Dogecoin [DOGE] continues decline, but will THIS turn things around?

![Dogecoin [DOGE] continues decline, but will THIS turn things around?](https://ambcrypto.com/wp-content/uploads/2024/05/Dogecoin_accumulation-1-1200x686.webp)

- Dogecoin has declined for ten days straight.

- Millions were moved into a wallet despite the recent decline.

Dogecoin [DOGE] experienced a substantial movement of its tokens recently, drawing attention amidst its recent price trend.

Despite remaining at the top of meme coin rankings, its recent decline in price has led to a reduction in the supply held at a profit.

Dogecoin sees large transfer

There was a recent transfer of 150 million Dogecoin tokens from Robinhood to an unknown wallet, as reported by Whale Alert.

At the time of the transfer, the value of the DOGE tokens amounted to over $19.8 million, indicating a substantial transaction.

Furthermore, the Netflow of large holders revealed an increase on the 1st of May. The chart depicted a notable rise, with the large holders’ netflow surging to 285.7 million from approximately 52.3 million on 30th April.

This influx of tokens held by large holders suggests increased activity and potential market influence within the Dogecoin network.

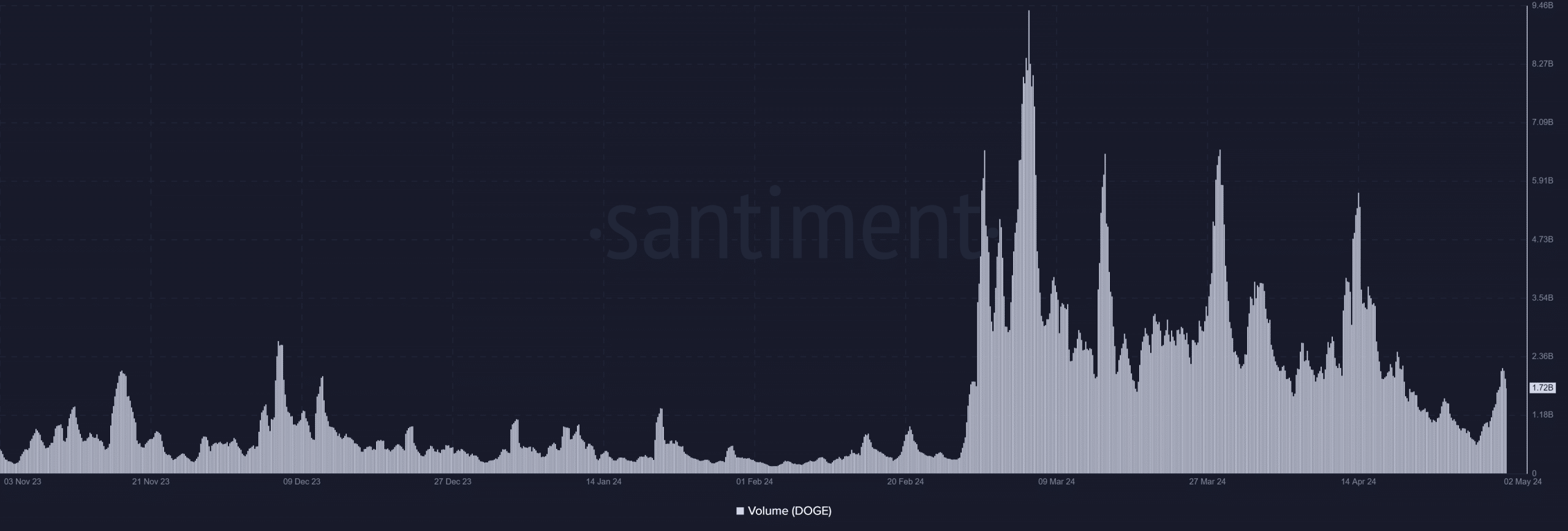

Dogecoin’s notable volume rise

AMBCrypto’s analysis of Dogecoin’s volume on Santiment indicated a notable increase compared to previous weeks, although not reaching the levels observed in some weeks of April.

On the 1st of May, the volume surpassed $2 billion, a significant rise from the previous range of around $1 billion.

Although it has slightly decreased since then, with the volume now over $1.7 billion, the surge suggested heightened trading activity within the Dogecoin market.

Data from IntoTheBlock revealed an interesting trend in Dogecoin exchange flow over the past seven days. Despite recent price declines, there has been more exchange outflow than inflow.

With almost $237 million worth of DOGE inflow and over $264 million outflow, this indicated a slightly bullish sentiment among Dogecoin holders, suggesting potential confidence in the asset despite its recent price movements.

