Dogecoin breaks key resistance: Is a surge to $0.150 inevitable?

- DOGE surged past the $0.111 resistance, eyeing $0.150 as key technicals signal potential bullish breakout.

- Rising open interest and short liquidations indicate growing market confidence and bullish momentum.

Dogecoin [DOGE] has surged past the crucial $0.111 resistance level, where over 62,270 addresses hold more than 36 billion DOGE.

This resistance breach has triggered renewed optimism that DOGE might be ready for a significant rally.

Therefore, traders are now speculating whether Dogecoin can capitalize on this momentum and potentially reach the $0.150 mark, a key level that could lead to a major price breakout.

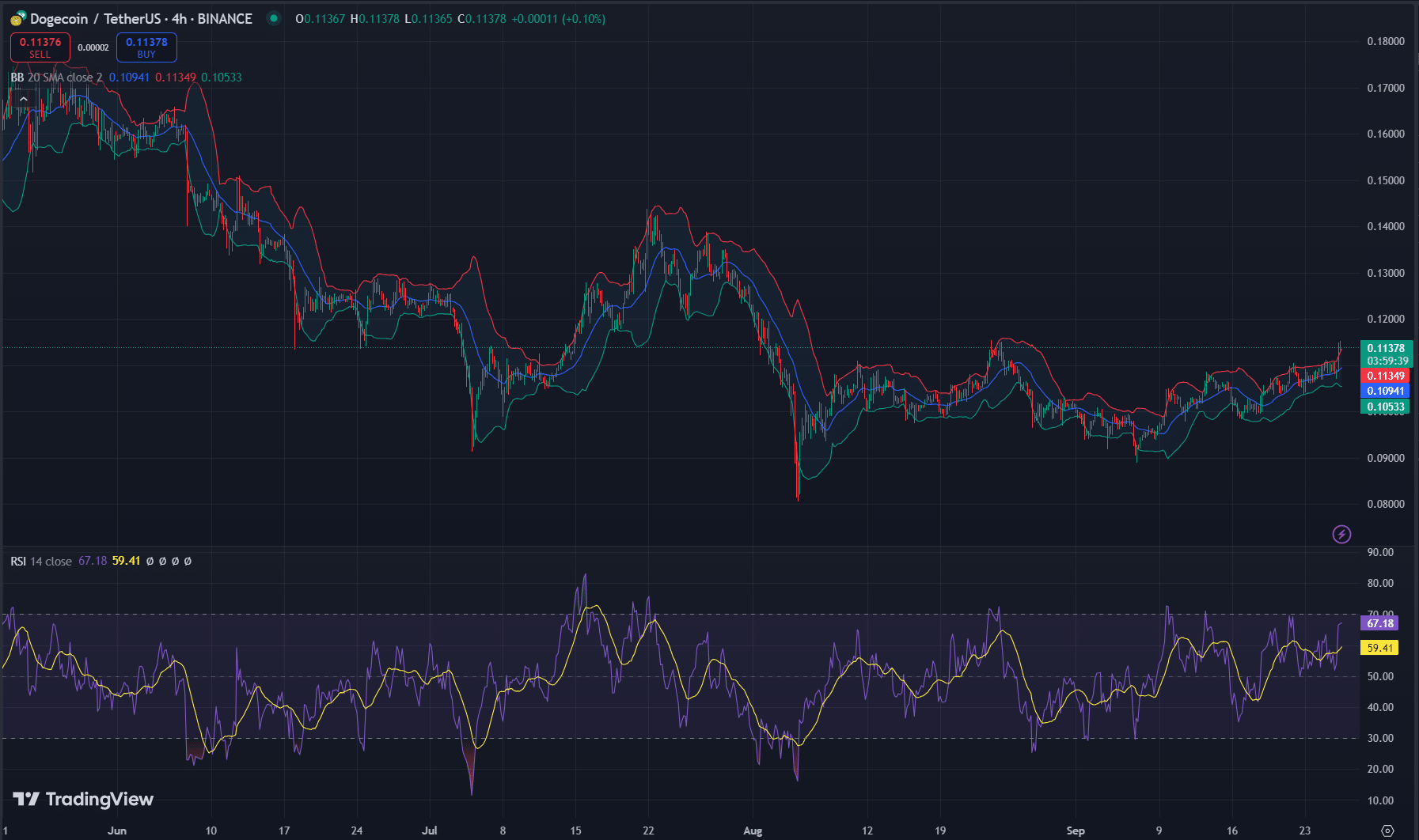

At press time, Dogecoin trades at $0.1138, marking a 3.58% gain in the last 24 hours. The price has consistently stayed above the $0.111 level, which many view as a positive sign.

However, technical indicators such as the Bollinger Bands (BB) on the 4-hour chart suggest DOGE could be nearing overbought territory, as it hovers near the upper band at $0.11349.

