Dogecoin breaks out: Can DOGE reach $1.60 this time?

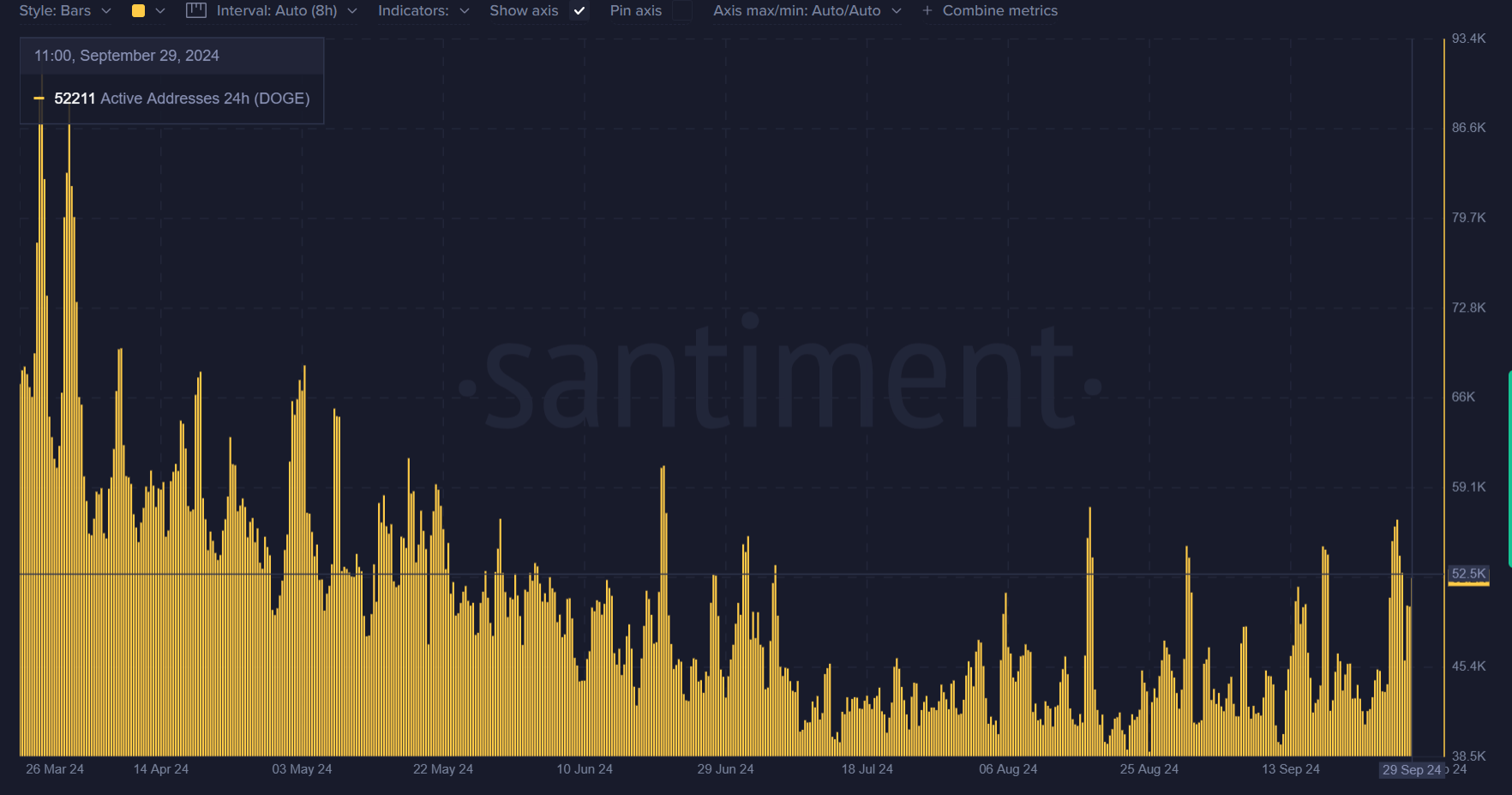

- Dogecoin’s daily active addresses surged, signaling strong on-chain activity and growing demand.

- Rising volume and bullish liquidation data indicate continued momentum, despite a slight decline in Open Interest.

Dogecoin [DOGE] has shown strong signs of breaking out of its falling wedge pattern, sparking excitement among investors.

Priced at $0.127 with a 4.96% increase in the past 24 hours at press time, DOGE has captured the attention of traders.

