Dogecoin [DOGE] sinks below $0.085, here’s where buyers can set their bids

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Dogecoin bulls were unable to defend the mid-range mark during the recent sell-off.

- The range formation meant that DOGE was close to a support level.

Bitcoin [BTC] was able to climb to the $25.2k mark on Tuesday. But the bulls simply did not have any ammunition left to breach that resistance. Instead, the bears took control and steadily pushed prices lower. At the time of writing, Bitcoin traded at $23.9k.

Read Dogecoin’s [DOGE] Price Prediction 2023-24

This meant that the sentiment for many altcoins flipped to the bearish side as well. Dogecoin [DOGE] was one such coin that saw a sharp shift. DOGE bulls already faced trouble defending $0.086, and the recent selling pressure was too much to handle.

Breakouts past the range were rejected earlier this month

Since mid-January, DOGE traded within a range (yellow) that extended from $0.079 to $0.092. On 1 February and 5 February, the bulls made valiant attempts to break out of the range, and succeeded. However, the band of resistance from $0.092-$0.1 was too sturdy to break.

This was because it was a D1 bearish order block from 8 December. A daily trading session close above this region would have encouraged buyers. Instead, their efforts met a brick wall, and the bears seized the initiative to drive prices all the way to the range lows on 9 February.

A revisit to the range lows seemed to be on the cards once more. Over the past four days, the bulls attempted to defend the $0.086 mid-range support after the rally from $0.079. Even though the RSI has been on an uptrend, it might not be enough to save the bulls from a short-term plunge back to $0.079.

Therefore, buyers can wait for a move to this level and a bounce in prices on lower timeframes before looking to buy. A couple of days of consolidation above this support could give buyers time and confidence to enter long positions targeting $0.09-$0.092. Their stop-losses can be set near $0.0775.

Is your portfolio green? Check the Dogecoin Profit Calculator

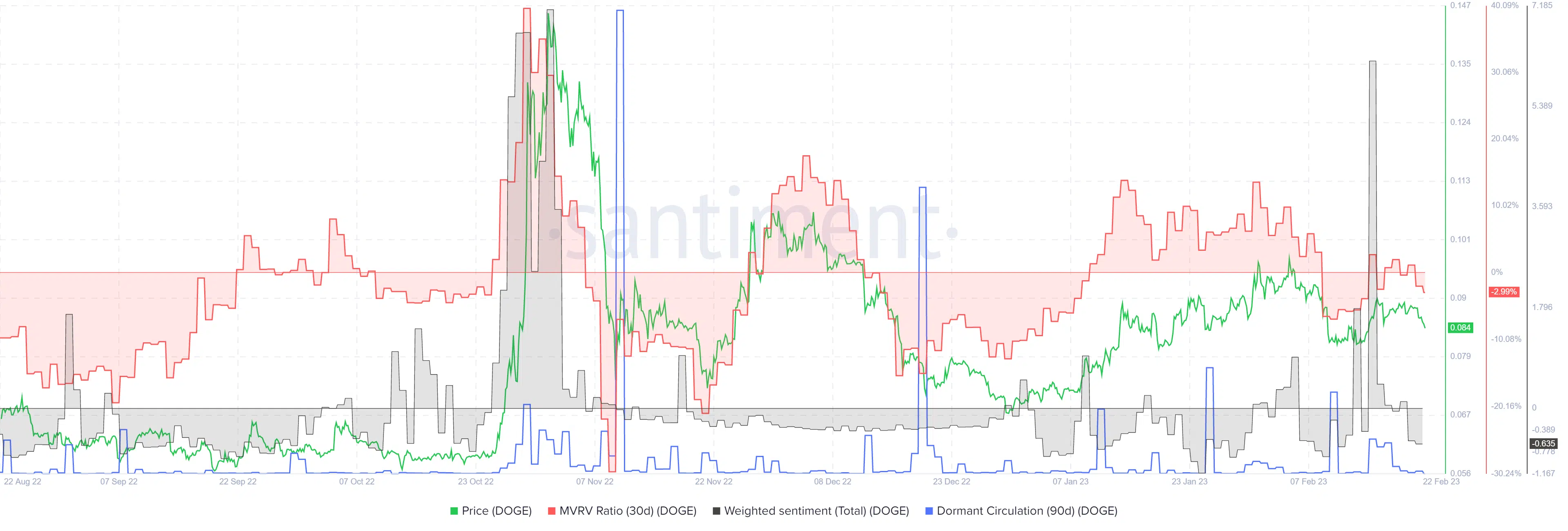

Weighted sentiment falls into negative territory once more

Source: Santiment

In response to the downturn in prices, the weighted sentiment also crashed into negative territory over the past couple of days. The MVRV ratio was also in a slow decline, which showed that holders from the past month were at a loss.

The 90-day dormant circulation saw a small spike on 15 and 16 February, when DOGE attempted to climb past $0.09. This could be an indication of a minor sell-off. Hence, buyers should be wary in case this metric witnesses another surge.