Dogecoin – Exploring why DOGE’s price may see more upside soon

- DOGE registered gains of just over 1% in the last 24 hours

- Memecoin may be set for a breakout that could take it to $0.134

Over the past week, many memecoins have recorded significant losses. Dogecoin [DOGE] is among them, with the crypto down by 12.4%.

On the contrary, the last 24 hours saw DOGE register some moderate gains on the charts. In fact, at press time, Dogecoin was trading at $0.109.

Needless to say, the memecoin’s prevailing price action has left crypto analysts talking. One of them is Kevin Capital, with the analyst predicting potential upside on the charts, citing the macro falling wedge trend.

Dogecoin’s market sentiment

In his analysis, Kevin posited that Dogecoin’s latest price action is seeing some signs of potential bullish recovery after peaking above its macro falling wedge trend over the past 48 hours.

According to this analysis, the 48-hour recovery indicated that the recent breakdown may be a false bearish signal and DOGE is now in a bullish backtest. As such, a successful backtest would confirm that the wedge’s trendline is holding as support, resulting in an upwards breakout.

Usually, a falling wedge is typically a bullish reversal pattern, one that occurs during a downtrend. This trend signifies that selling pressure is weakening and a breakout to the upside may be imminent.

Historically, a breakout from this trend is considered a bullish reversal, especially after an extended downtrend. When it forms, it means that buyers may be gaining control.

For example, in 2021, Dogecoin saw a parabolic rise during what’s called the meme-driven bull market. Over this period, DOGE surged by 1333% in 2 days, reaching $0.0459. This was followed by a bullish move, with DOGE skyrocketing by 10531% over 100 days, hitting an ATH of $0.70.

Therefore, if this analysis holds, DOGE will make significant gains on the price charts.

What do the charts say?

As observed above, the prevailing market conditions could set Dogecoin for further gains in the short term.

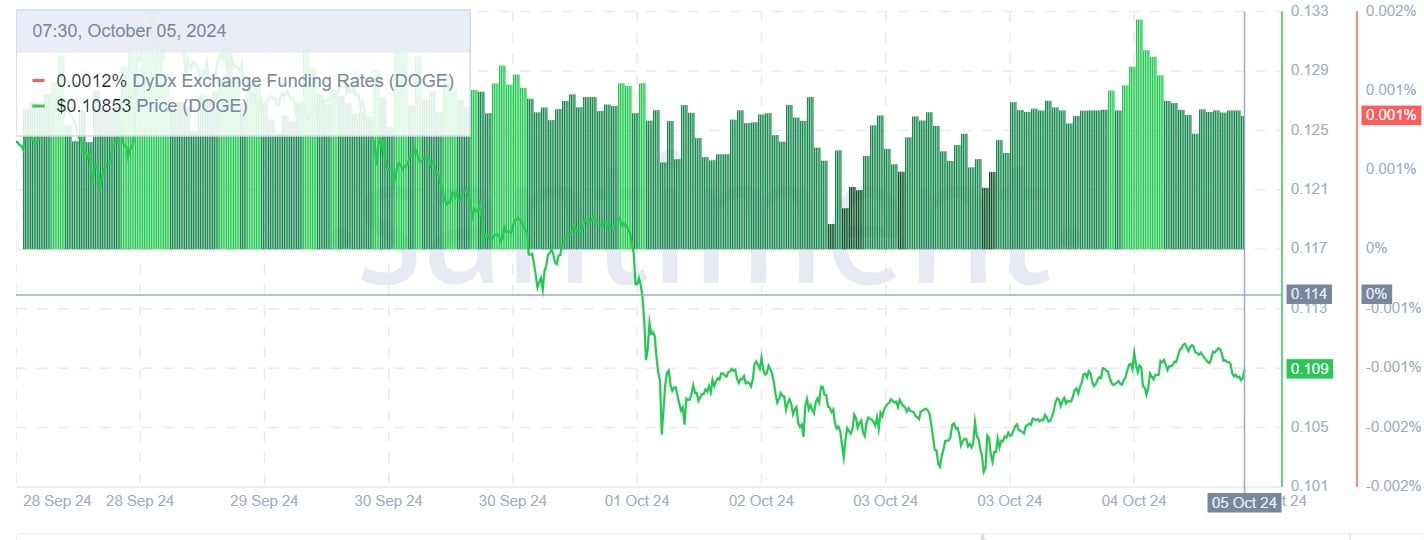

For starters, Dogecoin’s DyDx exchange funding rate has remained positive over the past week.

This means that long position holders are paying shorts during market downturns to hold their positions. Such market behavior is a sign of confidence in the memecoin’s prospects.

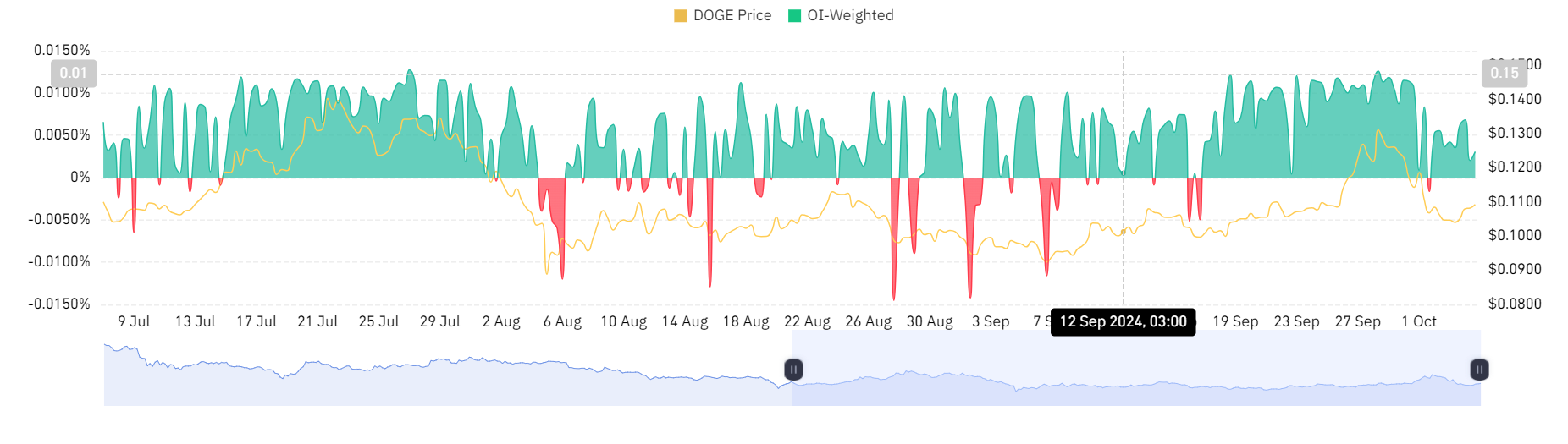

This demand for long positions can be further supported by a positive Open Interest (OI) weighted funding rate.

Additionally, large holders’ netflow has spiked over the past week from a low of 37.43 million to 563.1 million. Such a surge implies that many large holders are increasing their investments and holdings, compared to those withdrawing to sell. This is a sign of confidence among large holders as they anticipate further price gains.

Simply put, Dogecoin is at the end of favorable market sentiment right now. If these conditions hold, DOGE will break out of the stubborn resistance level at $0.11105. A breakout from this level will see the memecoin hit $0.134.