If the price continues to hold this position or break higher, it could pave the way for a move toward $0.150. Conversely, if the price falters at this level, the rally could lose steam.

Are network fundamentals strong enough?

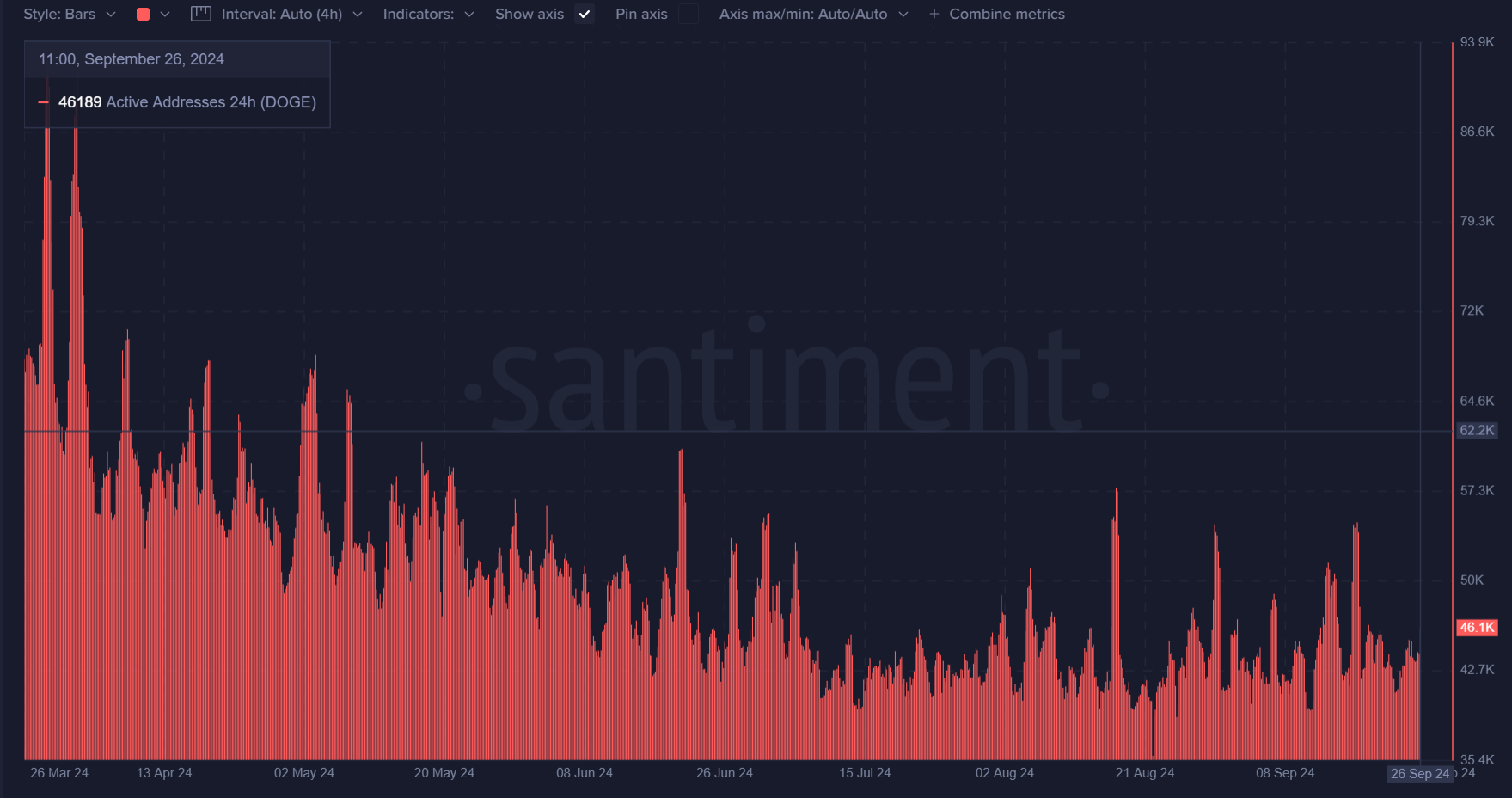

Network activity plays a critical role in supporting price action, and Dogecoin has seen 46,189 active addresses over the last 24 hours.

While this number reflects steady engagement, it falls short of the levels seen during previous major rallies.

However, any surge in active addresses could significantly support DOGE’s price movement.

Consequently, increased network activity would likely fuel optimism among traders, as a rise in user activity often correlates with price increases.

