its peers further underlined DOGE’s singular momentum, a sign of its limited positive correlation with the broader memecoin segment.