Dogecoin: Mapping how and why DOGE could fall 25%

- DOGE’s bearish thesis will only hold if it closes a daily candle below the $0.30 level.

- Currently, 58.3% of top DOGE traders hold short positions.

Dogecoin [DOGE], the world’s largest and most popular meme coin, is poised for a significant price decline as it has formed a bearish price action pattern.

On the 26th of December, the overall cryptocurrency market, including Bitcoin [BTC], Ethereum [ETH], and XRP, experienced a notable price decline, shifting market sentiment toward a downtrend.

Data shows that the major factors currently supporting DOGE’s bearish outlook are the overall market sentiment, traders’ bearish activity, and bearish price action.

Dogecoin technical analysis and key level

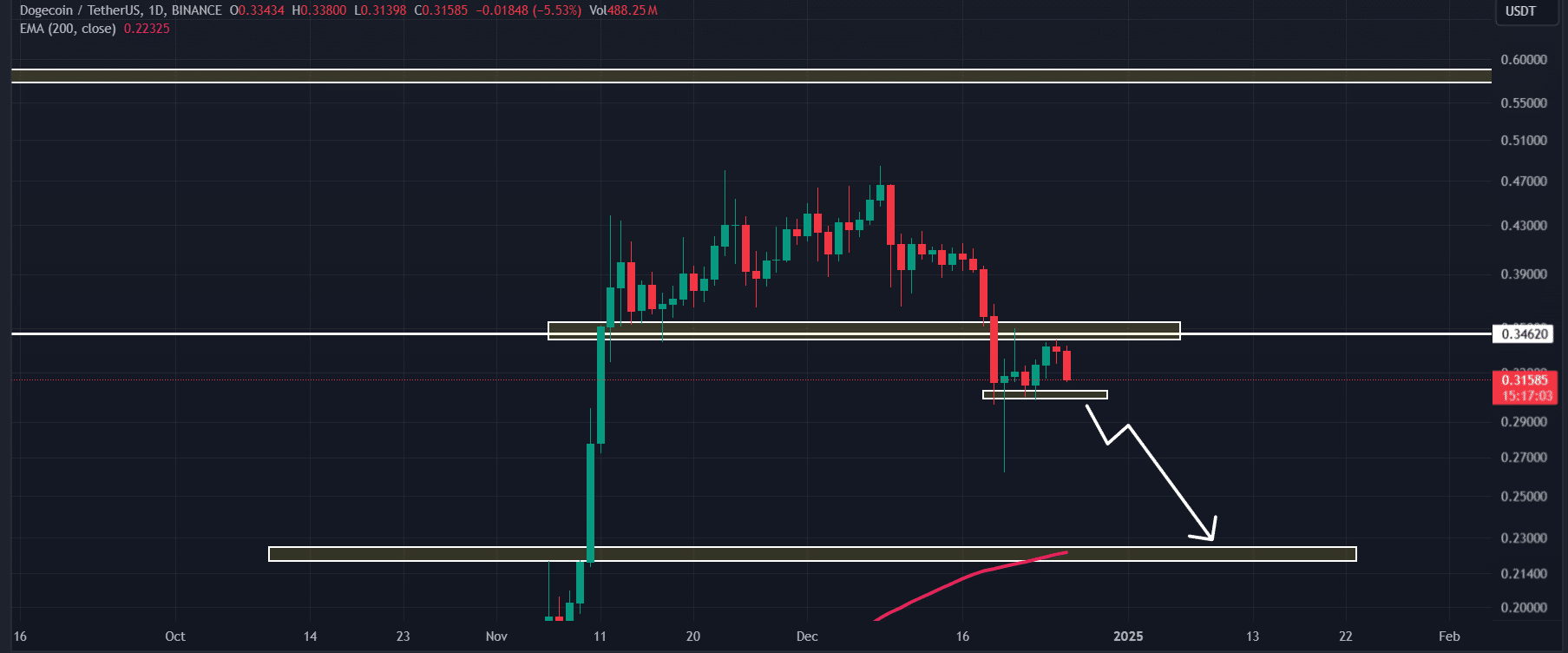

According to AMBCrypto’s technical analysis, DOGE is on the verge of breaking down from a small consolidation zone, which formed after it failed to hold the support level at $0.35.

