Dogecoin market watch: Is a rally possible amidst whale selling?

- Dogecoin has a bullish market structure and could climb higher next week.

- The metrics and the trading volume were not wholly supportive of the bullish bias.

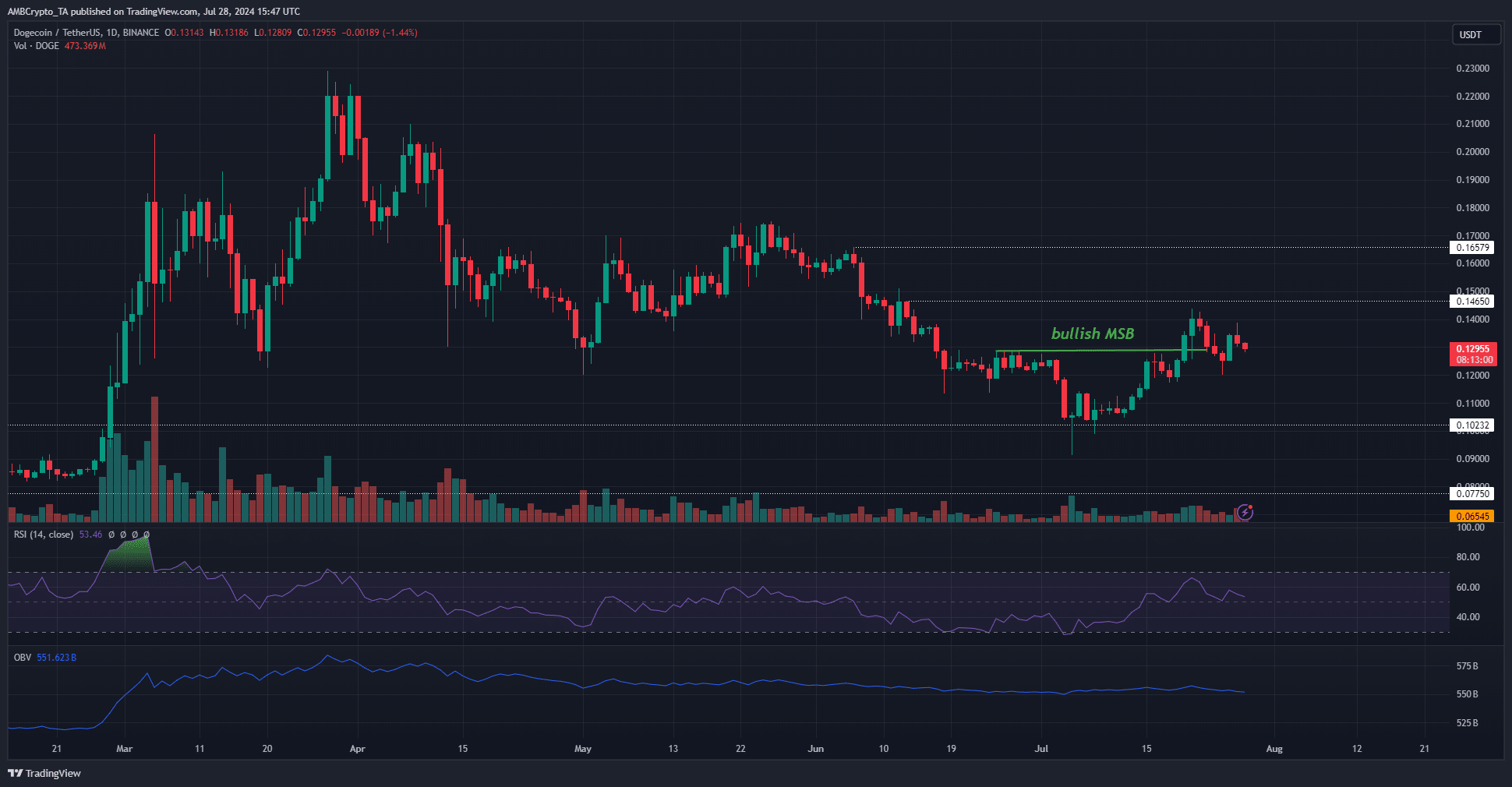

Dogecoin [DOGE] formed a falling wedge pattern and was on the verge of a bullish breakout from it. Another analysis perspective showed that the breakout has already occurred.

In either case, the price has stalled over the past week and wiped out some of the earlier gains.

Despite that, it maintained the bullish market structure on the 1-day chart. Things were not as simple, and the bulls had significant challenges ahead.

