Dogecoin longs hit 80% on Binance Futures: Traders, this means…

- Futures traders are heavily long on DOGE, showing short-term bullish conviction.

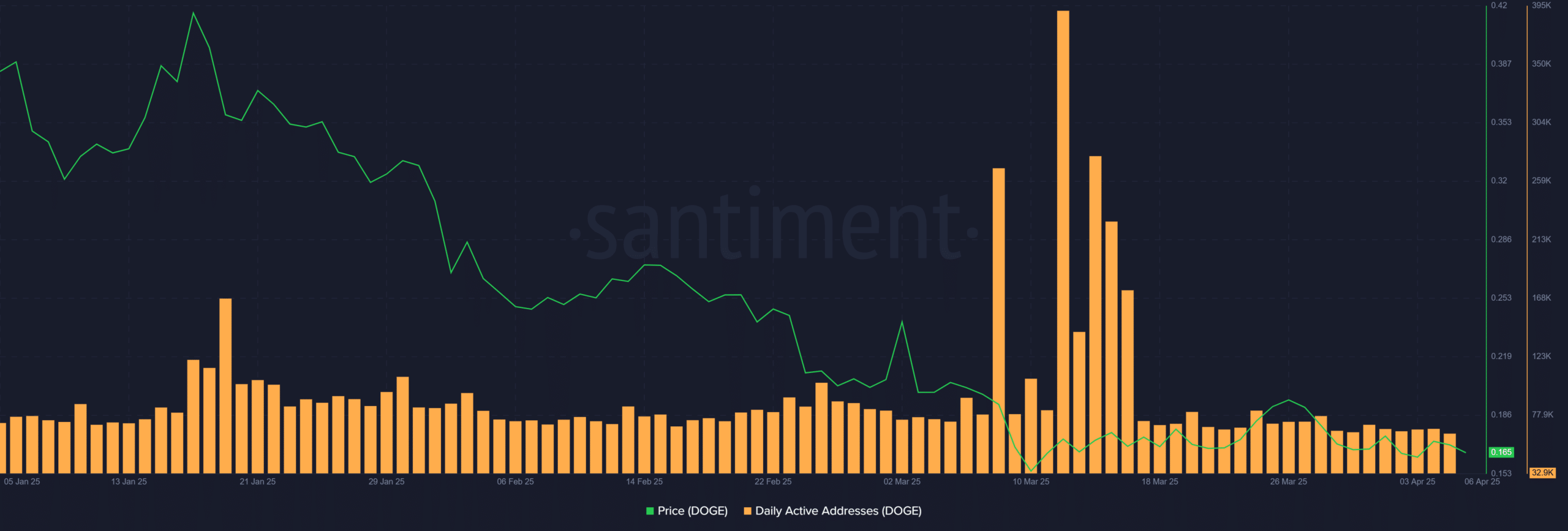

- No strong correlation between DAA spikes and price gains, hinting at speculative activity.

Binance Futures traders appear overwhelmingly confident in Dogecoin [DOGE], with long positions outpacing shorts across multiple intervals.

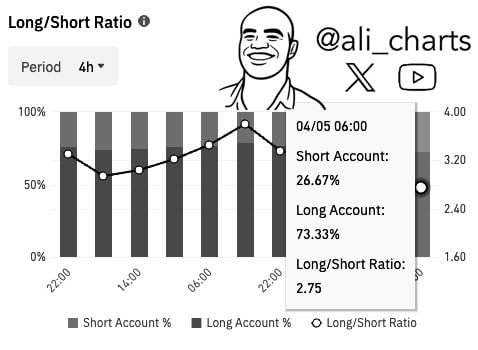

As per a chart shared by Ali Martinez, long accounts peaked at 73.33% with a Long/Short Ratio of 2.75 on the 5th of April.

Earlier data sets show an even stronger sentiment.

For instance, on the 3rd of April, long positions surged to 80.23%, with a Long/Short Ratio of 4.06. Meanwhile, short accounts fell sharply to just 19.77%.

By the 6th of April, long interest had decreased slightly, but still accounted for 77.98% of open positions.