However, the key question remains: can this bullish momentum push Dogecoin to the much-anticipated $1.60?

Surge in daily active addresses and volume

One of the most encouraging signals for Dogecoin’s potential upward movement is the recent surge in daily active addresses. Over the past 24 hours at press time, the number of active addresses jumped from 50,124 to 52,211.

This rise in network activity reflects growing interest and participation from both retail and institutional investors.

Therefore, this uptick in daily active addresses suggested an underlying demand, which could drive Dogecoin’s price higher.

This increased engagement on the network added confidence in the sustainability of the current rally.

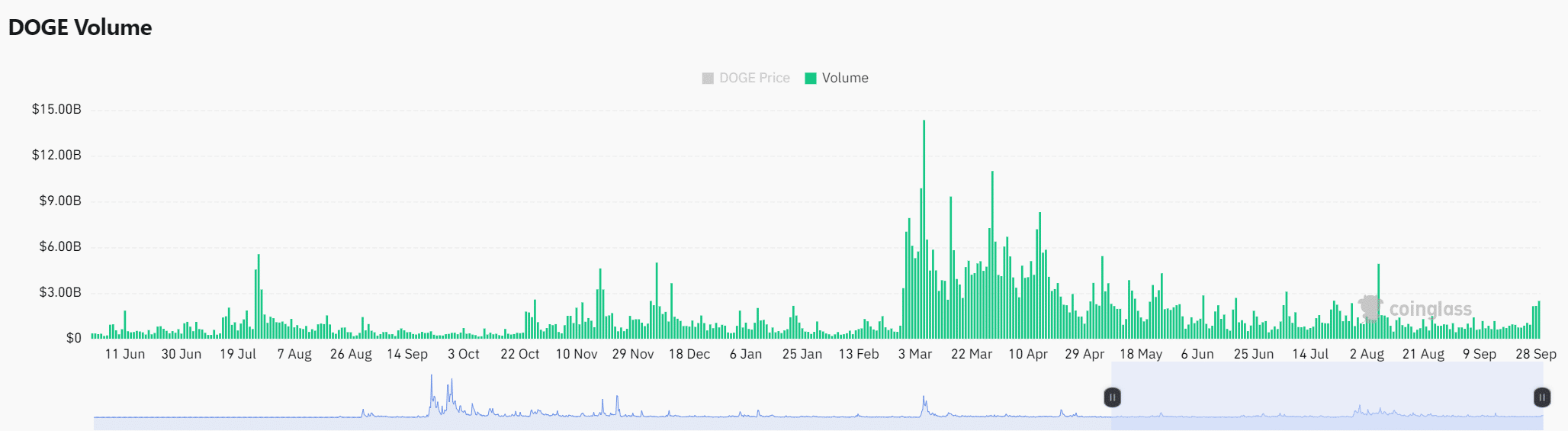

Furthermore, Dogecoin’s trading volume has risen, providing another bullish indicator. Over the past 24 hours at press time, volume surged to $2.07 billion, reflecting a 0.35% increase.

Consequently, the higher volume indicates growing liquidity and interest in DOGE, which tends to support continued price growth. When volume rises in tandem with price increases, it generally confirms the strength of the rally.

Therefore, if volume continues to increase, it may add further fuel to Dogecoin’s bullish trajectory toward its target of $1.60.