The first of many is the volume

The market structure was still bullish after the structure break earlier this month. Since then, the meme coin has not formed a lower low. The RSI was also above neutral 50, although just barely.

Together they showed that the bulls still have a chance of pushing prices higher.

However, the trading volume has been very low throughout July. Even when the prices started climbing higher halfway through the month, bullish conviction was hard to come by.

The OBV reflected this fact with a tepid bounce in July, and over the past few days has resumed its slump.

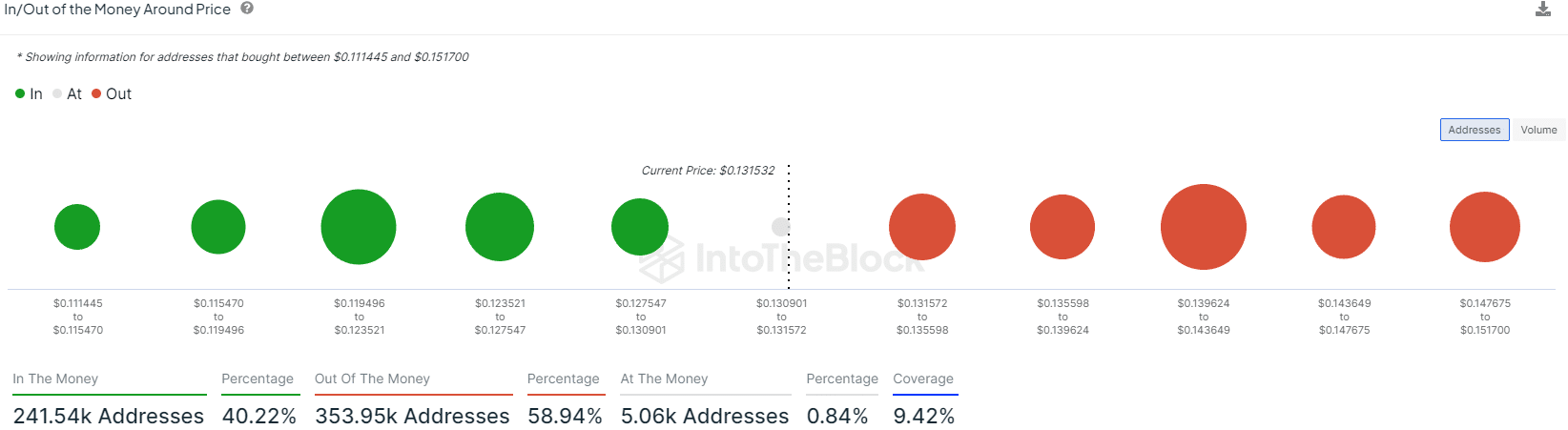

Source: IntoTheBlock

The $0.119-$0.123 zone is the biggest support zone nearby, and the $0.139-$0.143 is the largest resistance. A retest of the $0.12 support level appeared possible and might present a buying opportunity given the bullish structure on the daily chart.

Dogecoin is still undervalued- should you buy it?