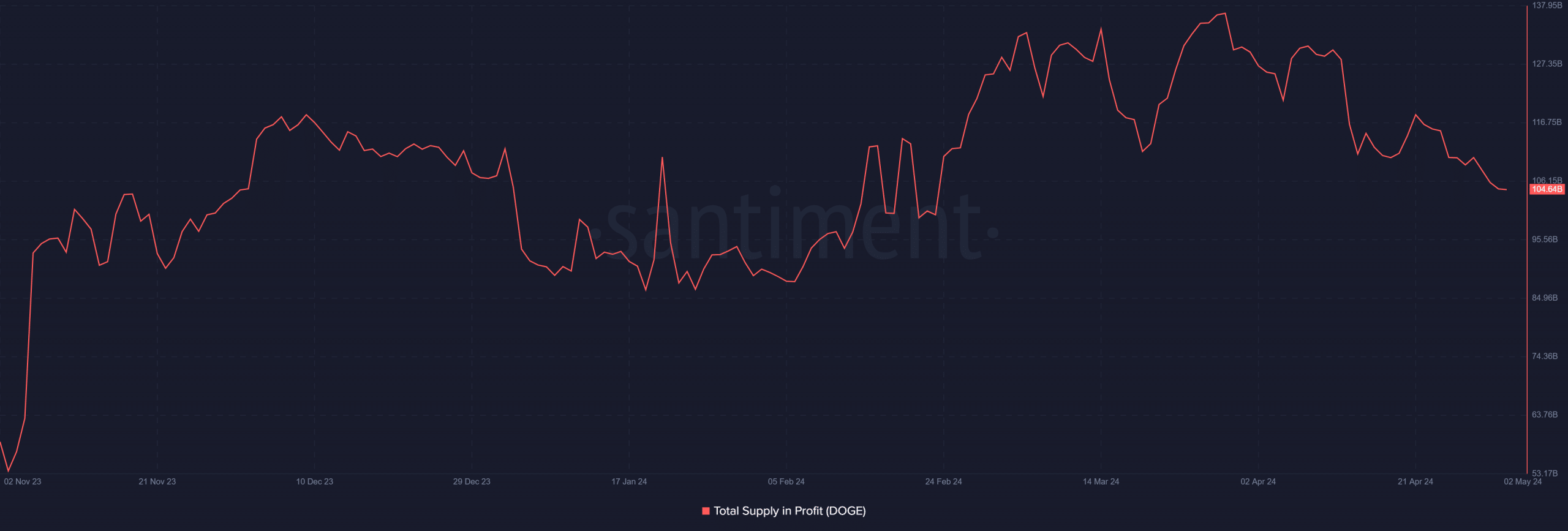

More DOGE in supply leaves the profit zone

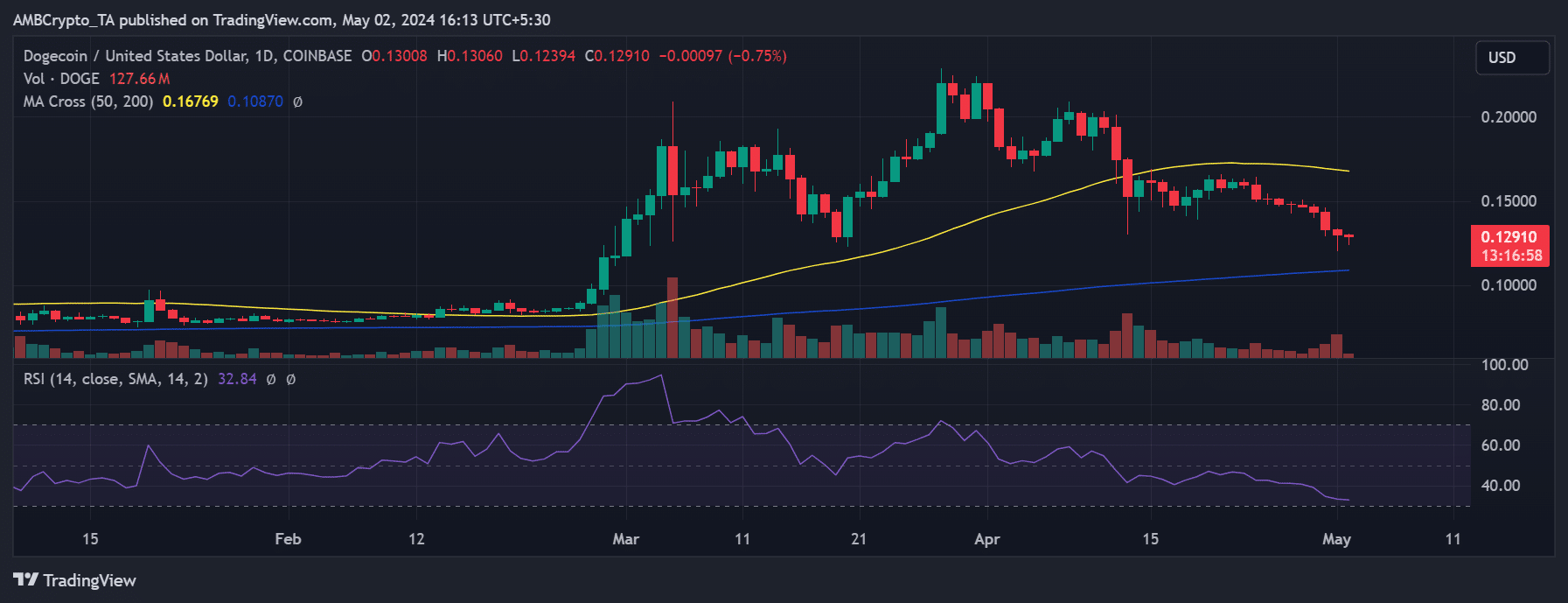

The analysis of Dogecoin’s price trend on a daily timeframe revealed a concerning ten-day downtrend streak. Starting the month with a 2% decline, DOGE traded around $0.13.

At the time of writing, it was hovering near $0.12 with a decline of less than 1%. This consistent decline has pushed its Relative Strength Index (RSI) close to the oversold zone, indicating a strong bear trend.

Is your portfolio green? Check out the DOGE Profit Calculator

The consecutive declines have led to a decrease in the supply in profit, which stood at around 72% at press time.

This signified that the number of DOGE in profit has declined to approximately 104 billion, suggesting a significant reduction in profitability for DOGE holders amidst the ongoing downtrend.