Dogecoin hits 34-day high: Can DOGE maintain its climb?

- Dogecoin’s price surged by more than 14% in the last seven days.

- Market indicators and a few metrics looked bearish on DOGE.

Dogecoin [DOGE] bulls have kept their game up as the world’s largest memecoin reached a 34-day high. This became possible because of its double-digit price increase over the last week.

Let’s have a look at the memecoin’s current state to see whether a further price rise is possible in the coming days.

Dogecoin’s latest achievement

CoinMarketCap’s data revealed that Dogecoin’s price increased by more than 14% in the last seven days. The bullish price trend continued in the last 24 hours too, as its value surged by over 4%.

At the time of writing, DOGE was trading at $0.1369 with a market capitalization of over $19.88 billion, making it the 8th largest crypto.

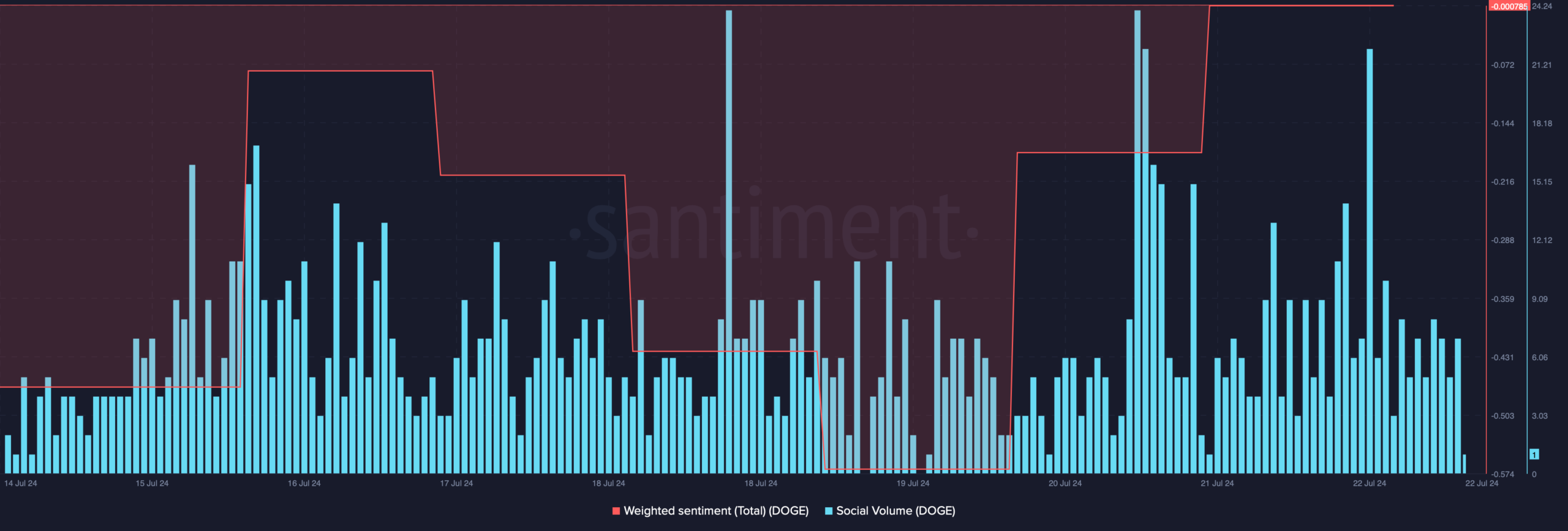

Thanks to the bulls, DOGE’s price reached a 34-day high. The bullish price action also had a positive impact on Dogecoin’s social metrics.

For instance, its social volume increased, reflecting a rise in its popularity. Additionally, its weighted sentiment improved, which meant that bullish sentiment around the coin increased over the last few days.

Apart from this, IntoTheBlock’s data revealed that nearly 50 million Dogecoin addresses were in profit, which accounted for 77% of its total holders.

Will DOGE bull rally continue further?

AMBCrypto then checked Dogecoin’s on-chain metrics to see whether they hinted at a continued price rise, which could allow DOGE to reach new milestones.

We found that DOGE miners were having doubts about the memecoin. This seemed to be the case, as DOGE’s miner netflow suggested a sell-off.

The memecoin’s derivatives metrics also looked pretty concerning. For instance, as per our look at Coinglass’ data, Dogecoin’s long/short ratio registered a sharp decline.

A drop in the metric means that there were more short positions in the market than long positions, suggesting that bearish sentiment was rising.