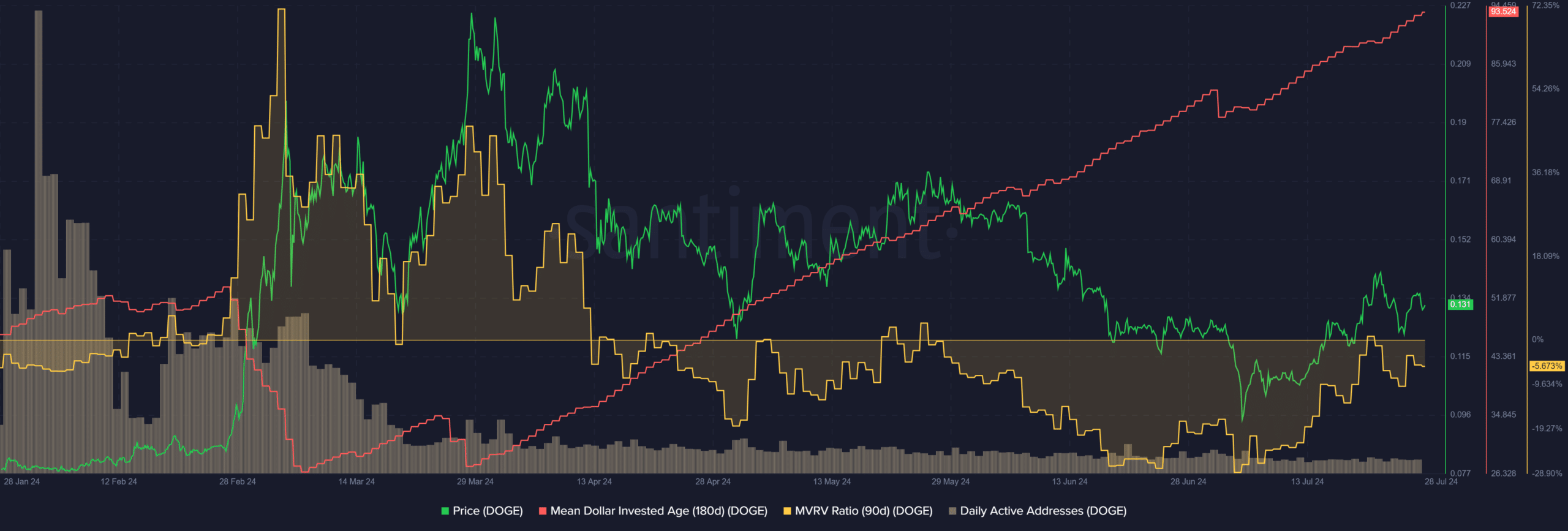

Source: Santiment

The mean dollar invested age continued to trend higher. It meant that investments were getting more stagnant and the old coins continued to remain in their wallets.

Generally, a dip in the MDIA coincides with a strong uptrend, as we saw in late February.

The 90-day MVRV ratio showed DOGE was undervalued despite the recent bounce. This was encouraging as it reduced the likelihood of a wave of selling from profit-takers.

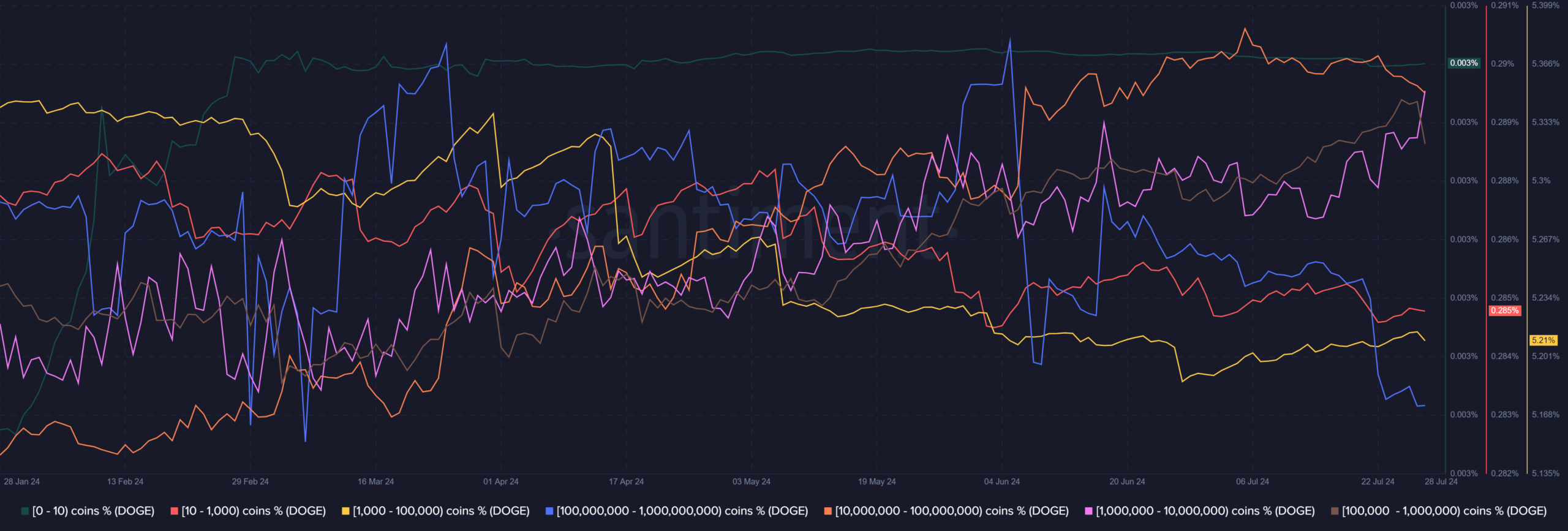

Source: Santiment

The 10M-1B coin holders (blue and orange) had accumulated DOGE in early July. Shortly thereafter, they began to unload their bags, indicating a lack of faith in the token.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Whale selling combined with a lack of trading volume meant that the chances of a strong rally were slim.

A Bitcoin [BTC] pullback can impact sentiment more in these conditions, especially since the BTC-DOGE correlation stood at +0.95.