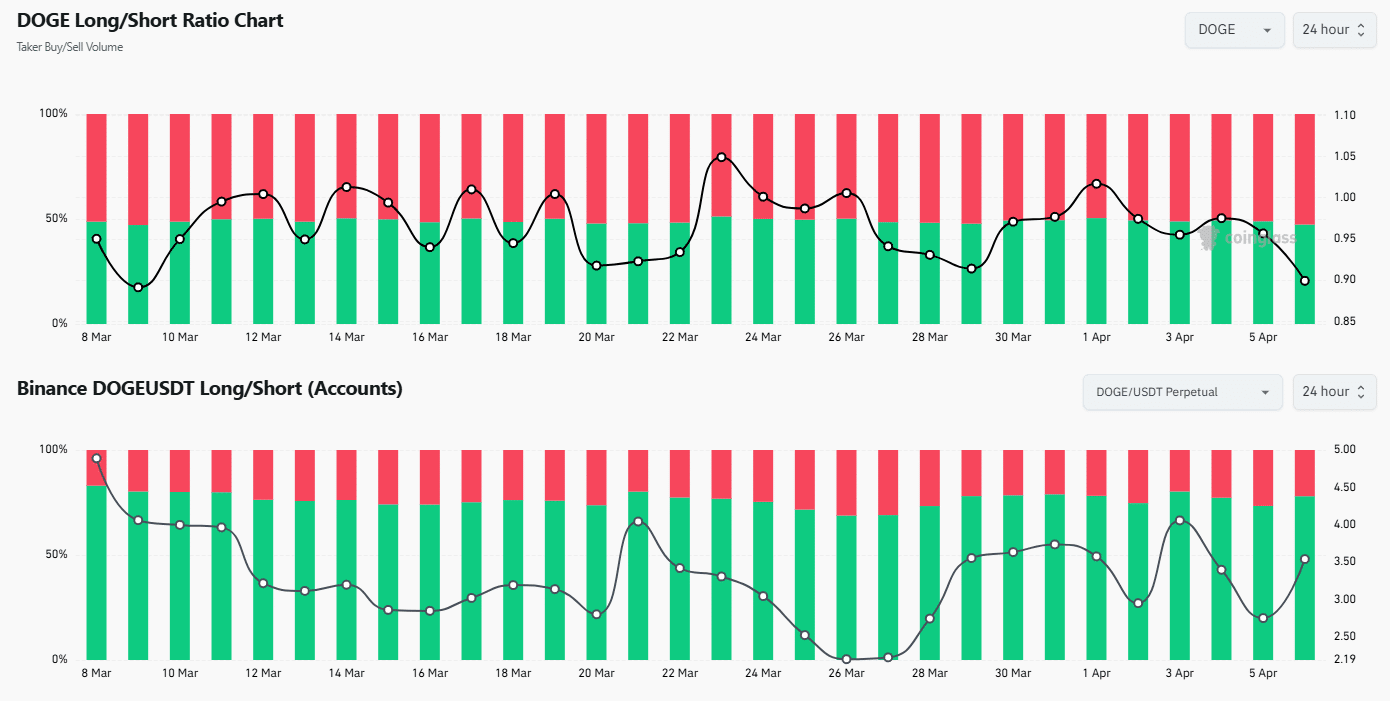

Data from Binance Futures’ Long/Short Ratio between the 30th of March and the 6th of April reveals a stark shift in sentiment.

Of course, the futures book leaned long at the start, but by April, short positions crept up to 52.66%, while long interest dipped to 47.34%, pulling the Long/Short Ratio down to 0.899—its lowest reading of that week.

The impact is even clearer in DOGE futures liquidations

Moreover, this divergence grows clearer when spot price and liquidation figures come into play.