At press time, DOGE’s fear and greed index had a value of 73%, meaning that the market was in a greed phase.

Whenever the metric hits this level, it suggests that the chances of a price correction are high.

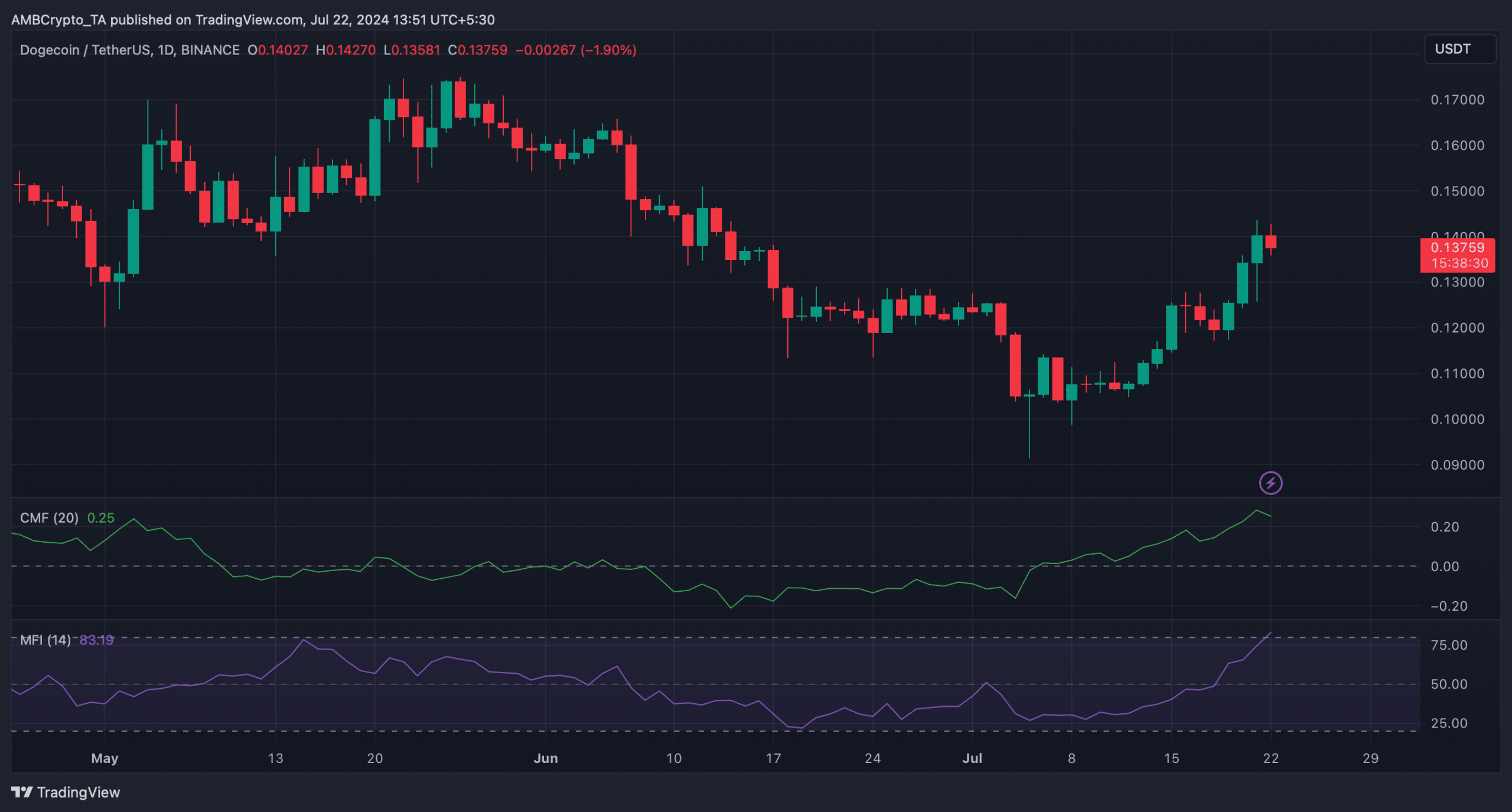

We then took a look at DOGE’s daily chart to better understand whether it would soon witness a price correction.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Our analysis revealed that after a sharp increase, DOGE’s Chaikin Money Flow (CMF) registered a downtick.

On top of that, the coin’s Money Flow Index (MFI) entered the overbought zone. This might increase selling pressure on DOGE and, in turn, push its price down in the coming days.