With the recent price decline, the memecoin has reached the lower boundary of the consolidation zone at the $0.30 mark.

Based on technical analysis, if DOGE fails to hold this lower boundary and closes a daily candle below the $0.30 level, there is a strong possibility that the memecoin could decline by 25%, reaching the $0.22 level.

DOGE’s bearish thesis will only hold if it closes a daily candle below the $0.30 level, otherwise, it may fail.

DOGE’s bearish on-chain metrics

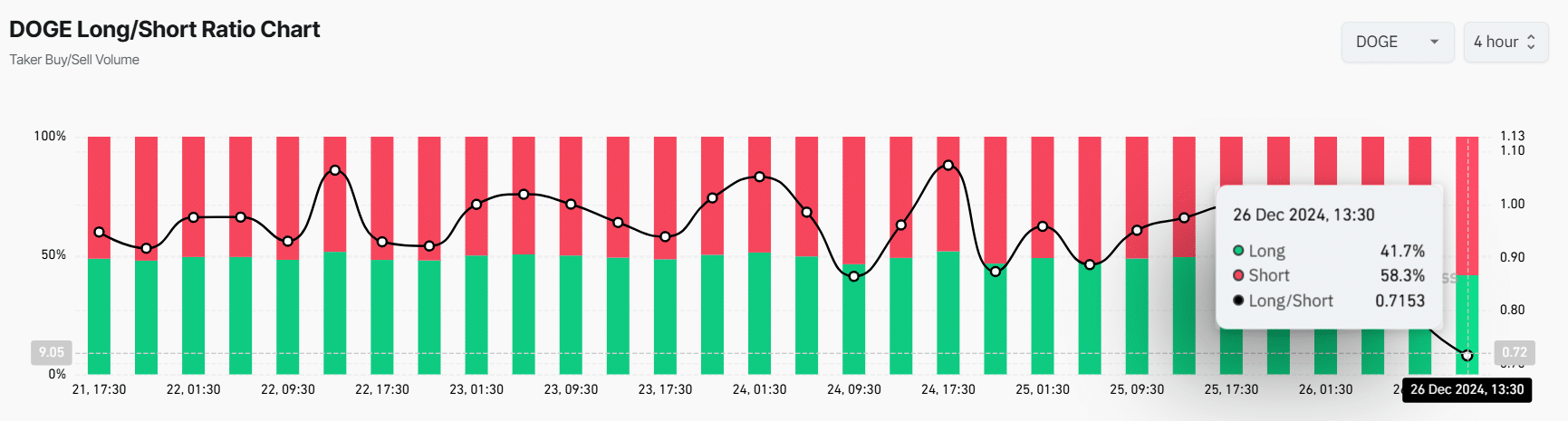

This bearish price action has shifted traders’ sentiment. According to the on-chain analytics firm Coinglass, DOGE’s Long/Short Ratio was at 0.71 at press time, the lowest since the beginning of December 2024.

A ratio below 1 indicates strong bearish market sentiment among traders. Data further reveals that 58.3% of top DOGE traders held short positions at this point, while 41.7% held long positions.

In addition to traders’ bearish views, long-term holders appeared to be accumulating the asset from exchanges, as reported by Coinglass data.

Data from DOGE’s spot inflow/outflow reveals that exchanges have witnessed a significant outflow of $32.75 million in DOGE.

This substantial outflow indicates an ideal buying opportunity and suggests potential upside momentum in the future.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Current price momentum

At press time, DOGE was trading near $0.315, having experienced a price decline of over 6.89% in the past 24 hours.

During the same period, its trading volume has dropped by 13%, indicating reduced participation from traders and investors amid fears of a potential price decline.