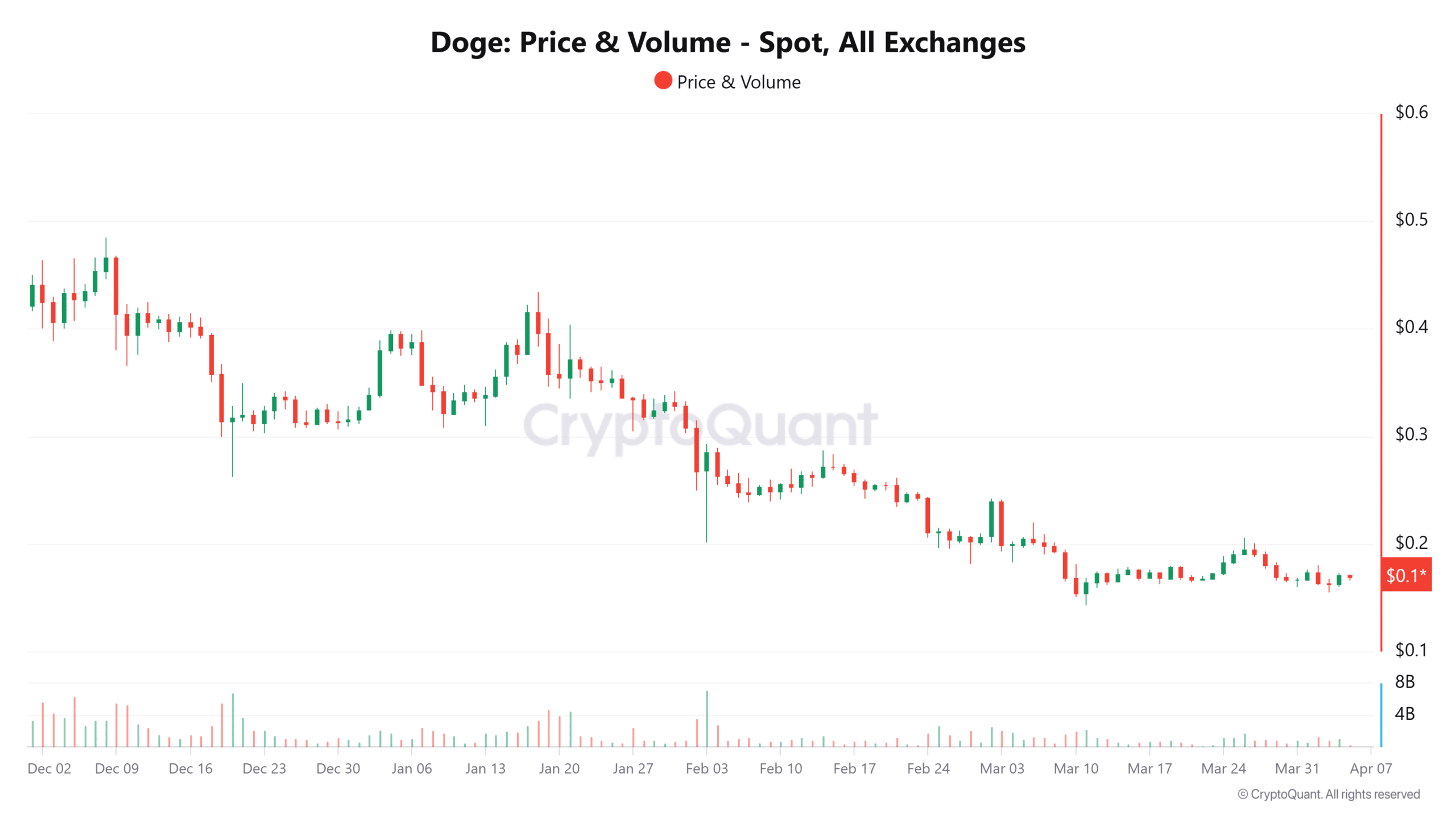

Between February and April, Dogecoin’s price sank nearly 32%, sliding from $0.248 to $0.169, as aggregated spot data shows.

On top of that, volume imploded from 7.18 billion tokens traded to just 353 million. This staggering 95% plunge hinted at waning conviction in the spot market.

More revealing is the decline in whale activity.

On the 21st of January, when DOGE hovered near $0.42, there were 466 transactions over $100,000. By the 5th of April, that figure plummeted to just 19, even as price held around $0.169.

Of course, such a steep fall in large trades strongly implies that institutions or high-net-worth participants have been offloading. Or simply avoiding DOGE amid receding prices. Moreover, on-chain data projects caution.

Dogecoin metrics suggest network health is also deteriorating

Daily Active Addresses (DAA) peaked at 81,861 on the 11th of March. By the 5th of April, that number slid to 63,736, a 22% drop.

Interestingly, strong Daily Active Addresses (DAA) did not always align with price increases.

In early April, despite futures traders showing a strong preference for long positions, other indicators painted a different picture. Whale transactions decreased, spot volumes declined, and network activity weakened.

This reveals a gap between short-term speculative excitement and broader market hesitation.

Moreover, while bullish sentiment temporarily boosted optimism among DOGE traders, the advantage remains fragile. Spot market and on-chain data highlight waning interest, lower participation from key stakeholders, and ongoing price declines.

The data depicts a market in conflict. Brief euphoria in futures trading contrasts sharply with a longer-term cautious outlook.