Dogecoin [DOGE] buyers can leverage this pattern’s break to their benefit

![Dogecoin [DOGE] buyers can leverage this pattern's break to their benefit](https://ambcrypto.com/wp-content/uploads/2022/11/Untitled-design-33.png.webp)

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- While defending the $0.07 baseline, Dogecoin formed a bearish pattern on its daily chart.

- DOGE’s Social volumes declined but its funding rate unveiled some hope.

Dogecoin’s [DOGE] reversal from the $0.07 support finally broke the streak of red candles as the buyers attempted to change the narrative. Consequently, the meme coin grew but flattened near the 200 EMA (green).

Read Dogecoin’s [DOGE] Price Prediction 2023-24

Meanwhile, the alt formed a bearish structure in the daily timeframe. At press time, DOGE was trading at $0.0855.

Can the sellers induce another breakdown?

The previous buying resurgence aided the buyers in testing the $0.14-ceiling after witnessing triple-digit gains in just a week. With the market-wide uncertainties kicking in, the sellers quickly propelled a downturn over the last two weeks.

The rebound from the $0.07 baseline induced a near-term consolidation on the charts. The resulting price movement chalked out at a bearish pennant structure in the daily timeframe.

A reversal below the 200 EMA near the $0.08 resistance can aid the sellers in provoking further losses. In this case, potential targets would lie in the $0.07 region.

Any jump above the constraints of the 200 EMA followed by the 20 EMA can invalidate the bearish tendencies. The first major resistance barrier in these circumstances would be in the $0.1-mark.

The Relative Strength Index (RSI) stood near the equilibrium while depicting a slight edge for the sellers. The buyers could wait for a convincing reversal from the 50-mark to gauge the chances of a pulldown.

DOGE stood in a critical spot

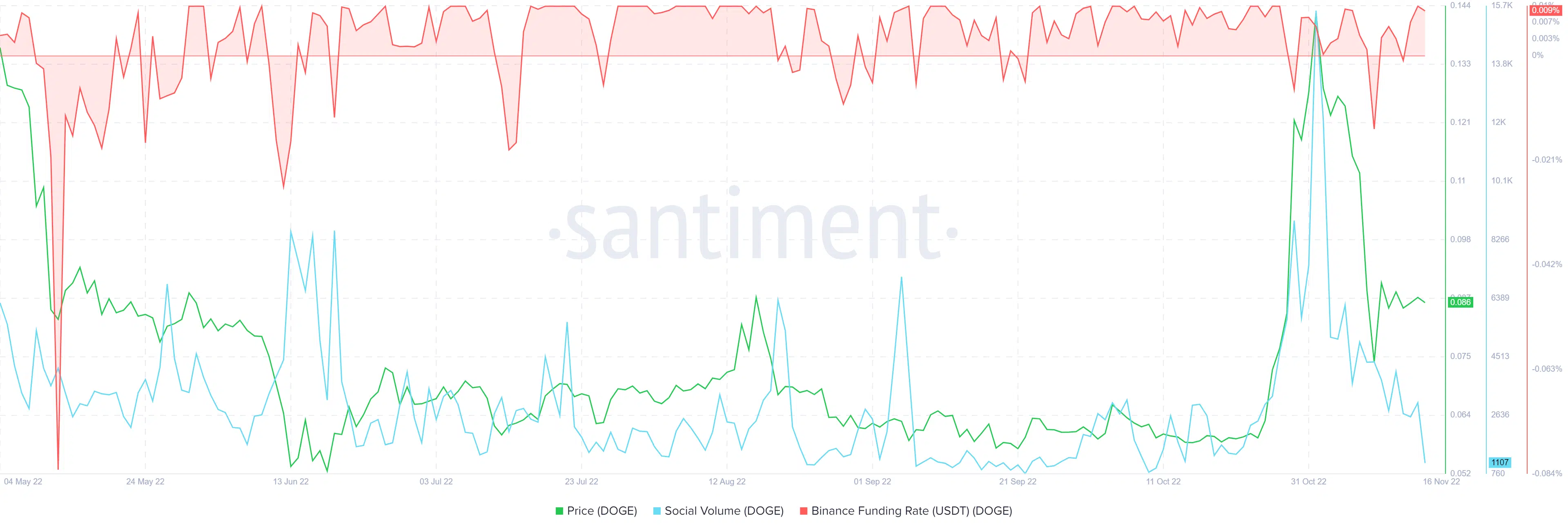

According to data from Santiment, DOGE’s social volume over the last few days has marked a steep decline. Given the price action’s empirical correlation to this metric, the price could account for this decline in the coming sessions.

Nonetheless, the coin’s funding rate on Binance stood positive. Any reversals on this front can resonate with the bearish narrative.

Finally, DOGE shared a 42% 30-day correlation with the king coin. Thus, keeping an eye on Bitcoin’s movement would complement these technical factors.