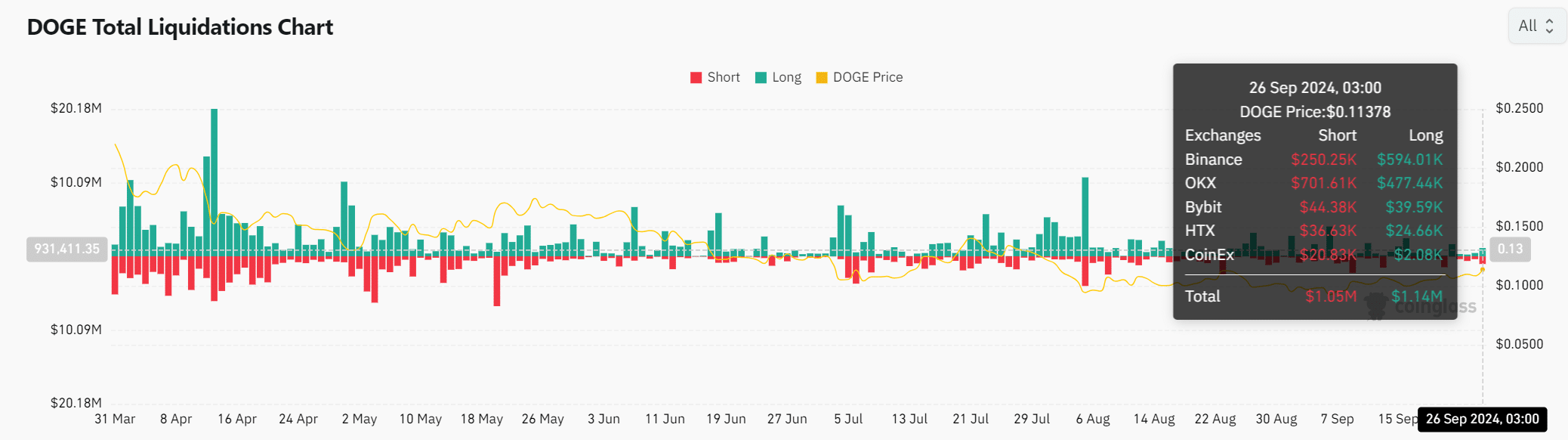

Liquidations hint at market sentiment

Dogecoin’s recent price surge has led to significant short liquidations. On the 26th of September, $1.05 million in short positions were liquidated, particularly across major exchanges like Binance and OKX.

These liquidations indicated that bearish traders were losing their positions, which often adds momentum to an asset’s upward movement.

Therefore, the liquidation of short positions strengthens the possibility of a sustained bullish breakout.

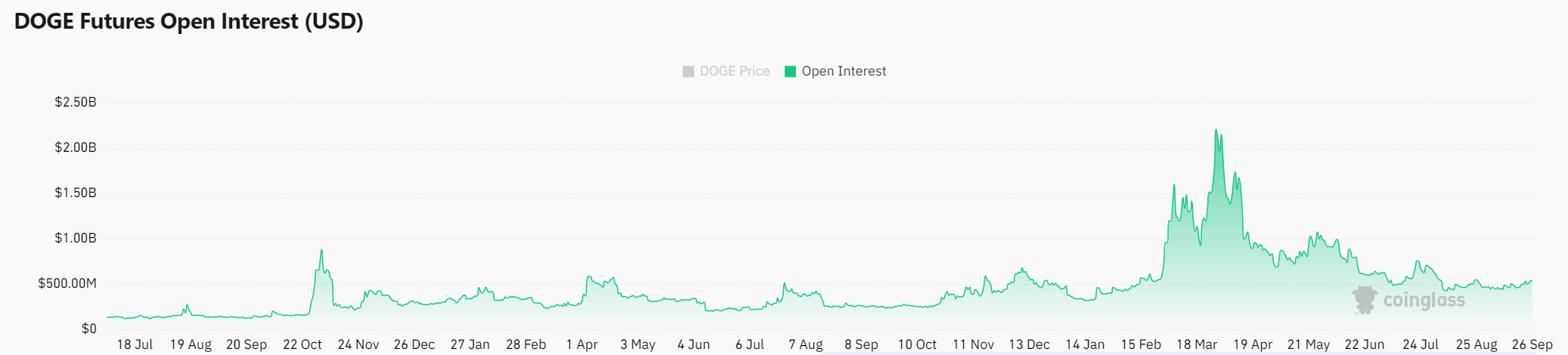

Rising Open Interest shows growing attention

Open interest in Dogecoin has climbed by 11.16%, reaching $587.53 million. This rise in Open Interest reflected increasing trader participation and confidence in DOGE’s price trajectory.

Consequently, a growing number of traders are engaging with the asset, which could amplify any future price movements and potentially push DOGE higher.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Dogecoin has broken a key resistance level and is showing strong signs of a potential breakout.

Therefore, with rising Open Interest, the liquidation of short positions, and growing trader attention, DOGE appears to be on the brink of a bullish run. However, network activity must increase to solidify this momentum.

![Will Avalanche [AVAX] crash deeper? Why $14.5 support is bears' new target](https://ambcrypto.com/wp-content/uploads/2025/03/Avalanche-Featured-1-400x240.webp)