Cautious signals despite rising volume

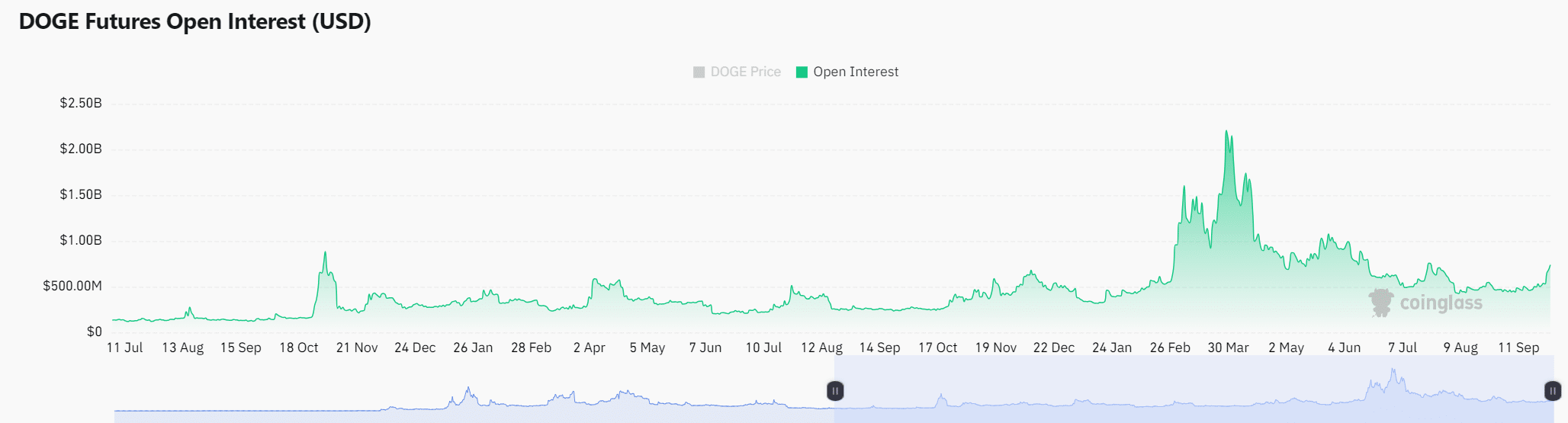

However, despite the strong on-chain activity and increasing volume, Open Interest has declined by 2.63%, now sitting at $726.26 million.

This decrease suggests that some traders have begun reducing their positions, likely to lock in profits or hedge against potential short-term volatility.

Therefore, while Dogecoin’s momentum appears strong, this drop in open interest introduces a note of caution.

Bullish bias remains

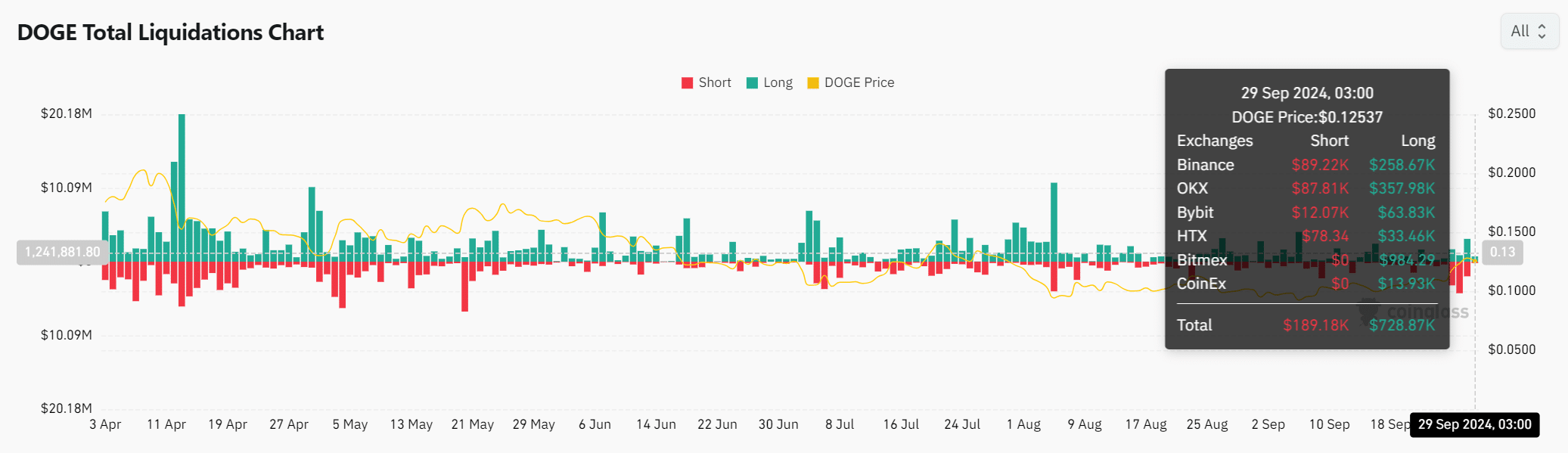

Additionally, recent liquidation data shows a clear bullish bias. Liquidations of long positions reached $728.87k, while short liquidations totaled just $189.18k.

This imbalance indicates that while some traders are taking profits, the majority remain optimistic about further price increases.

Therefore, as long as Dogecoin holds key support levels, this bullish sentiment may continue to drive prices higher.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Dogecoin’s breakout appears promising with rising daily active addresses, growing volume, and favorable liquidation data.

However, traders should watch the decline in Open Interest closely to assess whether this momentum will sustain and push DOGE toward $1.60.